The Centers for Medicare & Medicaid Services (CMS) has released its final rule to update both the Hospital Inpatient Prospective Payment System (IPPS) and the Long-Term Care Hospital (LTCH) Prospective Payment System for fiscal year (FY) 2018.

The document was published in the Federal Register Aug. 14th and is available at https://www.gpo.gov/fdsys/pkg/FR-2017-08-14/pdf/2017-16434.pdf. A display version is at: https://s3.amazonaws.com/public-inspection.federalregister.gov/2017-16434.pdf. Page numbers in this article refer to the display copy unless otherwise noted.

The IPPS tables are at: http://www.cms.hhs.gov/Medicare/Medicare-Fee-for-Service-Payment/AcuteInpatientPPS/index.html. Click on the link on the left side of the screen titled, “FY 2018 IPPS Final Rule Home Page” or “Acute Inpatient—Files for Download.”

The LTCH PPS tables are available at: http://www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/LongTermCareHospitalPPS/index.html under the list item for Regulation Number CMS-1677-F.

Comment

CMS says the changes it is making will increase Medicare payments by $2.4 billion in FY 2018. This is a huge reduction from CMS’s proposed estimate of a $3.1 billion increase. Payments to long-term care hospitals are expected to decrease by $110 million in FY 2018. As of July 2017, there were 3,292 IPPS acute care hospitals included in CMS’s analysis; 1,387 critical care hospitals (CAHs) and 419 LTCHs.

This is another long rule—some 2,450 pages—with much, too much, repeated history. And, unfortunately, this rule fails to provide simple and clear final decision sections. This makes finding such actions burdensome, time consuming and very difficult.

Considering the rule has a table of contents extending some 37 pages, CMS fails, once again, to provide any help with page numbering. If the agency wants to assist the reader locate pertinent information and reduce burden, page numbers would be very helpful.

To assist those with a particular subject interest, page numbers corresponding to the material in the display copy of the rule are provided. Note, these numbers will change upon the rule’s publication in the Federal Register. It is highly recommended that you download the display version before it is removed on August 14th. Also, there are instances in which a particular item can be discussed in more than one area. Not all such area page listings are identified.

For many payment issues, the rule’s Addendum (beginning on pdf page 2,129) contains much concise and helpful information.

The summary information over the next several pages is extracted from the rule’s executive material and a CMS fact sheet.

Changes to Payment Rates Under IPPS (page 720 & addendum)

The increase in operating payment rates for general acute care hospitals paid under the IPPS that successfully participate in the Hospital Inpatient Quality Reporting (IQR) Program and are meaningful electronic health record (EHR) users will be 1.35 percent.

The 1.35 percent increase reflects a projected hospital market basket update of 2.7 percent (proposed at 2.9 percent); adjusted by a -0.6 percentage point required for productivity (proposed at -0.4 percent); and a -0.75 percentage point adjustment to the update required by the Affordable Care Act (ACA).

There are other adjustments, as well—a -0.6 percent adjustment to remove the one-time adjustment made in FY 2017 for the FYs 2014–2016 effect of the adjustment to offset the estimated costs of the “two midnight” policy, and a +0.4588 percentage point adjustment required by the 21st Century Cures Act (Cures Act) that together will reduce the 1.35 percent update further.

Other additional payment adjustments include continued penalties for excess readmissions, a continued 1.0 percent penalty for hospitals in the worst performing quartile under the Hospital Acquired Condition Reduction Program, and continued upward and downward adjustments under the Hospital Value-Based Purchasing Program.

CMS says also, that “the applicable percentage increase to the IPPS rates required by the statute, in conjunction with other payment changes in this final rule, will result in an estimated $2.4 billion increase in FY 2018 payments, reflecting a $1.7 billion increase in FY 2018 operating payments, a $0.8 billion increase in uncompensated care payments, a $0.2 billion increase in FY 2018 capital payments, and a $0.3 billion decrease in low volume payments.”

After all adjustments, CMS says the net FY 2018 update will be approximately 1.2 percent.

Medicare Dependent Hospitals (MDH) (page 726)

CMS notes that under current law, the MDH program will expire at the end of FY 2017. CMS says 96 MDHs will no longer receive the blended payment and will be paid only under the Federal rate in FY 2018. CMS estimates that those hospitals will experience an overall decrease in payments of approximately $119 million.

Medicare Uncompensated Care Payments (page 771)

CMS will distribute roughly $6.8 billion in uncompensated care payments in FY 2018, an increase of approximately $800 million from the FY 2017 amount. This change reflects CMS’s finalized proposal to incorporate data from its National Health Expenditure Accounts into its estimate of the percent change in the rate of uninsurance, which is used in calculating the total amount of uncompensated care payments available to be distributed.

Also, CMS is finalizing its proposal to begin incorporating uncompensated care cost data from Worksheet S-10 of the Medicare cost report in the methodology for distributing these funds. Specifically, for FY 2018, CMS will use Worksheet S-10 data from FY 2014 cost reports in combination with Medicare and Medicaid low income days data from the two preceding cost reporting periods to determine the distribution of uncompensated care payments.

CMS is providing hospitals with an opportunity to resubmit certain Worksheet S-10 data to their Medicare Administrative Contractors by September 30, 2017.

Imputed Floors (page 566)

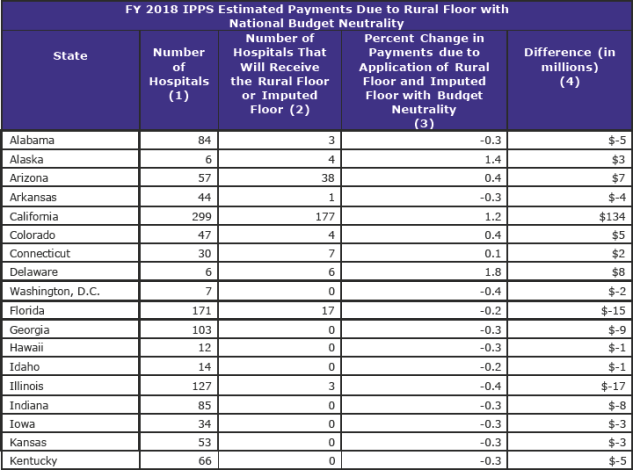

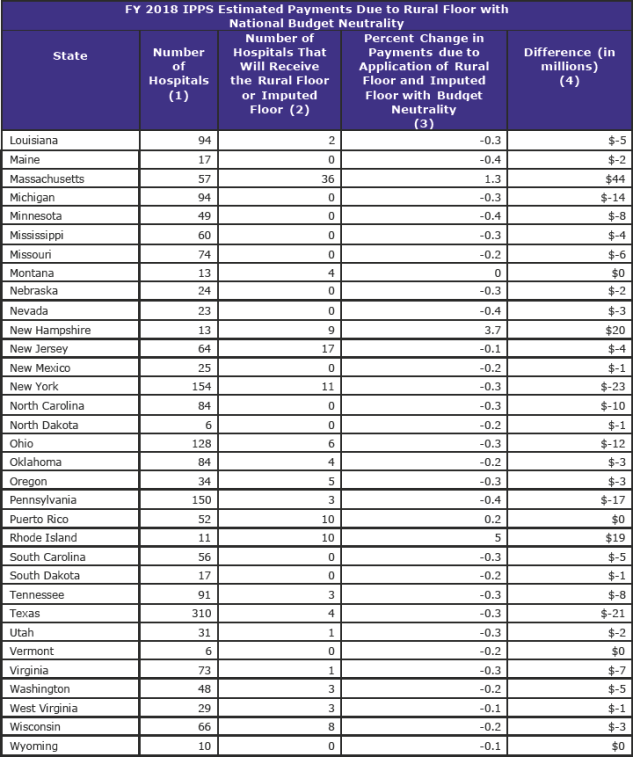

The statute established the rural floor by requiring that the wage index for a hospital in any urban area cannot be less than the wage index received by rural hospitals in the same State. CMS estimates that 400 hospitals will receive the rural and imputed floors in FY 2018.

