Race tracks, film studios, and other businesses are in line to face higher taxes next year if lawmakers are unable to bridge the partisan rift widening on Capitol Hill.

The nearly two-week old shutdown that’s led to furloughs of thousands of federal workers hinges in part over looming expiration of an enhanced premium tax credit for health plans purchased on exchanges created by the Obama-era health care law.

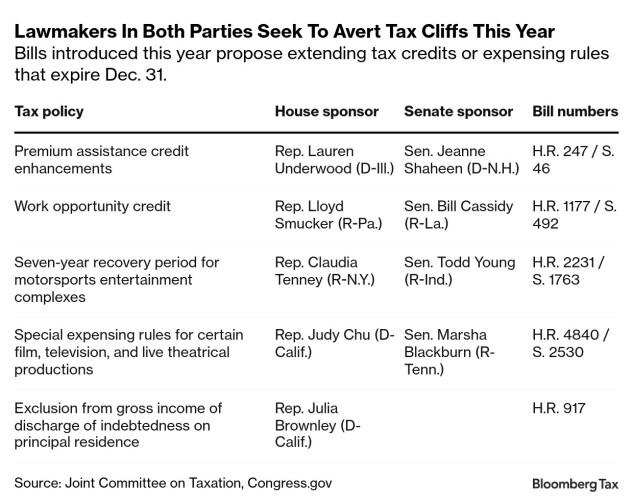

But other bipartisan tax credits are also expiring. Their backers hope a year-end deal averts those cliffs but acknowledge the dearth of trust between the parties amid the shutdown bodes poorly.

“I’ll work with anybody on legislation that’s good for the American people and my district,” said Rep. Mike Thompson (D-Calif.), the ranking member on the Ways and Means Committee’s tax subcommittee who co-sponsored a permanent extension of the race car break. “But this does kind of sour the soup.”

Extenders Left Behind

Congress has perennially passed what’s known as an extenders package, renewing mostly bipartisan expired and expiring tax breaks. Many of these, such as the expired credit for American Samoan tuna canneries, were left out of Republicans’ July mega law, leaving their fate to the whims of lawmakers considering a raft of issues in bipartisan legislation before the calendar turns.

Partisan rancor endures after Republicans enacted their tax law using maneuvers to sidestep Democrats, and the White House rescinded already appropriated federal funds.

Popular support for each extender break individually may be insufficient to overcome that strife, said Ray Beeman, who leads EY’s Washington Council practice.

Because lawmakers’ terms aren’t expiring this year, they may feel that waiting until 2026 and extending the breaks retroactively is more attractive, Beeman said. The funding lapse has also fractured the attention of lawmakers and their staff, dimming the prospects of planning a package.

“At least, while there’s a shutdown, I just don’t think anybody’s super focused on” other extenders, Beeman said.

There’s been little, if any, substantial negotiation over a year-end package.

Rep. Richard Neal (D-Mass.), the ranking member of the tax-writing House Ways and Means Committee, told reporters his discussions with Committee Chair Jason Smith (R-Mo.) about such a deal have been minimal.

Sen. Ron Wyden (D-Ore.), the ranking member of the tax-writing Senate Finance Committee, said he “will work with anybody to try to find common ground.” But he dinged the panel’s chair, Sen. Mike Crapo (R-Idaho) for skipping a committee debate and vote on Republicans’ tax law despite his calls for “regular order.”

Spokespeople for Smith and Crapo did not return requests for comment.

The House last year passed a $78 billion bipartisan business and child tax break bill and a year later voted to create treaty-like tax benefits to firms operating in Taiwan. That’s giving some lawmakers reason to think an extenders deal is possible.

“We’ve shown that even in a pretty hyperpartisan environment, we were able to come together,” said Rep. Lloyd Smucker (R-Pa.), a senior member of the Ways and Means and Budget committees.

Employer, Film Studio Tax Breaks

One extender at stake is the Work Opportunity Tax Credit, which benefits employers who hire veterans, felons, the disabled and other disadvantaged groups. Smucker is pushing for an expansion of that bonus, arguing it ends up saving money as workers contribute to the Treasury.

The ability of film and TV studios, theaters, and sound recording studios to quickly write off their expenses also faces expiration. Lobbyists for the entertainment industry have sought to extend a long-standing benefit that allows such productions to immediately take advantage of depreciation rules that would normally have to wait for their work to premiere to claim.

Sen. Marsha Blackburn (R-Tenn.) hopes to include her bill extending that break in any tax package that materializes this year, according to a spokesperson. Sen. Raphael Warnock (D-Ga.), who has co-sponsored her bill, also wants to get it across the finish line.

“I disagree with her on almost everything, but here we finding a way to sing from the same song sheet,” he said.

Tax writers representing motorsports speedways are also hoping to preserve the tax treatment of race tracks used by operators big and small, including NASCAR.

“If any bill has a tax title, you see if you can insert it into the larger package,” said Sen. Todd Young (R-Ind.), who represents the home of the Indy 500. “I’m imagining it’ll be a year-end play.”

Speedway operations don’t qualify for the taxpayer subsidies that other major league sports often get, and the industry is hoping they can avoid an expiration or at least apply the break retroactively next year so they stay on a level playing field with amusement parks and golf courses.

“The only thing that makes me feel good is that we’ve been in these positions before,” said Dean Aguillen, a principal at OGR who lobbies for the Automobile Competition Committee for the United States, the trade association for the motorsports industry.

Thompson, who has co-sponsored the House companion to Young’s motorsports bill, too hopes it can be included in a year-end package.

But he said hasn’t talked with his Republican colleagues about a broader package as the House remains in recess amid the shutdown.

“I just walked the halls this morning, can’t find a single one,” Thompson said.

To contact the reporters on this story:

To contact the editor responsible for this story:

Learn more about Bloomberg Tax or Log In to keep reading:

See Breaking News in Context

From research to software to news, find what you need to stay ahead.

Already a subscriber?

Log in to keep reading or access research tools and resources.