This analysis is part of a series covering the 2025 Fenwick–Bloomberg Law SV 150 List, an annual resource developed by Bloomberg Law and technology and life sciences law firm Fenwick. The SV 150 List ranks the largest public technology and life sciences companies in Silicon Valley by revenue. Additional analyses in the series are listed at the end of this article.

The 2025 version of the Fenwick–Bloomberg Law SV 150 List—which ranks Silicon Valley’s largest public tech and life science companies, based on 2024 revenue—welcomed back the same top 10 companies that appeared on the list last year. While there were only slight shifts in the placements of the top 10 companies from the previous year, there was a flurry of deal activity within the group. NVIDIA maintained its position in the top 10, despite being a newcomer on the list just last year.

If you are having trouble viewing this interactive graphic, please enable third-party cookies on your browser. Terminal users, please click here to view this interactive graphic.

The top 5 spots remained intact from last year: Apple Inc., Alphabet Inc., Meta Platforms Inc., NVIDIA Corp., and TD SYNNEX Corp., respectively. Also standing pat was Cisco Systems Inc. at No. 6, even though its revenue fell 5.3% in 2024 from the previous year.

Two members of the top 10 showed upward movement from last year: HP Inc., which rose one place to No. 7, and Broadcom Inc., which also rose one place to No. 9.

Two top 10 companies slipped slightly in 2025, including Intel Corp. (down one spot to No. 8) and Uber Technologies Inc. (down one spot to No. 10). Intel’s drop in ranking was coupled with a 2.1% decrease in total revenue, while Uber’s shift in placement came despite its total revenue increasing by 18% in 2024.

Deal Activity Among the Top 10

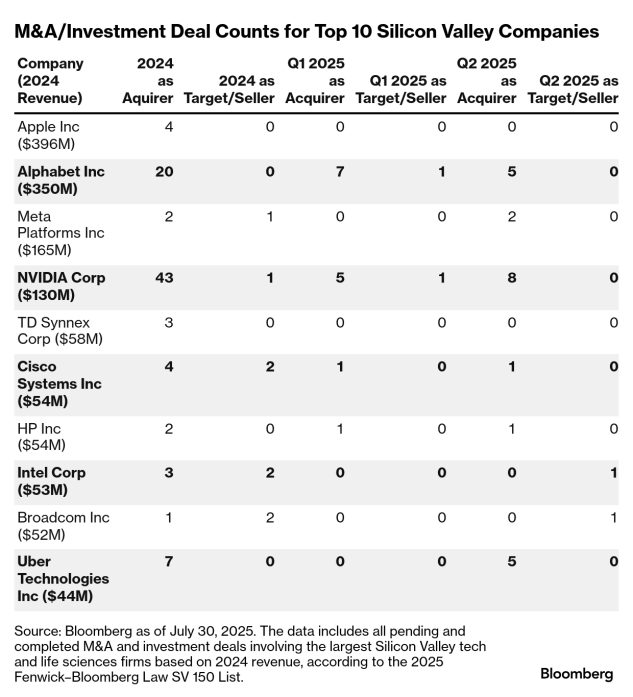

The top 10 companies on 2025’s Fenwick–Bloomberg Law SV 150 List were all involved in M&A or investment activity in 2024.

Racking up a total of 89 acquisitions, all of the top 10 made at least one deal as an acquirer or investor in 2024. They made few or no deals as a seller or target; between them, they totaled only seven such deals in 2024.

This same list-topping group accounted for 78 acquisitions in 2023, but not every company in last year’s top 10 notched at least one deal as an acquirer or investor. TD Synnex made no acquisitions or sales in 2024. Through the first two quarters of 2025, the top 10 companies have a combined total of 36 acquisitions.

NVIDIA’s Rapid Growth Continues

While NVIDIA may seem stagnant with the lack of change in placement on the top 10 list, its 2024 revenue has put the company in the same revenue bracket with Meta Platforms. Last year, Meta led NVIDIA by nearly $74 million, based on 2023 total revenue. In 2024, the gap narrowed to $34 million.