The imputed floor policy established a minimum wage index for hospitals in all-urban states (New Jersey, Rhode Island, and Delaware). This policy was set to expire at the end of FY 2017. However, CMS will now continue the imputed floor policy for an additional year, through FY 2018.

Notice Regarding Changes to Instructions for the Review of the Critical Access Hospital (CAH) 96-Hour Certification Requirement (page 1,204)

For inpatient CAH services to be payable under Medicare Part A, the statute requires that a physician certify that the individual may reasonably be expected to be discharged or transferred to a hospital within 96 hours after admission to the CAH. CMS has reviewed the CAH 96-hour certification requirement to determine if there are ways to reduce its burden on providers.

CMS is reiterating the notification provided in the proposed rule that it will direct Quality Improvement Organizations (QIOs), Medicare Administrative Contractors (MACs), the Supplemental Medical Review Contractor (SMRC), and Recovery Audit Contractors (RACs) to make the CAH 96-hour certification requirement a “low priority” for medical record reviews conducted on or after October 1, 2017. This means that absent concerns of probable fraud, waste, or abuse, CAHs should not expect to receive medical record requests from QIOs, MACs, RACs, or the SRMC related to the 96-hour certification requirement.

Hospital-Acquired Conditions (HAC) Reduction Program (page 1,092)

The HAC Reduction Program is intended to encourage hospitals to reduce the incidence of hospital-acquired conditions by requiring the Secretary to impose a payment reduction of 1.0 percent for applicable hospitals that rank in the worst-performing quartile. CMS is finalizing two changes to its existing HAC Reduction Program policies:

- Specifying the dates of the data period used to calculate hospital performance for the FY 2020 HAC Reduction Program; and

- Updating the Extraordinary Circumstance Exception policy.

Hospital Readmissions Reduction Program (HRRP) (page 907)

The HRRP requires a reduction to a hospital’s base operating DRG payment to account for excess readmissions associated with selected applicable conditions. CMS is implementing changes to the payment adjustment factor in accordance with the 21st Century Cures Act. CMS will assess penalties based on a hospital’s performance relative to other hospitals with a similar proportion of patients who are dually eligible for Medicare and full-benefit Medicaid. Specifically, CMS is finalizing the following:

- Defining the proportion of full benefit dual-eligible beneficiaries as the proportion of dual-eligible patients among all Medicare fee-for-service and Medicare Advantage stays during the 3-year period that corresponds to the performance period

- Stratifying hospitals into five peer groupings; and

- Adopting a change to the payment adjustment formula calculation methodology.

In addition, CMS is updating the program’s Extraordinary Circumstance Exception policy.

Hospital Value-Based Purchasing (VBP) Program (page 980)

The Hospital VBP Program adjusts payments to hospitals for inpatient services based on their performance on an announced set of measures. CMS is finalizing its proposals to implement updates to the Hospital VBP Program, including the removal of and the update of one measure, and adoption of two measures. Specifically, CMS is finalizing its proposals to:

- Remove the current 8-indicator Patient Safety for Selected Indicators measure from the Safety domain beginning with the FY 2019 program year and replace it with the 10-indicator Patient Safety and Adverse Events Composite measure, which is a modified version of the removed measure beginning with the FY 2023 program;

- Adopt a payment measure associated with 30-day episodes of care for pneumonia patients for the Efficiency and Cost Reduction domain beginning with the FY 2022 program year; and

- Update the weighting of measures in the Efficiency and Cost Reduction domain to reflect the addition of new condition-specific payment measures along with the overall Medicare Spending per Beneficiary measure beginning with the FY 2021 program year.

Long-Term Care Hospital (LTCH) Prospective Payment System (PPS) Changes (page 1,212 & Addendum)

CMS is updating the LTCH PPS standard Federal payment rate by 1.0 percent, consistent with the provisions of the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA). This is the payment rate applicable to LTCH patients that meet certain clinical criteria under the dual rate LTCH PPS payment system required by the Pathway for SGR Reform Act of 2013.

In addition, CMS is continuing to evaluate if the 25-percent threshold policy is still needed. For FY 2018, CMS is finalizing its proposal to implement a regulatory moratorium on the implementation of the 25-percent threshold policy for FY 2018 while it conducts the evaluation. CMS is also revising its short-stay outlier payment adjustment and implementing various provisions of the 21st Century Cures Act that affect LTCHs.

