- Sullivan & Cromwell bills $180 million on FTX, SVB bankruptcies

- FTX work draws scrutiny over S&C’s past representation

The FTX and Silicon Valley Bank collapses show Sullivan & Cromwell’s investments in its restructuring practice are paying enormous dividends for the law firm.

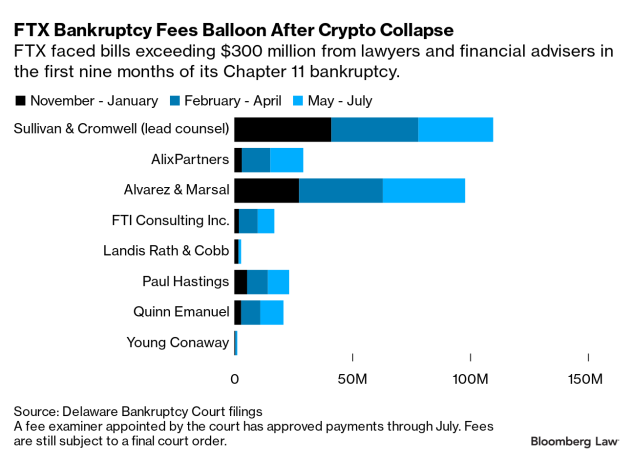

The elite Wall Street firm has billed more than $180 million since November 2022 in leading FTX Trading Ltd. and Silicon Valley Bank’s parent through Chapter 11, according to an analysis of fee requests. The $180 million is equal to 10% of revenue the firm told The American Lawyer it collected in all of 2022.

For Sullivan & Cromwell, the huge fees are a sea change from slightly more than a decade ago, when the firm had never represented a bankrupt entity. Wall Street firms once considered Chapter 11 work beneath them and left it to other shops until “Big Law realized this was an incredibly lucrative business,” said Robert Keach, a former president of the American Bankruptcy Institute.

Sullivan & Cromwell, with roots dating back to 19th century, has long staked its reputation as being the firm big business calls in a crisis, and its push into bankruptcy work augmented that position. But its success in the FTX case has also brought scrutiny tied to the firm’s work for the exchange before its collapse amid fraud allegations.

“People want to know what happened, and that means what happened with the gatekeepers,” said Jonathan Lipson, a Temple University law professor. He has advocated for an independent examiner to investigate the FTX fraud.

Sullivan & Cromwell’s first dabbling into restructuring came in 2008, when the Lehman Brothers collapse and untangling in Chapter 11 by Weil Gotshal & Manges and other advisers showed the law firm it was missing out on an opportunity.

“In the back of my head was, ‘Why can’t we do that?” said Andy Dietderich, a nearly 30-year firm veteran, in an interview. “How do you possibly pitch for that rescue work and tell clients, ‘Yeah, but if you actually need to file, go hire somebody else.’”

Dietderich, a finance and mergers and acquisitions lawyer by training, persuaded his partners to launch a restructuring group that year.

Fast forward to the FTX crypto exchange’s implosion, and Sullivan & Cromwell has billed more than $150 million while investigating the failure and while trying to recover billions of dollars in crypto assets, court filings show.

When combined with other advisers working on the case, approved fees for the first nine months eclipsed $300 million, making FTX “one of the highest, if not the highest,” burn rates for any bankruptcy, said Nancy Rapoport, a University of Nevada Las Vegas law professor. The fee collections, however, do remain subject to a final order at the end of a case.

Sullivan & Cromwell has defended the expenses, borne by creditors, saying they stem in part from FTX’s failure to retain corporate records and the challenge of applying the US bankruptcy code to the unregulated world of crypto.

“When we’re done, I think people are going to realize the amount of value created,” Dietderich said. “The professional fees are going to be a fairly modest amount of the value created, certainly when” compared with Lehman Brothers, where bankruptcy costs surpassed $5 billion, he said.

Sullivan & Cromwell is hardly alone in reaping large fees from bankruptcy cases. Kirkland & Ellis is poised to earn more than $120 million for its work as lead counsel to BlockFi Inc., Celsius Network LLC and Voyager Digital Holdings Inc. The three major crypto exchanges filed bankruptcy cases between June and November in 2022.

‘Savvy’ Practice

Sullivan & Cromwell’s restructuring group started as a tool for the firm to get involved in distressed acquisitions. The firm didn’t represent a bankrupt entity until 2012, when it took Eastman Kodak Co. into the company’s Chapter 11 reorganization.

