Health-care industry deals continue to increase in 2021, with health IT and life science and pharmaceuticals the top two sectors, according to Epstein Becker Green attorneys and health industry financial/investment analysts at KPMG and FocalPoint Partners. They predict a possible record year, with many deals set to close by the end of the year in light of uncertainty around tax rate changes, as well as other factors, including high valuations in the current market.

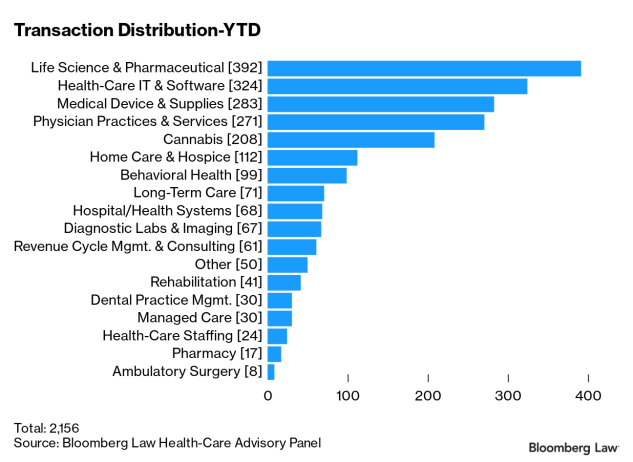

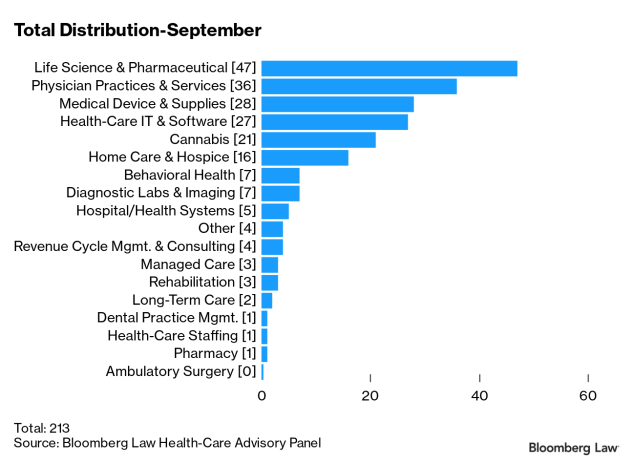

Although deal volume in September (213) dipped a little from the Summer, announced and closed deals through the first three quarters of 2021 (2,156) now already exceeds the total deal volume for all of 2020 (1,936).

At current pace, deal volume for 2021 will easily exceed 2,750—and likely will traverse the 3,000 deal mark due to the extensive volume of transactions underway which are targeted to close before the end of the year due to various reasons, including uncertainty in future tax rates based on ongoing discussions in Congress, and also the desire to capture current frothy valuations in the market.

With regard to the top two sectors, life science and pharmaceuticals has already reached nearly 400 deals to-date (and is expected to surpass 500 by years end), while health-care IT and software already has exceeded 320 deals and is expected to end the year with around 450 deals.

Economic headwinds (e. g. continuing supply chain challenges, higher inflation and employment shortages), as well as continuing uncertainty over whether Congress can pass an infrastructure bill or a Democratic-driven reconciliation bill, could be tempering enthusiasm for health-care investment; however, we expect the deal market to continue to be robust in the fourth quarter, despite the economic and political headwinds.

Life Science & Pharmaceuticals

Life science and pharmaceutical had the highest volume of announced or closed deals in September (47) and averaged 49 deals over the past three months, the most active quarter this year. A continuing strong pipeline along with recent announcements about the additional Covid-19 therapeutics, including oral antivirals and vaccine boosters, will likely carry this momentum through the end of the year. On the other hand, investors will undoubtedly be watching to see what type of prescription drug price control measures may emerge from current discussions among congressional Democrats.

Health-Care IT and Software

Health-care IT, with nearly 30 deals in September, is on pace to have the second most announced or closed deals of any sector this year. As the pandemic continues to take its course through the coming months, consumer demand will likely remain high for innovative remote care options and new innovative IT tools, creating a new hybrid care delivery system that meets both pre-pandemic and pandemic consumer needs.