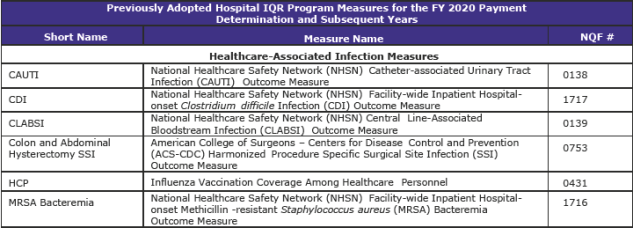

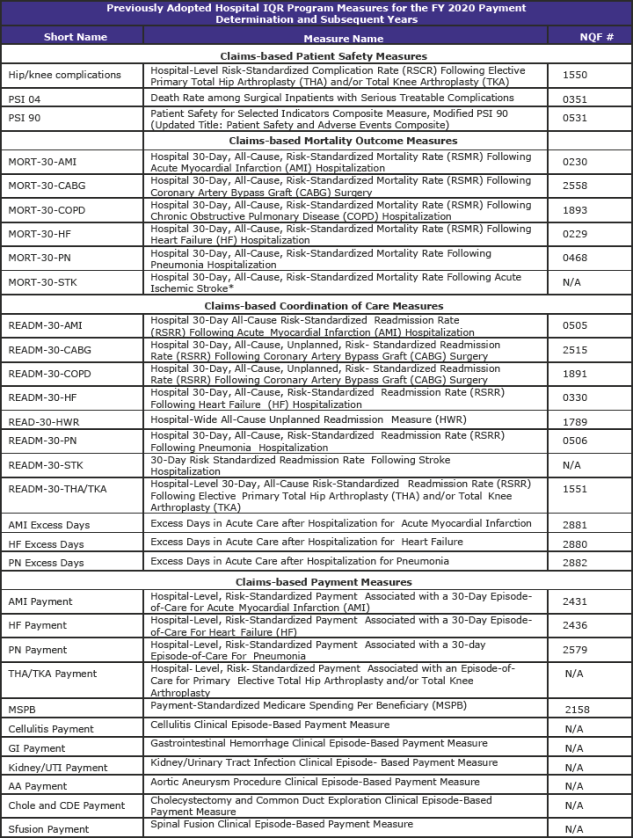

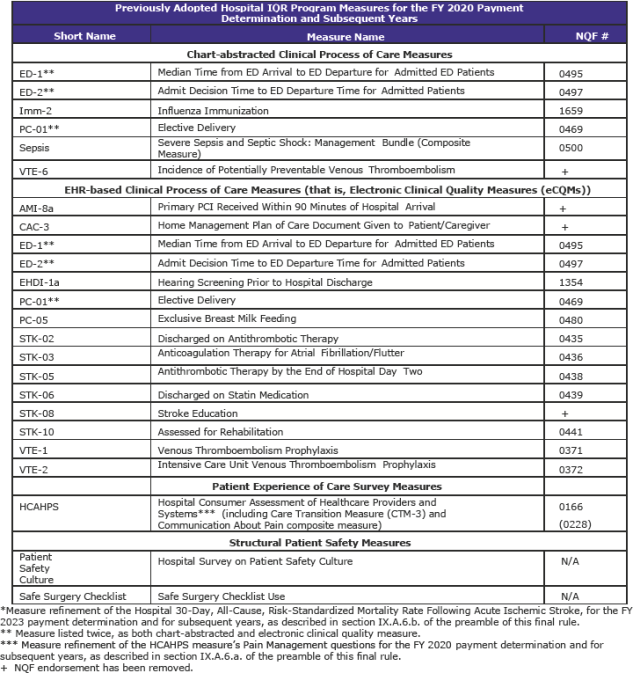

Hospital Inpatient Quality Reporting (IQR) Program (page 1,316)

The Hospital IQR Program was established by the Medicare Prescription Drug, Improvement, and Modernization Act of 2003.

CMS is refining two previously adopted measures as follows:

- Replacing the pain management questions in the Hospital Consumer Assessment of Healthcare Providers and Systems (HCAHPS) Survey to focus on the hospital’s communications with patients about the patients’ pain during the hospital stay beginning with surveys administered in January 2018. In response to stakeholder feedback, public display of hospital performance data on these refined questions will be delayed for one year so that hospitals may gain more experience with the refined questions.

- Updating the risk adjustment methodology used in the Stroke 30-Day Mortality measure to include the use of stroke severity codes (based on the NIH Stroke Scale).

CMS is adopting the Hospital-Wide All-Cause Unplanned Readmission Hybrid Measure as a voluntary measure for the CY 2018 reporting period that uses both claims and electronic health record data for measure calculation.

Changes to Clinical Quality Measures (CQMs) (pages 1,442 & 1,937)

For eligible hospitals and CAHs that report CQMs electronically for the EHR Incentive Programs, CMS is finalizing the following policies:

• For Calendar Year (CY) 2017:

- a. Reporting period: For eligible hospitals and CAHs reporting CQMs electronically that demonstrate meaningful use for the first time in 2017 or that have demonstrated meaningful use in any year prior to 2017, the reporting period will be one self-selected quarter of CQM data in CY 2017.

- b. CQMs: If an eligible hospital or CAH is only participating in the EHR Incentive Program or is participating in both the EHR Incentive Program and the Hospital IQR Program, the eligible hospital or CAH will report on at least four (self-selected) of the available CQMs.

• For CY 2018:

- a. Reporting period: For eligible hospitals and CAHs reporting CQMs electronically that demonstrate meaningful use for the first time in 2018 or that have demonstrated meaningful use in any year prior to 2018, the reporting period will be one self-selected quarter of CQM data in CY 2018. For the Medicare EHR Incentive Program only, the submission period for reporting CQMs electronically will be the two months following the close of the calendar year, ending February 28, 2019.

- b. CQMs: For eligible hospitals and CAHs participating only in the EHR Incentive Program or participating in both the EHR Incentive Program and the Hospital IQR Program, the eligible hospital or CAH will report on at least four (self-selected) of the available CQMs.

- c. For eligible hospitals and CAHs that report CQMs by attestation under the Medicare EHR Incentive Program as a result of electronic reporting not being feasible and for eligible hospitals and CAHs that report CQMs by attestation under their State’s Medicaid EHR Incentive Program, they are required to report on all 16 available CQMs for the full CY 2018 (consisting of four quarterly data reporting periods). CMS has established an exception to this full-year reporting period for eligible hospitals and CAHs demonstrating meaningful use for the first time under their State’s Medicaid EHR Incentive Program. Under this exception, the CQM reporting period is any continuous 90-day period within CY 2018.

Additionally, for the eligible professionals (EPs) in the Medicaid EHR Incentive Program, CMS is finalizing the following changes:

- 1. Reporting Periods: For 2017, CMS is modifying the CQM reporting period for EPs in the Medicaid EHR Incentive Program to be a minimum of a continuous 90-day period during calendar year 2017.

- 2. CQMs: For 2017, CMS is aligning the specific CQMs available to EPs participating in the Medicaid EHR Incentive Program with those available to professionals participating in the Merit-based Incentive Payment System.

Lastly, CMS is aligning its Extraordinary Circumstances Exceptions (ECE) policy with other quality reporting programs and is making conforming updates to 42 CFR 412.140(c)(2).

Changes to the Medicare and Medicaid EHR Incentive Programs (page 1,992)

CMS is finalizing the modification to the EHR reporting periods for new and returning participants attesting to CMS or their state Medicaid agency from the full year to a minimum of any continuous 90-day period during the calendar year.

CMS is finalizing the addition of a new exception from the Medicare payment adjustments for EPs, eligible hospitals, and CAHs that demonstrate through an application process that compliance with the requirement for being a meaningful EHR user is not possible because their certified EHR technology has been decertified under ONC’s Health IT Certification Program.

CMS is also finalizing an exception to the 2017 and 2018 Medicare payment adjustments for ambulatory surgical center (ASC)-based EPs and defining ACS-based EPs as those who furnish 75 percent or more of their covered professional services in an ASC, using Place of Service (POS) code 24 to identify services furnished in an ASC.

CMS is adopting final policies to allow healthcare providers to use either 2014 Edition CEHRT, 2015 Edition CEHRT, or a combination of 2014 Edition and 2015 Edition CEHRT, for an EHR reporting period in 2018.

PPS-Exempt Cancer Hospital Quality Reporting (PCHQR) Program (page 1,678)

The PCHQR Program collects and publishes data on an announced set of quality measures. CMS is finalizing its proposals to adopt four new measures, remove three previously-adopted measures, and implement revisions to the PCHQR Extraordinary Circumstances Exceptions (ECE) Policy. Specifically, CMS is adopting four measures that assess end-of-life care:

- 1. Proportion of Patients Who Died from Cancer Receiving Chemotherapy in the Last 14 Days of Life (NQF #0210);

- 2. Proportion of Patients Who Died from Cancer Admitted to the ICU in the Last 30 Days of Life (NQF #0213);

- 3. Proportion of Patients Who Died from Cancer Not Admitted to Hospice (NQF #0215); and

- 4. Proportion of Patients Who Died from Cancer Admitted to Hospice for Less than Three Days (NQF #0216).

CMS is also removing three cancer-specific, chart-abstracted process measures:

- 1. Adjuvant Chemotherapy is Considered or Administered Within Four Months (120 Days) of Diagnosis to Patients Under the Age of 80 with AJCC III (Lymph Node Positive) Colon Cancer (NQF #0223);

- 2. Combination Chemotherapy is Considered or Administered Within Four Months (120 Days) of Diagnosis for Women Under 70 with AJCC T1c, or Stage II or III Hormone Receptor Negative Breast Cancer (NQF #0559); and

- 3. Adjuvant Hormonal Therapy (NQF #0220).