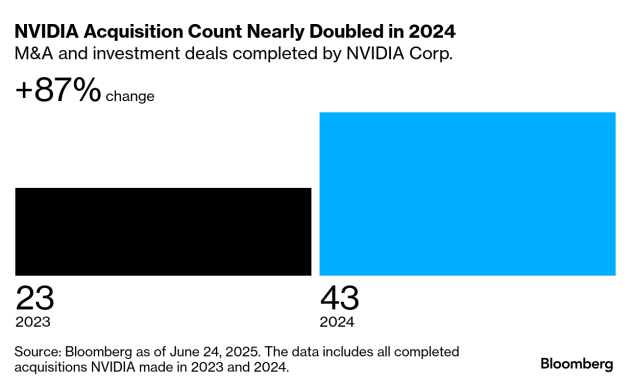

NVIDIA was also the most acquisitive company of the top 10 for the second year in a row. The company racked up an 87% increase in acquisitions in 2024 compared to the year prior. In the first half of 2025, NVIDIA has already made 13 acquisitions, putting the company on track to once again meet or exceed its number of acquisitions in 2023.

NVIDIA started Q3 of 2025 strong by becoming the first company in history to reach a $4 trillion market valuation. As predicted last year, NVIDIA’s meteoric revenue growth, AI potential, and risk management ability continue to bolster its placement among its Silicon Valley peers.

Google’s parent company, Alphabet Inc., was once again the second-most acquisitive company in this year’s top 10, with 20 total M&A or investment deals as an acquirer in 2024. With 12 acquisitions already in the first half of 2025, Alphabet is a strong contender to once again be a top acquirer. One sharp contrast in deal activity for Alphabet was in its sales. In 2023, Alphabet was the most frequent seller in the top 10, having been a target in five deals in 2023. In 2024, Alphabet did not sell. Alphabet made its first sale since 2023 in the first quarter of 2025.

An AI Antitrust Shift in the Making?

While it is not new that Silicon Valley’s tech giants have been acquiring or investing in artificial intelligence companies, a recent Department of Justice investigation into one of Alphabet’s 2024 transactions could change the processes and practices involving AI-related acquisitions going forward.

The deal involved the purchase of a minority stake in Character AI Inc. (Character.AI). Character.AI has technology that allows users to make chat bots that can impersonate anyone or anything through chat or voice calls. In May, the Department of Justice’s antitrust enforcers informed Google that they’re investigating its agreement with Character.AI, concerned that Google may have structured the transaction in a way that would avoid the merger review process.

In the deal, Google purchased shares in Character.AI, and Google received a non-exclusive license for Character.AI’s large language model technology. The founders of Character. AI and members of their research team also began working for Google after the deal.

This type of agreement is not unique in the tech space or among Google’s peers. Big companies, like Microsoft and Amazon, also entered agreements in 2024 with AI software companies, in which the tech giants provide investment money or licensing fees in return for artificial intelligence software licenses and staff from the AI software companies.

The results of the DOJ’s investigation may dictate the permissibility of these deals or impact companies’ strategies moving forward. The Federal Trade Commission is similarly investigating Amazon and Microsoft regarding these type of deals.

In other analysis articles covering the results of the 2025 Fenwick–Bloomberg Law SV 150 List:

- Preston Brewer analyzes how the 2025 list’s IPOs compare to previous years and to the market at large.

- Kafui Quashigah explores the growing impact SV 150 members are having in the syndicated lending markets.

- Stephanie-Solange Campbell introduces the 14 Silicon Valley companies that are new arrivals to the 2025 list.

Bloomberg Law subscribers can find related content on our M&A Deal Analytics resource.

If you’re reading this on the Bloomberg Terminal, please run BLAW OUT<GO> in order to access the hyperlinked content, or click here to view the web version of this article.

To contact the analyst on this story:

Learn more about Bloomberg Law or Log In to keep reading:

See Breaking News in Context

Bloomberg Law provides trusted coverage of current events enhanced with legal analysis.

Already a subscriber?

Log in to keep reading or access research tools and resources.