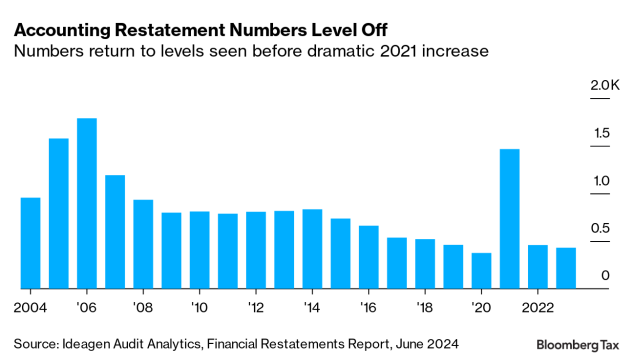

Corporate financial restatements have plateaued at levels close to those seen before 2021, when they rose to a 15-year high driven by a boom in blank-check companies correcting accounting errors, a new report shows.

Companies issued 430 financial statement corrections for accounting mistakes in 2023, according to Ideagen Audit Analytics’ latest annual financial restatements report released Monday. That represents a 6% decrease from 458 restatements issued in 2022, but both figures are less than one-third of the nearly 1,470 corrected financial statements recorded in 2021.

When companies uncover an accounting error, they must alert investors and formally restate their results to correct the problem. However, companies frequently also rely on informal corrections known as revisions, quietly tucked into routine securities filings, to fix what companies consider to be immaterial errors.

On average, each restatement cites fewer than two accounting issues annually, according to the report, but some companies far exceeded that.

Tupperware’s corrected issues included a lack of account reconciliations and improper accounting for expenses, discontinued operations, and more.

The company may be part of a larger pattern of companies revealing multiple problems in a single restatement, the report said. The percentage of restatements flagging just one issue decreased to 54% in 2023 from 70% in 2020, according to Ideagen.

The number of overall restatements has likely fallen since 2021 as a result of a decreasing number of special purpose acquisition companies, or SPACs, the report said. Those companies accounted for more than 75% of 2021 restatements after the Securities and Exchange Commission released guidelines on accounting for warrants and redeemable shares.

SPACs continue to restate at higher rates than traditional companies, according to Ideagen, though the number of SPAC restatements has decreased significantly in the two years since the IPO market boom.

To contact the reporter on this story:

To contact the editors responsible for this story:

Learn more about Bloomberg Law or Log In to keep reading:

See Breaking News in Context

Bloomberg Law provides trusted coverage of current events enhanced with legal analysis.

Already a subscriber?

Log in to keep reading or access research tools and resources.