- Google breakup proposal parallels Big Tech platform bills

- Legislative push died in 2022 amid fierce lobbying fight

The Justice Department’s move to break up

The Biden administration’s proposal, following a court win in its landmark case against Google, applies concepts that surfaced in recent legislative debates, such as tech giants’ ability to disadvantage rivals.

But it also marks the opening of another long fight—one that could take multiple appeals to resolve. Donald Trump’s election win raises additional questions about how leaders in his second administration will handle the case.

For some advocates, the protracted, likely yearslong process demonstrates the limits of an agenda operating solely through the courts.

“There is a timing issue that could mean they’re Pyrrhic victories,” said Amanda Lewis, a Cuneo Gilbert & LaDuca LLP partner and former Federal Trade Commission attorney.

Unlike in Europe, US efforts to enact federal laws imposing new regulations on major tech platforms have failed.

Even so, US antitrust enforcers won a key victory in August, when a federal judge ruled that Google maintained an illegal monopoly in the online search market. The Justice Department is now pushing for Google to divest its Chrome internet browser and potentially sell its Android smartphone system to restore competition.

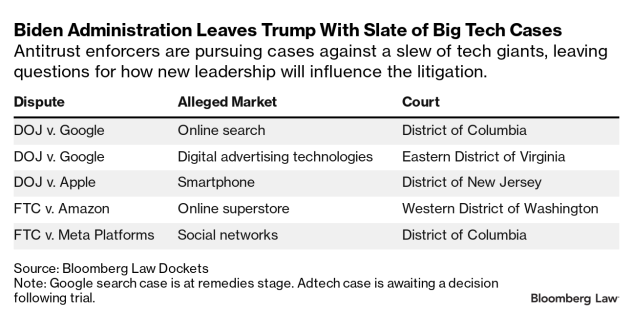

The Google decision shows that “we don’t need to upend the law” to target tech giants, said Neil Chilson, a former FTC chief technologist who now heads AI policy at the Abundance Institute. Enforcers are pursuing similar antitrust cases against Google’s ad tech business,

Whether there’s any appetite left for “upending” the law on Capitol Hill is unclear. The last real push died in 2022 amid a fierce lobbying fight, but criticism of Big Tech is one of the few issues in Washington that generates some bipartisan support.

Sen. Mike Lee (R-Utah), leader of a bill that would force Google to sell off parts of its ad business, said in a statement that an effective Google remedy “is essential to restore competition for American consumers who were harmed by Google’s monopoly for decades.”

“I look forward to exploring this and continuing our efforts to hold big tech accountable in the Judiciary Committee in the next Congress,” he said.

‘Self-Preferencing’

The Justice Department’s request for a Chrome sale parallels its push to break up Google’s ad tech business and Lee’s legislation, which, if enacted, would target such platforms as Google’s control of various points in the digital ad marketplace.

The divestiture is in line with a goal to prevent Google from “self-preferencing” its own assets over rivals “through the ownership and control of search-related products,” according to the Nov. 21 proposal.

That focus applies a concept raised in the American Innovation and Choice Online Act (S.2992, H.R. 3816)—a bipartisan measure first introduced in Congress in 2021 and that sought to stop big tech platforms from unfairly favoring their own products over rivals.

“It is fair to say the proposed remedies would implement some of the pieces of the legislation relative to Google,” said Lewis, who as a House detailee co-authored a 2020 report on the digital economy that helped spur the legislation.

Google claims the proposal would endanger user security and hobble people’s ability to access Google search. “DOJ chose to push a radical interventionist agenda that would harm Americans and America’s global technology leadership,” chief legal officer Kent Walker said in a company blog post, which noted Google is “still at the early stages of a long process.”

The company has already vowed to appeal the decision branding it a monopoly.

Courts’ Caution

Judge Amit Mehta of the US District Court for the District of Columbia is set to hold hearings in April 2025 and make a decision on remedies by August.

The Justice Department during Trump’s first term in office brought the Google search case, suggesting some consistency among administrations.

Trump, however, was noncommittal when asked during an October interview with Bloomberg News about the prospect of breaking up Google. He raised the specter of US competition with China, adding, “are you going to destroy the company by doing that?”

Courts have generally shown extreme caution with breakups, making it “highly unlikely” they’d go as far as the DOJ is asking, Keith Hylton, a Boston University law professor, said.

But even if the second Trump DOJ follows the Biden administration, the Google case will likely be litigated all the way up to the Supreme Court, which could take years.

“Our judicial system does take a long time to reach finality,” Bill Baer, chief of the DOJ antitrust division during the Obama administration, said. “That is a problem.”

‘European Approach’

Mehta will have the option to enact or delay certain remedies from his August order until appeals are resolved.

That process is playing out in a case by Epic Games Inc., which successfully alleged that Google’s app store is a monopoly. A San Francisco federal court in October temporarily paused its ruling ordering Google to overhaul its app store practices as the company appeals.

That pace shows that legislation would be a “much faster way to deal with what seems clear to be an abuse of market power,” Jason Kint, the CEO of media trade group Digital Content Next, said.

By contrast, the European Union’s Digital Markets Act placing new restrictions on “online gatekeepers” is now in full effect, with Apple, Meta, and Google already under fire for how their practices clash with the law.

“If we want to take a more European approach on how we shape our markets, we could do that,” said Chilson, who worked in the FTC during Trump’s first term. “But I think there’s generally not going to be a lot of appetite for that from this Trump administration.”

To contact the reporter on this story:

To contact the editor responsible for this story:

Learn more about Bloomberg Law or Log In to keep reading:

See Breaking News in Context

Bloomberg Law provides trusted coverage of current events enhanced with legal analysis.

Already a subscriber?

Log in to keep reading or access research tools and resources.