Long Term Care Hospital Quality Reporting Program (LTCH QRP) (page 1,736)

The LTCH QRP currently has 17 adopted measures.

CMS is finalizing the removal of two currently adopted measures; Percent of Residents or Patients with Pressure Ulcers That Are New or Worsened (Short Stay) (NQF #0678), and All-Cause Unplanned Readmission Measure for 30 Days Post-Discharge from LTCHs (NQF #2512). CMS is also finalizing the public display of six new quality measures on the LTCH Compare website by fall 2018 and the public display of one new quality measure on the LTCH Compare website by fall 2020.

In addition to the new policies to quality measures and public reporting, CMS is finalizing that beginning with the FY 2019 LTCH QRP, the data that LTCHs report on the measure, Percent of Residents or Patients with Pressure Ulcers That Are New or Worsened (Short Stay) (NQF #0678), meet the definition of standardized patient assessment data, and beginning with the FY 2020 LTCH QRP, the data that LTCHs report on the measures, Changes to Skin Integrity Post-Acute Care: Pressure Ulcer/Injury and Application of Percent of Long-Term Care Hospital Patients with an Admission and Discharge Functional Assessment and a Care Plan That Addresses Function (NQF #2631), meet the definition of standardized patient assessment data.

Lastly, CMS is finalizing its proposals with respect to the applicability of current procedural requirements.

Inpatient Psychiatric Facility Quality Reporting Quality Reporting (IPFQR) Program (page 1,880)

The current IPFQR Program includes 18 mandatory measures.

CMS is not finalizing the Medication Continuation following Inpatient Psychiatric Discharge measure. CMS is updating the IPFQR Program’s extraordinary circumstances exception (ECE) policy to align with other CMS programs’ ECE provisions. CMS is also changing the annual data submission timeframes for Notices of Participation (NOP) and withdrawals from the Program and its policy to provide precise dates defining the end of the data submission period. Finally, CMS is adopting factors by which it would evaluate measures to be removed from or retained in the IPFQR Program.

Rural Community Hospital Demonstration Extension (page 1,125)

Section 15003 of the 21st Century Cures Act requires an extension of the Rural Community Hospital Demonstration for an additional 5-year period. The demonstration was authorized originally for a 5-year period by section 410A of the Medicare Prescription Drug, Improvement and Modernization Act of 2003 (MMA), and it was extended for another 5-year period by sections 3123 and 10313 of the Affordable Care Act.

The Cures Act allows for hospitals that were participating in the demonstration as of the last day of the initial 5-year period, or as of December 30, 2014, to participate in this second extension period unless the hospital makes an election to discontinue participation. The statute also requires that no later than 120 days after enactment of the law, a request for applications be issued for additional hospitals to participate in the demonstration program for the second 5-year extension period, so long as the maximum number of 30 hospitals stipulated by the ACA is not exceeded.

The MMA requires the demonstration to be budget neutral. In prior years, CMS has adjusted the national IPPS rates by an amount sufficient to account for the added costs of this demonstration program, thus applying budget neutrality across the payment system as a whole rather than merely across the participants in the demonstration program.

In the proposed rule, CMS proposed to align the periods of performance for both previously participating hospitals and newly selected hospitals during the second 5-year extension period such that the performance periods for any of the hospitals would start with a hospital’s first cost reporting period beginning on or after October 1, 2017, following upon the announcement of the selection of the additional hospitals.

CMS is finalizing an alternative approach whereby the performance period for previously participating hospitals that choose to participate would begin immediately after the date the period of performance under the first 5-year extension period ended. CMS has not yet finalized the selection of additional participants to participate in the demonstration, and the start dates for the 5-year extension period for the additional hospitals will be announced after selections are announced.

In addition, CMS is finalizing a budget neutrality methodology similar to that of previous years by adjusting the national IPPS rates to account for the added costs of the demonstration for the second extension period. As the additional participants for the second extension period have not been selected, CMS is finalizing the proposal to include the estimated costs of the demonstration for all participating hospitals for FY 2018 in the budget neutrality offset amount to be calculated in the FY 2019 IPPS/LTCH PPS proposed and final rules.

The material that follows is a section-by-section analysis of major components based on the rule. The material does not follow the order in the regulation.

Please note that the printed pages of the pdf file are “6” less than the pdf count starting after page 2,129.

I. STANDARDIZED PAYMENT RATES

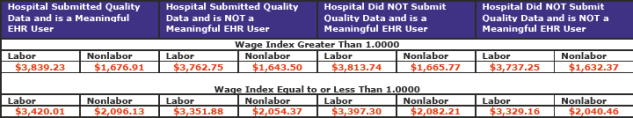

The following are the current FY 2017 standardized payment amounts. (Note: these rates were promulgated in the October 5, 2016 Federal Register as a correction to the amounts published in the August 22, 2016 Federal Register.)

The total labor/nonlabor amount for the full update (2 left columns) for hospitals that submitted quality data and are meaningful EHR users is $5,516.14.

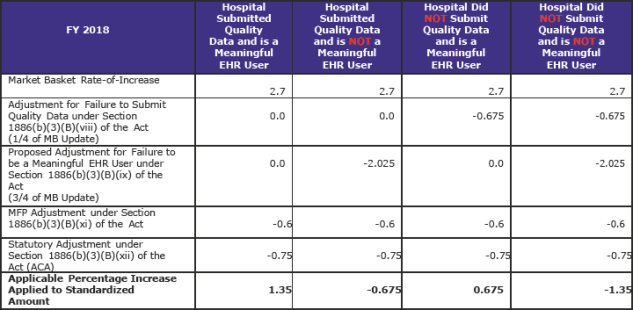

There are four possible applicable percentage increases that can be applied to the national standardized amount. The table below reflects these four options. (pdf pages 2,133)

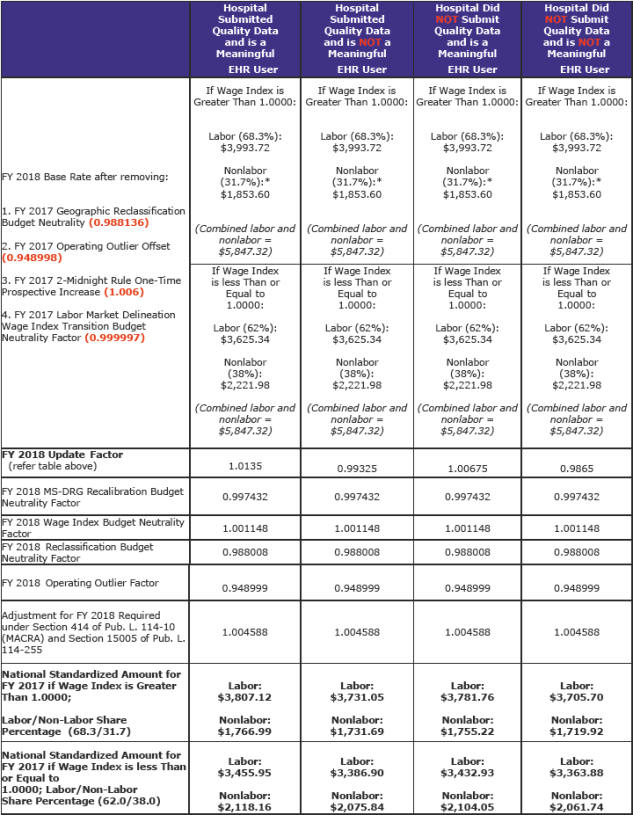

The labor-related portion for areas with wage indexes greater than 1.0000 is being changed to 68.3 percent, a decrease from the current amount of 69.6 percent as a result of rebasing and revising the IPPS market basket. Areas with wage index values equal to or less than 1.000 would remain at 62.0 percent, as required by statute.