Medical Device and Supplies

The medical device and supply sector also is close to 300 transactions thus far in 2021, and due to various factors, including continued demand pertaining to the distribution and administration of Covid-19 vaccines, could reach the 400 mark by the end of the year.

Physician Practices & Services

The physician practices and services sector saw 36 deals closed or announced in September, finishing Q3 with 79 total transactions. Interest in the sector persists and because numerous physician groups have deals in process that plan to close by year end, we anticipate this sector exceeding 400 deals this year.

Women’s health enjoyed another active month with five deals in total, highlighted by multiple acquisitions by Webster Equity Partners following the firm’s entrance into the space with the acquisitions of California-based Santa Monica Fertility in late 2019 and Ohio-based Reproductive Gynecology & Infertility in August 2021. The firm continued to increase its geographic reach in September, adding Virginia-based Dominion Fertility and Illinois-based Institute for Human Reproduction.

Eye care transaction activity remains robust as well, with nine transactions closed or announced during the month. Retina Consultants of America and US Eye were the most active acquirers, each completing two deals during the month. Texas-based Retina Consultants of America continued its string of acquisitions in 2021, adding practices in New York and Tennessee, while Florida-based US Eye added groups in Virginia and North Carolina.

Home Health and Hospice

The home health and hospice sector exceeds 100 transactions thus far through Q3, and could very well exceed 150 deals by year end due to the ongoing and increasing demand for cost-effective and convenient health-care services in the home setting.

Behavioral Health

Behavioral health had an active month in September with a total of 30 in Q3 and 99 thus far in 2021, and potentially could close out the year with over 150 deals due to the extensive activity in the pipeline. The sector has experienced heightened demand for services in recent years due to increased recognition of its importance, a trend which has been accelerated by Covid-19 and the impacts the pandemic has had on mental health.

The largest transaction in the sector during September was Patient Square Capital’s acquisition of Summit BHC for $1.3 billion. The transaction is just the fourth for Patient Square, a newly formed private equity firm led by ex-KKR head of health care, Jim Momtazee. Summit is a leading substance abuse treatment and psychiatric services platform based in Tennessee. The company experienced rapid growth following its sale to Lee Equity Partner and FFL Partners in 2017, having made seven acquisitions during the firms’ ownership, opened five new facilities, and expanded many of its existing facilities. Today the practice has 24 locations in 16 states.

Cannabis

Cannabis transaction volume also remains robust, with over 200 years through Q3, almost doubling the activity seen last year. It is certainly possible that this sector could end the year with over 300 transactions.

While concentration of deals remains high in states like California and Colorado, which have had legalized cannabis for years, activity continues to occur in a wide number of states that have recently enacted legislation legalizing both medical and recreational marijuana.

Outlook for Q4 2021

For all the reasons described above, we anticipate a super-robust fourth quarter, with a record number of deals in all leading sectors to close out 2021, with around 3,000 total transactions. This soaring health-care deal pace is expected to continue well into 2022 as long as the economy doesn’t encounter a major disruption.

This column does not necessarily reflect the opinion of The Bureau of National Affairs, Inc. or its owners.

Write for Us: Author Guidelines

Author Information

Gary W. Herschman is a member of Epstein Becker Green in its Newark, N.J., office. Anjana D. Patel is a member of Epstein Becker Green in Newark. Zachary S. Taylor is an associate at Epstein Becker Green in Newark. Hector M. Torres is managing director at FocalPoint Partners LLC in Chicago. Larry Kocot is a principal and national leader, Center for Healthcare Regulatory Insight at KPMG LLP in Washington, D.C. Carole Streicher is U.S. lead partner, deal advisory and strategy at KPMG LLP in Chicago

Ryan DeBlaey and Michael Stotz of FocalPoint Partners; and KPMG’s Ross White, Puja Ghelani, and Shakoor Jilani contributed to this article.

Learn more about Bloomberg Law or Log In to keep reading:

See Breaking News in Context

Bloomberg Law provides trusted coverage of current events enhanced with legal analysis.

Already a subscriber?

Log in to keep reading or access research tools and resources.