Happy Friday! Would you like to go to Houston in January AND February?

This week I wrote about a lawsuit that Texas-based Siltstone Capital brought against its former general counsel, Manmeet Walia. Siltstone alleges he formed a competing business while still an employee and diverted opportunities to the new venture. The funder also contends that he used confidential and proprietary information, including investor lists, to form his new company, Signal Peak Partners. Walia responded that Siltstone was aware of his plans and he was released from his non-compete obligations.

Siltstone filed a temporary restraining order but it was denied.

Another allegation is that Walia formed a competing conference to one that Siltstone has held since 2022. Walia’s conference will be about a month after Siltstone’s at the same hotel. As anyone who follows litigation finance knows, this industry loves conferences. So it is entirely plausible that people will travel to Houston twice in a month span. At least the conferences aren’t in the summer...

Bloomberg Law subscribers can get this Litigation Finance newsletter in their inbox on Fridays. Sign up here.

LF Dealmakers

Speaking of conferences, I’m moderating a panel next week at the LF Dealmakers conference in New York City. My panel is on the state of the industry and we’ll be talking about deal flow, regulation and many of the trends that have been occurring this past year. Here’s the rundown on the panelists:

- Nathaniel Catez, Executive Director, Moelis & Company

- Craig C. Martin, Chairman, Americas, Willkie, Farr & Gallagher

- Michael Nicolas, Co-Founder & Managing Director, Longford Capital

- Simon Warr, Lead Underwriter, AmTrust International

I’m planning to be at the conference all three days, so feel free to reach out if you want to meet up or just come and say hi!

What I’m reading

The Financial Times had a story out this week about UK law firm Pogust Goodhead having a staff revolt over concerns that its funder, Gramercy Funds Management, is attempting to interfere in the firm’s work. Pogust is bringing a £36 billion lawsuit against miner BHP and a senior partner at the firm removed himself from the case over these concerns. Gramercy also recently pushed out the law firm’s chief executive, Tom Goodhead. Pogust called the idea that Gramercy is directing its decision “entirely false.” Gramercy declined comment.

Burford Capital announced a minority investment in Kindleworth, a finance and asset management firm focused on law. Kindleworth helps launch law firms and also manages key back office functions, like technology and HR. The company has helped more than 50 law firms and offices globally get started.

Reuters had a story about litigation funder Archetype Capital Partners suing one of its co-founders and a law firm, alleging they stole client information. In the suit, they allege co-founder Andrew Schneider and law firm Bullock Legal used company trade secrets to secure funding for cases. Schneider called the allegations “patently false.”

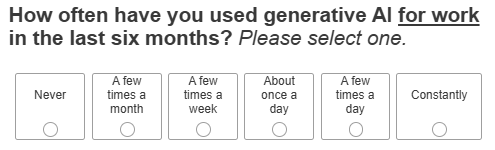

Weigh in on the State of Your Practice

The practice of Law is constantly changing, and all practice areas seem to be affected. Provide your insights in Bloomberg Law’s last State of Practice Survey of the year.

Leading the News

Clients Push Big Law Firms to Use Generative AI for Cost Savings

Law firm partners are wrestling with a new question from clients: How are you using generative artificial intelligence to lower the cost of your work?

Commentary & Opinion

Anthropic Settlement Has Historic Implications—Beyond the Cost

USC law professor Jonathan Barnett says Anthropic’s decision to settle its class action rather than continue litigation is a sign that copyright owners’ power may grow in courtrooms, despite recent trends.

To contact the reporters on this story:

To contact the editor responsible for this story:

Learn more about Bloomberg Law or Log In to keep reading:

See Breaking News in Context

Bloomberg Law provides trusted coverage of current events enhanced with legal analysis.

Already a subscriber?

Log in to keep reading or access research tools and resources.