The FY 2018 standardized amounts for operating and capital costs appear in Tables 1A, 1B, and 1C that are listed and published in section VI of the Addendum to this rule. (pdf page 2,284)

The following table (pdf pages 2,185 & 2,186) illustrates the changes from the FY 2017 national standardized amount. The unadjusted FY 2017 total rates (labor and non-labor) are $5,847.32 for all columns.

The combined FY 2018 labor and nonlabor amounts for a full update is $5,574.11. The proposed amount was $5,596.00. The current amount is $5,516.14. The FY 2018 amount is a net increase of $57.97.

These amounts are before other adjustments such as the hospital value-based purchasing program, readmission program, and hospital acquired conditions program.

Comment

CMS says that 82 hospitals are estimated to not receive the full market basket rate-of-increase for FY 2018 because they failed the quality data submission process or did not choose to participate, but are meaningful EHR users.

CMS says that 103 hospitals are estimated to not receive the full market basket rate-of-increase for FY 2018 because they are identified as not meaningful EHR users.

CMS says that 21 hospitals are estimated to not receive the full market basket rate-of-increase for FY 2018 because they are identified as both not meaningful EHR users and do not submit quality data.

The above numbers are the same as those in the proposed rule. Bottom line is few hospitals are not reporting quality or are not meaningful EHR users.

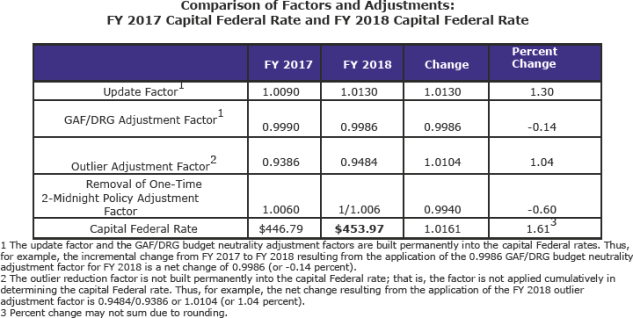

Changes to Payment Rates for Acute Care Hospital Inpatient Capital-Related Costs for FY 2018 (pdf page 2,215)

The FY 2018 capital rate will be $453.97. It was proposed at $451.37. The current amount is $446.79.

Outlier Payments (pdf page 2,187)

CMS is finalizing an outlier fixed-loss cost threshold for FY 2018 equal to the prospective payment rate for the MS-DRG, plus any IME, empirically justified Medicare DSH payments, estimated uncompensated care payment, and any add-on payments for new technology, plus $26,601. The proposed amount was $26,713. The current amount is $23,573.

CMS says that its current estimate, using available FY 2016 claims data, is that actual outlier payments for FY 2016 were approximately 5.41 percent of actual total MS-DRG payments.

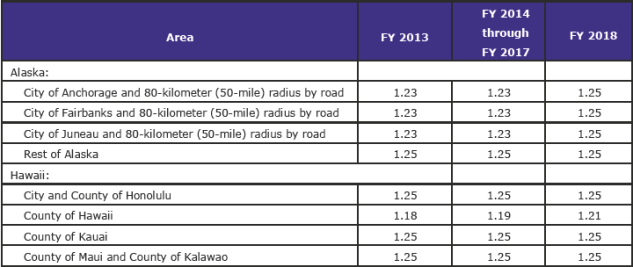

Cost-of-Living Adjustment Factors: Alaska and Hawaii Hospitals (pdf page 2,192)

CMS is finalizing the COLA factors for Alaska and Hawaii as proposed effective for FY 2018.

Sole Community Hospitals (pdf page 2,197)

The prospective payment rate for SCHs for FY 2018 equals the higher of the applicable Federal rate, or the updated hospital-specific rate based on FY 1982 costs per discharge; the updated hospital-specific rate based on FY 1987 costs per discharge; the updated hospital-specific rate based on FY 1996 costs per discharge; or the updated hospital-specific rate based on FY 2006 costs per discharge.

Changes to Payment Rates for Excluded Hospitals: Rate-of-Increase Percentages for FY 2018 (pdf page 2,219)

Payments for services furnished in children’s hospitals, 11 cancer hospitals, and hospitals located outside the 50 States, the District of Columbia and Puerto Rico (that is, short-term acute care hospitals located in the U.S. Virgin Islands, Guam, the Northern Mariana Islands, and American Samoa) that are excluded from the IPPS are made on the basis of reasonable costs based on the hospital’s own historical cost experience, subject to a rate-of-increase ceiling.

The rate of increase update for FY 2018 will be 2.7 percent.

II. CHANGES TO THE HOSPITAL WAGE INDEX FOR ACUTE CARE HOSPITALS (page 527)

Core-Based Statistical Areas (CBSAs) (page 528)

The current statistical areas (which were implemented beginning with FY 2015) are based on revised OMB delineations issued on February 28, 2013, in OMB Bulletin No. 13-01.

For the purposes of cross-walking counties to CBSAs, CMS will discontinue the use of Social Security Administration (SSA) codes and begin using only Federal Information Processing Standard (FIPS) codes.

CMS notes that OMB has issued a revised bulletin—OMB Bulletin 15-01—that makes the following definitional adjustments to CBSAs:

- Petersburg Borough, AK (FIPS State County Code 02-195), CBSA 02, was created from part of former Petersburg Census Area (02-195) and part of Hoonah-Angoon Census Area (02-105). The CBSA code remains 02.

- The name of La Salle Parish, LA (FIPS State County Code 22-059), CBSA 14, is now LaSalle Parish, LA (FIPS State County Code 22-059). The CBSA code remains as 14.

- The name of Shannon County, SD (FIPS State County Code 46-113), CBSA 43, is now Oglala Lakota County, SD (FIPS State County Code 46-102). The CBSA code remains as 43.

Worksheet S-3 Wage Data for FY 2018 Wage Index (page 532)

The FY 2018 wage index values are based on the data collected from the Medicare cost reports submitted by hospitals for cost reporting periods beginning in FY 2014 (the FY 2017 wage indexes were based on data from cost reporting periods beginning during FY 2013).

Clarification of Other Wage Related Costs in the Wage Index (page 548)

CMS is clarifying that a cost must be a fringe benefit as described by the IRS and must be reported to the IRS on employees’ or contractors’ W-2 or 1099 forms as taxable income in order to be considered an other wage-related cost on Line 18 of Worksheet S-3 and for the wage index.

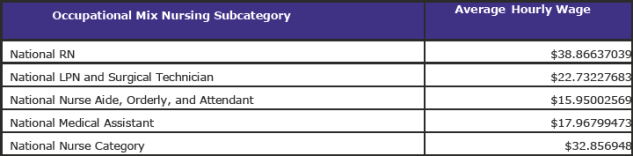

Occupational Mix Adjustment to the FY 2017 Wage Index (page 558)

For the FY 2018 wage index, CMS used the occupational mix data collected using the 2013 survey.

