- IPO mishaps spell likely litigation for newly public companies

- Misrepresentation suits may outpace fraud filings, lawyers say

Lawyers are planning for an increase in shareholder lawsuits after the US IPO market recently stumbled through a series of busts.

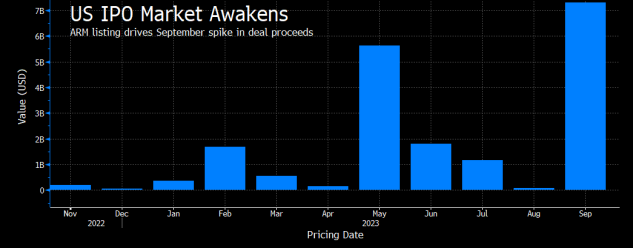

A run of listings that includes Arm Holdings Plc, Kenvue Inc., and Birkenstock Holding Plc have driven this year’s IPO proceeds to nearly double the same period in 2022. But the newest stocks are almost uniformly trading below their offering prices after a sharp selloff across the broader market.

Stocks that tumble after going public can be more prone to suits alleging misrepresentations during the listing process, lawyers said, even when those drops happen for unrelated reasons.

“We’ve seen a couple recently where companies have gone in, and the expectations have not been there for the investors, so the investors are disappointed,” said Todd Murray, a partner at Foley & Lardner LLP. “Those are maybe just market-driven events, and have nothing to do with misrepresentations at all, but that doesn’t mean that they won’t draw a lawsuit.”

So far in 2023, there have been 15 IPO-related cases filed against companies, down from 47 cases related to IPO misrepresentations last year, according to ISS Market Intelligence data. But the recent track record of IPOs undercutting expectations could prompt that number to climb back up going forward, according to Peter Stokes, partner at Norton Rose Fulbright US LLP.

“I think there is a likelihood of an upward trend,” he said. “The more IPOs there are, and the more IPOs at a high offer price, the likelier it is just based on the numbers game that you’re going to have more suits filed.”

Surprisingly, the entire cohort of companies that held their IPO in 2022 have not yet faced stock-drop litigation as of Sept. 30, says Priya Cherian Huskins, partner at Woodruff Sawyer.

“It’s early days yet and the plaintiffs’ bar knows well that they have a three-year statute of limitations,” she said. “I don’t think the class of 2022 is out of the woods yet.”

Lawsuits alleging misrepresentations in public filings and other misleading statements ahead of stock drops also accompanied a previous boom in special purpose acquisition company activity. But any stock drop can draw litigation for a given company after going public, with plaintiffs and the law firms that represent them prepared to scour disclosures for potentially misleading forward-looking statements or omissions, according to Stokes.

Unlike the more prevalent Section 10b-5 false statement-based stock drop cases, those filed under Section 11 of the Securities Act—which applies to registration statements—do not require plaintiffs to show any fraudulent intent by the company or its leadership.

“That also might incentivize plaintiffs to take more chances with an IPO claim, as opposed to an open-market claim where they have to ultimately come up with some compelling allegations of fraud,” Stokes said.

That strict liability doctrine also means that Section 11 allegations play particularly well into IPO- and SPAC-related class action lawsuits, according to Murray.

Double-Digit Decreases

“You used to see a lot more Section 11 claims 10 or 15 years ago, but with the current IPO and SPAC market, you might see a trend back in that direction,” he said. “You’ve got to find the right representation to hang your hat on, but a lot of plaintiffs just come in and say, ‘I can trace my shares into the IPO,’ and that gets you over the motion to dismiss phase.”

Double-digit percentage decreases are more likely to draw potential plaintiffs’ attention and accounting mistakes or problems with internal controls are also a common feature of lawsuits, so companies must be be extra careful to scrub their financial disclosures for those issues to stave off litigation, Murray said

Current market conditions should also give companies caution about the potential legal risks that could arise after going public, even if the outlook before the IPO was optimistic, he said.

“When the plaintiffs’ bar is analyzing whether or not to bring a case, they will of course decide if the squeeze is worth the juice,” Huskins said.

US IPOs have raised about $21 billion this year, compared to $11 billion at this point in 2022, according to data compiled by Bloomberg that excludes SPACs. A $7.3 billion windfall in September was this market’s biggest month since November 2021 after rising interest rates and bouts of market volatility sidelined most activity during the nearly two-year span. But 15 of the month’s 17 listings have fallen below their respective IPO prices, including ARM.

The full cohort of 2023 US IPOs is trading 7.5% below their offering prices on average, breaking from the 8.5% run-up in the S&P 500 Index through Oct. 30. The IPO market contracted in response, with 13 deals raising $2.2 billion in October.

Read More: US IPO Market Teetering on Edge After Fall Class Disappoints

To contact the reporter on this story:

To contact the editors responsible for this story:

Learn more about Bloomberg Law or Log In to keep reading:

See Breaking News in Context

Bloomberg Law provides trusted coverage of current events enhanced with legal analysis.

Already a subscriber?

Log in to keep reading or access research tools and resources.