As Delaware, the country’s long-established corporate capital, saw several high-profile companies leave the state last year, a debate is building whether ‘DExit’ will be a lasting trend.

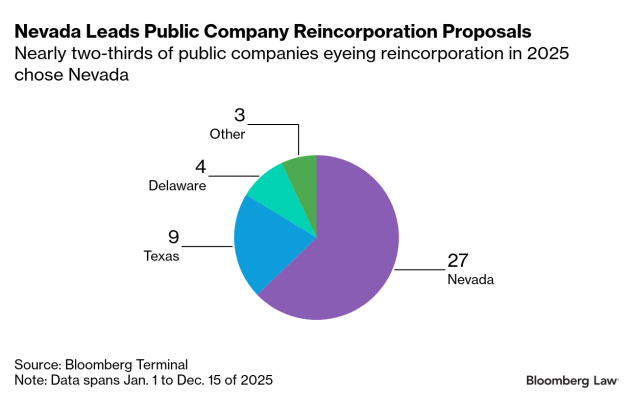

More than three-dozen public companies proposed changing their state of incorporation last year, and Nevada was the most popular destination, according to Bloomberg Terminal data.

Yet Delaware’s still home to about two-thirds of the Fortune 500 and unlikely to become a “ghost town” anytime soon, said Benjamin Edwards, a law professor at the University of Nevada, Las Vegas.

“Other states may pick up some of the market share,” but many companies would need a significant reason to abandon the Delaware corporate law they understand well, he said.

Here are four things to watch next year to see how far reincorporation goes:

Industry

Reincorporation data hasn’t shown a strong political trend, said Michal Barzuza, a corporate law professor at the University of Virginia. But politics aren’t totally irrelevant either: Texas is aligned with the current White House, so industries favored by President

Cryptocurrency, which has the support of the Trump-nominated Securities and Exchange Chair Paul Atkins, is one example. Two public cryptocurrency companies,

Meanwhile, Nevada has grabbed companies across the technology and entertainment industries, including

Sectors that already have a large Texas presence, such as energy, might get more pressure from investors and stakeholders to reincorporate there, said Samantha Hale Crispin, partner at Baker Botts LLP. At least one energy company, Zion Oil & Gas Inc., moved to Texas in 2025.

Litigation

Delaware wrapped up one buzzy case before the new year, with the state supreme court ruling in favor of Tesla Inc. CEO

But another big case to watch is taking place in Texas, where a federal court is set to decide whether the state’s new requirements for proxy advisory firms violate the First Amendment. The outcome of that case will help determine how companies view Texas and who’s excited to reincorporate there, Crispin said.

Companies have been struggling with “the burden and the hassle of dealing with” increasing numbers of social and governance proposals, she said. But a new Texas law letting companies raise ownership thresholds to submit such proposals, as well as parameters around proxy advisors, are “really attractive” to companies seeking to save time and money dealing with annual shareholder proposals, she said.

Proxy Season

If companies make proposals for moves to Nevada, Texas, or another state, many will likely pop up in proxy statements this spring and face a shareholder vote.

Shareholders will have to compare investor protections in the two states, Barzuza said. But if company insiders control significant parts of the stock, it ultimately won’t matter what retail investors desire. In 2025, shareholders seemed wary of approving reincorporations in Nevada and a little less hesitant with Texas, she said. Fintech company Netcapital Inc.‘s Nevada reincorporation proposal, for instance, failed by nearly one million votes. Texas reincorporation proposals haven’t seen outright failures, but one company, MercadoLibre Inc., withdrew the measure before its annual meeting.

Last year was the biggest year on reincorporation proposals, according to Bloomberg data, and that trend isn’t likely to reverse in 2026, said Abigail Gampher Takacs, a Bloomberg Law analyst.

“We will see a number of companies in their proxies looking to move, and I think there are even more that really like the idea — but they’re not sure they want to be a first mover. Some of them want to see ‘Is there a crowd that goes before me?’” Crispin said, adding that some also are awaiting the development of business courts outside Delaware.

Business Courts

The Delaware Chancery Court has for years been considered the premier venue to settle corporate disputes, with judges who are business law experts empowered to expedite cases and resolve them without juries. But more controller-led companies have cited dissatisfaction with that system—particularly rulings perceived as favoring minority shareholders—in opting to reincorporate in other states.

Texas opened its specialized business court in 2024 with the promise of a staunchly code-based interpretation system to offer companies more predictability. The Texas Business Court wrapped up its first bench trial in November, ruling in favor of

Mark Pendleton, a Dallas-based partner at Bradley Arant Boult Cummings LLP, said companies he counsels have been pleased with the courts so far. But the system isn’t as busy as the state’s other courts right now, so the test will be whether they can keep the same speed and ease as more cases come, he said.

Meanwhile, the Nevada Supreme Court tasked a commission of judges, attorneys, and business leaders to get its own specialty business court to start hearing cases later this year.

Creating a system that allows for efficient and consistent case adjudication “has that trickle effect of making our community more desirable for businesses to relocate to,” Chief Justice Douglas W. Herndon said at a Nov. 18 commission meeting.

To contact the reporters on this story:

To contact the editors responsible for this story:

Learn more about Bloomberg Law or Log In to keep reading:

See Breaking News in Context

Bloomberg Law provides trusted coverage of current events enhanced with legal analysis.

Already a subscriber?

Log in to keep reading or access research tools and resources.