Using the occupational mix survey data and applying the occupational mix adjustment to 100 percent of the FY 2018 wage index results in a national average hourly wage of $42.0564.

The FY 2018 national average hourly wages for each occupational mix nursing subcategory are as follows:

Use of the 2016 Medicare Wage Index Occupational Mix Survey for the FY 2019 Wage Index (page 560)

The FY 2019 occupational mix adjustment will be based on a new calendar year (CY) 2016 survey. The CY 2016 survey (CMS Form CMS-10079) received OMB approval on September 27, 2016. The final CY 2016 Occupational Mix Survey Hospital Reporting Form is available on the CMS website at: https://www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/AcuteInpatientPPS/Wage-Index-Files-Items/2016-Occupational-Mix-Survey-Hospital-Reporting-Form-CMS-10079-for-the-Wage-Index-Beginning-FY-2019.html.

Hospitals were required to submit their completed 2016 surveys to their MACs by July 3, 2017. The preliminary, unaudited CY 2016 survey data were posted on the CMS website on July 12, 2017. As with the Worksheet S–3, Parts II and III cost report wage data, as part of the FY 2019 desk review process, the MACs will revise or verify data elements in hospitals’ occupational mix surveys that result in certain edit failures.

Application of the Rural, Imputed, and Frontier Floors

Rural Floor Section (page 565)

The area wage index applicable to any hospital that is located in an urban area of a State may not be less than the area wage index applicable to hospitals located in rural areas in that State. CMS estimates that 366 hospitals will receive an increase in their FY 2018 wage index due to the application of the rural floor.

Imputed Floor Policy (page 566)

Currently, there are three all-urban States: Delaware, New Jersey, and Rhode Island. The imputed floor is set to expire effective October 1, 2017, and CMS proposed eliminating the imputed floor policy.

However, CMS has reversed its proposal and will continue to apply its imputed floor for FY 2018.

There are 17 hospitals in New Jersey that will receive an increase in their FY 2018 wage index due to the continued application of the imputed floor policy under the original methodology, and 10 hospitals in Rhode Island and 6 hospitals in Delaware that will benefit under the alternative methodology.

State Frontier Floor (page 582)

Forty-nine (49) hospitals will receive the frontier floor value of 1.0000 for their FY 2018 wage index. These hospitals are located in Montana, Nevada, North Dakota, South Dakota, and Wyoming.

FY 2018 Reclassification Requirements and Approvals (page 583)

At the time this rule was constructed, CMS says the MGCRB had completed its review of FY 2018 reclassification requests. Based on such reviews, there are 374 hospitals approved for wage index reclassifications by the MGCRB starting in FY 2018. Because MGCRB wage index reclassifications are effective for 3 years, for FY 2018, hospitals reclassified beginning in FY 2016 or FY 2017 are eligible to continue to be reclassified to a particular labor market area based on such prior reclassifications for the remainder of their 3-year period. There were 245 hospitals approved for wage index reclassifications in FY 2016 that will continue for FY 2018, and 246 hospitals approved for wage index reclassifications in FY 2017 that will continue for FY 2018. Of all the hospitals approved for reclassification for FY 2016, FY 2017, and FY 2018, 865 hospitals are in a MGCRB reclassification status for FY 2018.

Applications for FY 2019 reclassifications are due to the MGCRB by September 1, 2017 (the first working day of September 2017). CMS notes that this is also the deadline for canceling a previous wage index reclassification, withdrawal, or termination under 42 CFR 412.273(d). Applications and other information about MGCRB reclassifications may be obtained, beginning in mid-July 2017, via the Internet on the CMS website at: https://www.cms.gov/Regulations-and-Guidance/Review-Boards/MGCRB/index.html, or by calling the MGCRB at (410) 786-1174. The mailing address of the MGCRB is: 2520 Lord Baltimore Drive, Suite L, Baltimore, MD 21244-2670.

Deadline for Submittal of Documentation of Sole Community Hospital (SCH) and Rural Referral Center (RRC) Classification Status to the MGCRB (page 591)

The regulations at 42 CFR 412.230(a)(3), consistent with section 1886(d)(10)(D)(i)(III) of the Act, set special rules for sole community hospitals (SCHs) and rural referral centers (RRCs) that are reclassifying under the MGCRB. Specifically, a hospital that is an RRC or an SCH, or both, does not have to demonstrate a close proximity to the area to which it seeks redesignation. If a hospital that is an RRC or an SCH, or both, qualifies for urban redesignation, it is redesignated to the urban area that is closest to the hospital. If the hospital is closer to another rural area than to any urban area, it may seek redesignation to either the closest rural or the closest urban area.

The MGCRB currently accepts supporting documentation of SCH and RRC classification (the CMS approval letter) up until the date of MGCRB’s review, which varies annually. CMS proposed to establish a deadline of the first business day after January 1 for hospitals to submit to the MGCRB documentation of SCH or RRC status approval (the CMS approval letter) in order to take advantage of the special rules under § 412.230(a)(3) when reclassifying under the MGCRB.

CMS has decided not to finalize its proposed deadline of the first business day after January 1 for hospitals to submit documentation of SCH and RRC status to the MGCRB.

Clarification of Special Rules for SCHs and RRCs Reclassifying to Geographic Home Area (page 601)

Hospitals may simultaneously be redesignated as rural under § 412.103 and reclassified under the MGCRB. An urban hospital seeking benefits of rural status, such as rural payments for disproportionate share hospitals (DSH) and eligibility for the 340B Drug Pricing Program, without the associated rural wage index may be redesignated as rural under § 412.103 (if it meets the applicable requirements) and also reclassify under the MGCRB to an urban area (again, if it meets the applicable requirements).

CMS is finalizing, without modification, its proposed revision of § 412.230(a)(3)(ii) to clarify that a hospital with a § 412.103 rural redesignation and SCH or RRC approval may reclassify under the MGCRB to its geographic home area or to the closest area outside of its geographic home area.

Redesignations Under Section 1886(d)(8)(B) of the Act (page 611)

CMS is revising §§ 412.273(c)(1)(ii) and (c)(2) to clarify that, under these regulations, a hospital’s request to withdraw or terminate an MGCRB reclassification must be received by the MGCRB within 45 days of the date the annual notice of proposed rulemaking is issued in the Federal Register.

Out-Migration Adjustment Based on Commuting Patterns of Hospital Employees (page 616)

Table 2 associated with this final rule (which is available via the Internet on the CMS website) includes the final out-migration adjustments for the FY 2018 wage index. There are an estimated 267 providers that will receive the out-migration wage adjustment in FY 2018.

Process for Requests for Wage Index Data Corrections (page 625)

CMS is finalizing its proposal, without modification, to require that, beginning next year (that is, April 2018 for wage data revisions for the FY 2019 wage index), a hospital that seeks to challenge the MAC’s handling of wage data on any basis (including a policy, factual, or any other dispute) must request CMS to intervene by the date in April that is specified as the deadline for hospitals to appeal MAC determinations and request CMS’s intervention in cases where the hospital disagrees with the MAC’s determination (as stated in the wage index timetable that will be updated to reflect the specified date).

Labor Market Share for the FY 2018 Wage Index (Page 643)

CMS will use a labor-related share of 68.3 percent for discharges occurring on or after October 1, 2017.

