To complement Bloomberg Law’s In Focus: Executive Orders and Actions page and Executive Orders & Related Developments Tracker, Bloomberg Law’s legal analysts are exploring issues, data, and trends regarding the Trump administration’s executive orders. “Executive Orders: Assessing the Impact”, a new report currently available to subscribers and soon to be released to the public, features five EO-related legal analyses, including this one.

President Donald Trump’s immigration policies have clearly influenced corporate immigration risk disclosures thus far in his term. The sheer volume of the disclosures only 20 weeks into the term shows that corporate America views the orders as credible risks.

Companies disclosed more immigration risks in their Form 10-K risk filings during this time frame than they did for the same period in the first Trump administration. Furthermore, the number of disclosures so far appears poised to overtake the number of disclosures for the entirety of the first Trump administration in the coming months. As during the previous administration, however, companies have revealed few details about the risks.

Companies Flag Immigration EO Risks Early

Within his first two weeks in office this term, Trump signed a number of immigration-related EOs including “America First Policy Directive to the Secretary of State”, “Protecting the American People Against Invasion”, and “Protecting the United States From Foreign Terrorists and Other National Security and Public Safety Threats”.

Several immigration policies are new, such as the executive order to end birthright citizenship. Others like the travel ban came from his first term’s playbook.

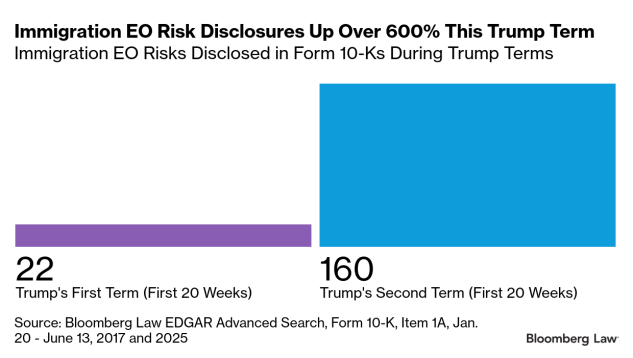

Based on a Bloomberg Law EDGAR search of corporate risk filings, there have been 160 immigration risk disclosures in the first 20 weeks of the Trump administration. There were 22 for the same period during the first Trump administration—a more than 625% increase from the first to the second term.

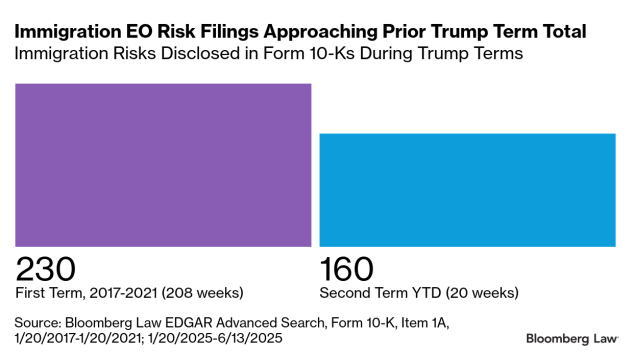

If disclosures continue at this rate, the number of disclosures will surpass the 230 filed during the entirety of the first Trump administration in eight to nine weeks.

More companies are acknowledging the potential impact of this Trump administration’s immigration actions on their operations than during his prior term, as the surge in filings this year shows. This boost likely indicates that companies see a strong resolve on the administration’s part with regard to meeting its immigration goals.

There’s evidence that corporate America has already altered its oversight of employee immigration status. For example, Walmart has terminated workers and is conducting employee audits based on the new immigration policies.

Early Filings Offer Few Details

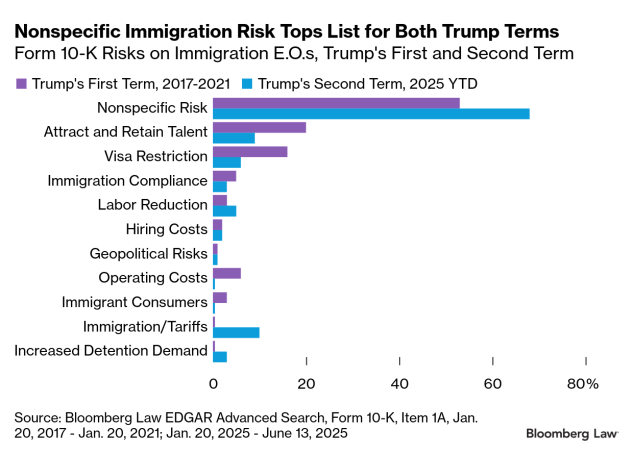

Companies listed several categories of concern in their Form 10-K filings for both terms, yet more than half of the corporate filings simply listed nonspecific “immigration” as a corporate risk, meaning that they provided no details of the impact on the company.

Also notable is the decrease in reported risk for the “attract and retain talent” and “visa restrictions” categories from Trump’s first term to now. New immigration risks—"increased detention demand” and immigration risk coupled with tariffs—have emerged during Trump’s second term.

Nevertheless, the majority of companies are choosing to file nonspecific risk disclosures related to immigration. It’s interesting that this catchall category’s popularity has persisted into Trump’s second term. It would seem that his first term would have equipped companies with some insight into the corporate risks of certain immigration policies. One explanation may be that the volatile immigration-related headlines relating to the current policies are causing uncertainty.

Given the relatively high number of filings thus far in Trump’s term and the central role immigration plays in the administration, the momentum in immigration risk filings likely won’t abate any time soon.

Other analyses of the executive orders featured in the report cover AI regulation, immigration, DEI, and disparate impact liability (publishing soon).

Bloomberg Law subscribers can find related content on our Corporate Governance Practice Page and our Corporate Compliance Practice Page.

If you’re reading this on the Bloomberg Terminal, please run BLAW OUT in order to access the hyperlinked content or click here to view the web version of this article.

To contact the reporter on this story:

To contact the editor responsible for this story:

Learn more about Bloomberg Law or Log In to keep reading:

See Breaking News in Context

Bloomberg Law provides trusted coverage of current events enhanced with legal analysis.

Already a subscriber?

Log in to keep reading or access research tools and resources.