The firm has kept its bankruptcy group lean, with just a few restructuring specialists. But it brings in a mass of corporate partners and associates when cases emerge.

About 200 Sullivan & Cromwell lawyers—an amount equal to about a fourth of the firm’s size—have worked on bankruptcies over the past year. That includes nearly 50 partners and counsel who have charged more than $2,100 an hour on FTX, court documents show.

Sullivan & Cromwell’s bench of lawyers with federal law enforcement and regulatory experience makes for a “real savvy bankruptcy practice,” said Dan Nardello, chief executive of Nardello & Co., an investigations firm working on the FTX matter.

The practice gained a key new piece in 2019 with the firm’s hire of Jim Bromley, then a restructuring leader at rival Cleary Gottlieb Steen & Hamilton. The timing proved fortuitous, as the Covid-19 pandemic fueled numerous big bankruptcies in 2020.

A few years later, FTX and Silicon Valley Bank, two of the firm’s clients, collapsed within months of each other amid broader shocks in the crypto and financial markets.

“For us, the main business reason to have a Chapter 11 practice is that it helps make the firm countercyclical,” said Dietderich, co-head of the global finance and restructuring group. Bromley’s hire “allows us to do matters like FTX and SVB simultaneously.”

Dietderich has led the FTX case, while Bromley has taken the mantle on the Chapter 11 of SVB Financial Group, after federal regulators seized control of the bank in March amid a run on deposits. The firm has billed more than $28 million through October on the case as it sells off assets and fights with US regulators over $2 billion in cash seized from the bank.

The work has carried a brighter spotlight over the past year. Sullivan & Cromwell, which began working with FTX after its former partner, Ryne Miller, joined the US arm, earned over $8 million advising the exchange in the 16 months before its downfall. That has prompted scrutiny over what its lawyers knew about the business.

Some FTX customers who were frozen out of their accounts have also voiced frustration as advisory fees balloon and the path to recovery remains uncertain.

“There’s a lot of money around and there’s a lot of vested interests,” said Pat Rabbitte, a former FTX customer who said he has a six-figure claim. “We have concerns about whose needs are being best served.”

FTX Role

Sullivan & Cromwell has been a key operator for FTX since Nov. 8, 2022, the date when Miller and another top FTX in-house lawyer called Dietderich and informed him of FTX’s liquidity crisis.

Dietderich said in a court filings that he began preparing a potential Chapter 11 filing and recommended FTX hire a chief restructuring officer. He named two potential candidates, including John Ray, who had worked with Bromley on the insolvencies of Nortel Networks and Overseas Shipholding Group Inc.

Upon being appointed, Ray filed for bankruptcy protection for FTX and about 130 affiliates. He then worked out of Sullivan & Cromwell’s Manhattan office as he took control of the company, according to a person familiar with the matter.

Working with Ray, Sullivan & Cromwell has recovered about $7 billion in assets while bringing several causes of action seeking to claw back billions more. The exchange has received customer claims surpassing $16 billion, according to a September court filing.

Sam Bankman-Fried, the FTX founder who was convicted of fraud in November, has attacked Sullivan & Cromwell, claiming the firm pressured him to appoint Ray and file for Chapter 11. Dietderich has denied this. The firm also faced an unsuccessful attempt by two FTX creditors to kick them off the case over an alleged conflict of interest.

Sullivan & Cromwell has led investigations into FTX in consultation with US law enforcement and has helped produce periodic reports. But the US Trustee, a federal watchdog that monitors corporate bankruptcies, argued that the work is not enough and sought an independent examiner.

“What you have here in effect is Sullivan & Cromwell deciding what is and is not in the public interest,” said Temple’s Lipson, who submitted an amicus brief with eight other law professors supporting the US Trustee.

Delaware Bankruptcy Judge John Dorsey originally denied the US Trustee’s motion, agreeing with Sullivan & Cromwell’s argument that FTX has a new, independent board and that an additional probe would cost creditors more than $100 million.

The Third Circuit, however, rejected Dorsey’s reasoning on Friday and ordered an outside investigator to be appointed. A “disinterested” examiner is “particularly salient here,” a three-judge panel wrote, in part due to potential conflicts issues raised over Sullivan & Cromwell.

To contact the reporter on this story:

To contact the editors responsible for this story:

Learn more about Bloomberg Law or Log In to keep reading:

See Breaking News in Context

Bloomberg Law provides trusted coverage of current events enhanced with legal analysis.

Already a subscriber?

Log in to keep reading or access research tools and resources.