III. REBASING AND REVISING OF THE HOSPITAL MARKET BASKETS FOR ACUTE CARE HOSPITALS (page 649)

Comment

CMS spends 65 pages discussing its rebasing and revisions to the hospital market basket. Bottom line, is they are adopting, as noted above, a labor share of 68.3 percent for areas with wage index values greater than 1.0000.

CMS spends considerable efforts describing, in detail, its various calculations to develop its many standards and values used in setting the IPPS rates.

Perhaps what is noteworthy in this discussion are the number of comments received regarding various aspects of the data used in calculating the rebasing and revision.

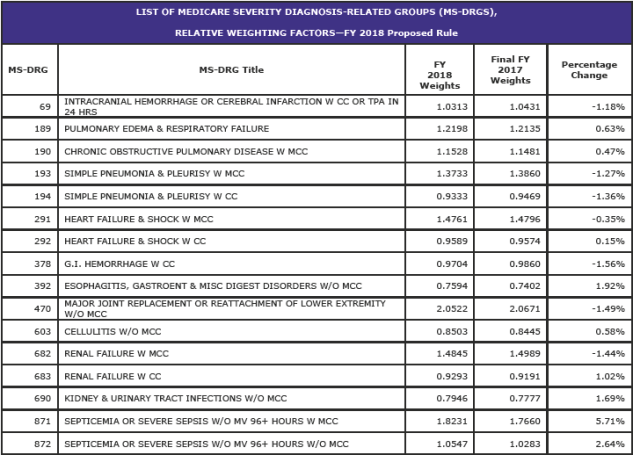

IV. CHANGES TO MEDICARE SEVERITY DIAGNOSIS-RELATED GROUP (MS-DRG) CLASSIFICATIONS AND RELATIVE WEIGHTS (pages beginning 97)

FY 2018 MS-DRG Documentation and Coding Adjustment (page 98)

The adoption of the MS-DRG system resulted in the expansion of the number of DRGs from 538 in FY 2007 to 745 in FY 2008. Since then, there has been much concern by Congress and CMS about increased coding by hospitals to maximize payments.

Section 631 of the American Taxpayer Relief Act of 2012 (ATRA) required the Secretary to make a recoupment adjustment or adjustments totaling $11 billion by FY 2017.

With the end of payment reductions for documentation and coding beginning in FY 2018, CMS says it planned on making a full positive adjustment to return IPPS rates to their appropriate payment amounts; i.e., the amounts without any reductions to recapture the $11 billion.

However, section 414 of MACRA replaced the single positive adjustment the agency intended to make with a 0.5 percent positive adjustment for each of FYs 2018 through 2023. Further, section 15005 of the Cures Act reduced the adjustment for FY 2018 from 0.5 percentage points to 0.4588 percentage points.

CMS is finalizing the +0.4588 percentage point adjustment to the standardized amount for FY 2018, as required under section 15005 of the Cures Act.

Comment

CMS is required by statute to reinstate the IPPS rates to the amounts that would be have been made had no reduction offsets been made. In other words, if CMS was paying hospitals $1,100 but reduced payment to recapture previous overpayments to say $1,000 by $100, CMS needs to reset the amounts back to $1,100. It cannot go forward using the $1,000 rate.

As noted above, MACRA and the Cures Act are going to limit the return to “proper/normal” amounts. MACRA appears to never allow the full recapture. CMS withheld 0.8 percent for 3 years (2.4 in aggregate) plus 1.5 percent for FY 2017 (2.4 + 1.5 =3.9). Yet, MACRA would only permit 3.0 percent (6 X 0.5) to be returned. And, this amount has now been reduced by the Cures Act to 2.9558 (5 x .05 + 0.4588).

It seems that the documentation and coding issue is a long way from being solved, if ever.

Changes to Specific MS-DRG Classifications (page 109)

The following items are some of the major MS-DRG changes for FY 2018.

Functional Quadriplegia (page 120)

CMS is finalizing the assignment of code R53.2 (Functional quadriplegia) to MS-DRGs 947 and 948 (Signs and Symptoms with MCC and without MCC, respectively).

Responsive Neurostimulator (RNS©) System (page 127)

CMS is finalizing its proposal to reassign all cases with a principal diagnosis of epilepsy and one of the following ICD-10-PCS code combinations capturing cases with the neurostimulator generators inserted into the skull (including cases involving the use of the RNS© neurostimulator), to MS-DRG 023, even if there is no MCC reported:

- 0NH00NZ (Insertion of neurostimulator generator into skull, open approach), in combination with 00H00MZ (Insertion of neurostimulator lead into brain, open approach);

- 0NH00NZ (Insertion of neurostimulator generator into skull, open approach), in combination with 00H03MZ (Insertion of neurostimulator lead into brain, percutaneous approach); and

- 0NH00NZ (Insertion of neurostimulator generator into skull, open approach), in combination with 00H04MZ (Insertion of neurostimulator lead into brain, percutaneous endoscopic approach).

CMS is also finalizing its proposed change to the title of MS-DRG 023 from “Craniotomy with Major Device Implant or Acute Complex Central Nervous System CNS) Principal Diagnosis (PDX) with MCC or Chemo Implant” to “Craniotomy with Major Device Implant or Acute Complex Central Nervous System (CNS) Principal Diagnosis (PDX) with MCC or Chemotherapy Implant or Epilepsy with Neurostimulator.”

Precerebral Occlusion or Transient Ischemic Attack with Thrombolytic (page 144)

CMS is finalizing its proposal to add certain ICD-10-CM diagnosis codes currently assigned to MS-DRGs 067 and 068 and the ICD-10-CM diagnosis codes currently assigned to MS-DRG 069 to the GROUPER logic for MS-DRGs 061, 062, and 063 when those conditions are sequenced as the principal diagnosis and reported with an ICD-10-PCS procedure code describing use of a thrombolytic agent (for example, tPA).

CMS is also finalizing its proposal to retitle MS-DRGs 061, 062, and 063 as “Ischemic Stroke, Precerebral Occlusion or Transient Ischemia with Thrombolytic Agent with MCC, with CC and without CC/MCC”, respectively, and to retitle MS-DRG 069 as “Transient Ischemia without Thrombolytic” effective October 1, 2017 for the ICD-10 MS-DRGs Version 35.

Swallowing Eye Drops (Tetrahydrozoline) (page 152)

CMS is finalizing its proposal to reassign the following ICD-10-CM diagnosis codes from MS-DRGs 124 and 125 to MS-DRGs 917 and 918 for FY 2018: T49.5X1A; T49.5X2A; T49.5X3A; and T49.5X4A.

Percutaneous Cardiovascular Procedures and Insertion of a Radioactive Element (page 155)

CMS is finalizing its proposal to remove ICD-10-PCS procedure codes 0WHC01Z, 0WHC31Z, 0WHC41Z, 0WHD01Z, 0WHD31Z, and 0WHD41Z from MS-DRGs 246 through 249, and maintain their current assignment in MS-DRG 264 effective October 1, 2017 for ICD-10 MS-DRGs Version 35.

