Hilco Corporate Finance’s Geoffrey Frankel considers whether recent signs of financial distress in the US portend a surge in restructuring and special situations activity in the next few months and which industries seem most at-risk.

In 2009, I attended a distressed investing conference where industry professionals lamented the dearth of restructuring activity, while offering a hopeful prediction for the future. “We’re slow now,” one said, “But six months from now … all bets are off.”

The same comments have been heard at nearly every restructuring industry conference since, with the exception of a few short intervals—most notably, the early pandemic days in 2020.

There is no shortage of theories why restructuring up-cycles have been fewer and shorter since the 2008 recession: unprecedented levels of market liquidity, market conditions distorted by artificially suppressed interest rates, and even the prohibitive cost of protracted Chapter 11 reorganizations, which have been supplanted by out-of-court restructurings or expedited, pre-negotiated Chapter 11 cases.

Whatever the merits of these explanations, it finally does seem that, over the next 12 months, all bets may at last be off. So, what is different this time and where might we be headed?

What Has Changed?

For over a decade, credit market conditions enabled a range of otherwise underperforming businesses to remain afloat despite sector downturns, poor management, and other challenging business conditions.

The abundance of relatively inexpensive capital, with lenient or non-existent covenant structures, has allowed public and private borrowers since the 2008 recession to extend their runways longer than they ever had previously—and left creditors with weakened protections, reduced leverage, and fewer viable options.

Over the past several months, the tide finally seems to be turning. Perhaps in response to persistent inflation, lingering supply chain disruptions, or just lenders whose patience has reached its limit, availability of cheap and easy credit has abated.

As of August 2022, for example, leveraged loan default rates in the US had nearly doubled since their pandemic trough in mid-2021—both in terms of volume of debt and number of issuers. Likewise, distressed loan volume steadily increased throughout 2022, reaching over $40 billion—a nearly 4x increase from mid-2021.

As of February 2023, the 12-month lag leveraged loan default rate stands at 1.02%, marking an increase of almost 75% since August 2022.

The number of bankruptcy filings has lagged these leading indicators. After a spike caused by the initial shock of Covid-19, bankruptcy filings between the second half of 2021 and first half of 2022 were well below historical levels.

Bankruptcy Filings by Type (2018-2022)

This lag is typical, as Chapter 11 filings are a lagging indicator of distress. It remains to be seen whether filing activity ultimately increase—or, perhaps, is suppressed due to a systemic shift away from the use of Chapter 11 to resolve a corporate reorganization.

Where Are We Headed?

The above indicators suggest that predictions of a surge in restructuring activity may finally be more than wishful thinking on the part of restructuring professionals.

Hilco Corporate Finance has analyzed market data—particularly trends in business development company mark-to-market activity across several sectors. The results provide a glimpse into where the trouble ahead may lie.

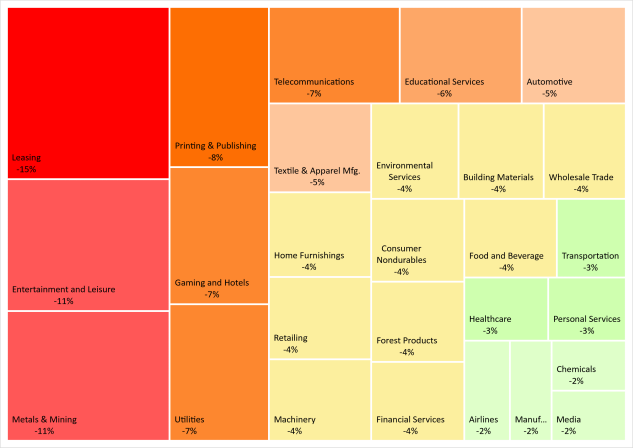

The chart below shows the aggregate BDC markdowns, by industry sector, both as a percentage of par value and in absolute dollars. The data show a dramatic discounting of BDC loans in the retail food and drug, entertainment/leisure, automotive, and health-care sectors.

A heat map of the above markdown data reveals the relative magnitude of distress in these industries and the sectors that are most likely to be at risk for the next wave of restructuring activity.

Outlook

In the nearly 15 years since the Great Recession, the US economy has managed to avoid a pervasive and sustained surge in corporate restructurings—with the notable exception of the initial wave of business failures resulting from the pandemic in 2020.

The accumulation of adverse market data throughout 2022 suggests that this time, something is different.

This article does not necessarily reflect the opinion of Bloomberg Industry Group, Inc., the publisher of Bloomberg Law and Bloomberg Tax, or its owners.

Author Information

Geoffrey Frankel is chief executive officer and senior managing director of Hilco Corporate Finance, a boutique investment banking adviser affiliated with Hilco Global.

Learn more about Bloomberg Law or Log In to keep reading:

See Breaking News in Context

Bloomberg Law provides trusted coverage of current events enhanced with legal analysis.

Already a subscriber?

Log in to keep reading or access research tools and resources.