Modification of the Titles for MS-DRG 246 (Percutaneous Cardiovascular Procedures with Drug-Eluting Stent with MCC or 4+ Vessels or Stents) and MS-DRG 248 (Percutaneous Cardiovascular Procedures with Non-Drug-Eluting Stent with MCC or 4+ Vessels or Stents) (page 155)

CMS is finalizing the title of MS-DRG 246 to “Percutaneous Cardiovascular Procedures with Drug-Eluting Stent with MCC or 4+ Arteries or Stents” and the title of MS-DRG 248 to “Percutaneous Cardiovascular Procedures with Non-Drug-Eluting Stent with MCC or 4+ Arteries or Stents” effective October 1, 2017 for ICD-10 MS-DRGs Version 35.

Percutaneous Mitral Valve Replacement Procedures (page 165)

CMS is finalizing its proposal to reassign the four percutaneous mitral valve replacement procedures from MS-DRGs 216 through 221 to MS-DRGs 266 and 267 and assign the eight new procedure codes that describe percutaneous and transapical, percutaneous tricuspid valve replacement procedures to MS-DRGs 266 and 267 effective October 1, 2017 for ICD-10 MS-DRGs Version 35.

Total Ankle Replacement (TAR) Procedures (page 173)

CMS will reassign the following TAR procedure codes from MS DRG 470 to MS DRG 469, even if there is no MCC reported: 0SRF0J9; 0SRF0JA; 0SRF0JZ; 0SRG0J9; 0SRG0JA; and 0SRG0JZ for FY 2018.

CMS is changing the titles of MS-DRGs 469 and 470 to the following to reflect these MS-DRG reassignments:

- • MS-DRG 469: “Major Hip and Knee Joint Replacement or Reattachment of Lower Extremity with MCC or Total Ankle Replacement”; and

- • MS-DRG 470: “Major Hip and Knee Joint Replacement or Reattachment of Lower Extremity without MCC.”

Combined Anterior/Posterior Spinal Fusion (page 193)

CMS is finalizing its proposal to: (1) move the seven procedure codes describing spinal fusion using a nanotextured surface interbody fusion device from the posterior spinal fusion list to the anterior spinal fusion list in the GROUPER logic for MS-DRGs 453, 454, and 455; (2) move the 149 procedure codes describing spinal fusion of the anterior column with a posterior approach from the posterior spinal fusion list to the anterior spinal fusion list in the GROUPER logic for MS-DRGs 453, 454, and 455; and (3) delete the 33 procedure codes describing spinal fusion of the posterior column with an interbody fusion device from MS-DRGs 453, 454, 455, 456, 457, 458, 459, 460, 471, 472, and 473, as well as from the ICD-10-PCS classification for FY 2018.

MS-DRG 998 (Principal Diagnosis Invalid as Discharge Diagnosis) (page 205)

CMS is finalizing its proposal to remove 314 ICD-10-CM diagnosis codes identified with “unspecified trimester” from MS-DRG 998 as shown in Table 6P.3b. associated with this final rule and reassign them to the MS-DRGs in which their counterparts (first trimester, second trimester, or third trimester) are currently assigned as specified in Column C, in the ICD-10 MS-DRGs Version 35, effective October 1, 2017.

MS-DRG 782 (Other Antepartum Diagnoses without Medical Complications) (page 209)

CMS is finalizing its proposal to remove ICD-10-CM diagnosis codes O09.41, O09.42 and O09.43, which describe supervision of pregnancy, from MS-DRG 782 and reassign them to MS-DRG 998 (Principal Diagnosis Invalid as Discharge Diagnosis) in the ICD-10 MS-DRGs Version 35, effective October 1, 2017.

Shock During or Following Labor and Delivery (page 210)

CMS is adopting the following in the ICD-10 MS-DRGs Version 35, effective October 1, 2017:

- Removing ICD-10-CM diagnosis code O75.1 from the list of principal or secondary diagnosis under the first condition-vaginal delivery GROUPER logic in MS-DRGs 774, 767, and 768;

- Moving ICD-10-CM diagnosis code O75.1 from the list of principal or secondary diagnosis under the second condition-complicating diagnosis for MS-DRG 774 to the secondary diagnosis list only; and

- Adding ICD-10-CM diagnosis code O75.1 to the principal diagnosis list GROUPER logic in MS-DRGs 769 and 776.

MDC 15 (Newborns and Other Neonates with Conditions Originating in Perinatal Period): Observation and Evaluation of Newborn (page 214)

CMS is finalizing its proposal to add the 14 diagnosis codes describing observation and evaluation of newborns for suspected conditions to the GROUPER logic for MS-DRG 795 (Normal newborn) in the ICD-10 MS-DRGs Version 35, effective October 1, 2017.

Changes to the Medicare Code Editor (MCE) (page 234)

The Medicare Code Editor (MCE) is a software program that detects and reports errors in the coding of Medicare claims data. Patient diagnoses, procedure(s), and demographic information are entered into the Medicare claims processing systems and are subjected to a series of automated screens. The MCE screens are designed to identify cases that require further review before classification into an MS-DRG.

Comment

CMS discusses a number of issues regarding the MCE and proposes several changes. Please refer to the rule for the technical specifics.

Changes to Surgical Hierarchies (page 272)

Some inpatient stays entail multiple surgical procedures, each one of which, occurring by itself, could result in assignment of the case to a different MS-DRG within the MDC to which the principal diagnosis is assigned. CMS notes that it is necessary to have a decision rule within the GROUPER by which these cases are assigned to a single MS-DRG. The surgical hierarchy, an ordering of surgical classes from most resource-intensive to least resource-intensive, performs that function.

CMS is finalizing its proposal to move MS-DRGs 614 and 615 above MS-DRGs 622, 623, and 624 in the surgical hierarchy effective October 1, 2017.

Other Items Being Addressed (beginning page 279)

CMS provides extensive discussions on the following:

- • Changes to the MS-DRG Diagnosis Codes for FY 2018 (page 279)

- • Comprehensive Review of CC List for FY 2019 (page 295)

- • Review of Procedure Codes in MS DRGs 981 through 983; 984 through 986; and 987 through 989 (page 297)

- • Changes to the ICD-10-CM and ICD-10-PCS Coding Systems (page 304)

Replaced Devices Offered Without Cost or With a Credit (page 316)

For FY 2018, CMS is not proposing to add any MS-DRGs to the policy for replaced devices offered without cost or with a credit. However, CMS is making a number of conforming title changes. Refer to the rule’s table beginning on page 317 for the new titles.

Other Operating Room (O.R.) and Non-O.R. Issues (page 320)

This section addresses the recommendations for consideration received in response to some of the proposals set forth in the FY 2017 IPPS/LTCH PPS proposed rule pertaining to changing the designation of ICD-10-PCS procedure codes from O.R. procedures to non-O.R. procedures.

The detailed lists of procedure codes are shown in Tables 6P.4a. through 6P.4p. (ICD-10-CM and ICD-10-PCS Code Designations, MCE and MS-DRG Changes—FY 2018).

Comment

The material on O.R. versus non O.R is extremely lengthy. This material spans some 79 pages.

Add-On Payments for New Services and Technologies for FY 2018 (page 419)

FY 2018 Status of Technologies Approved for FY 2017 Add-On Payments are as follows:

Discontinued

- • CardioMEMS™ HF (Heart Failure) Monitoring System

- • Lutonix® Drug Coated Balloon PTA Catheter and In.PACT™ Admiral™ Paclitaxel Coated Percutaneous Transluminal (PTA) Balloon Catheter

- • MAGEC® Spinal Bracing and Distraction System (MAGEC® Spine)

- • Blinatumomab (BLINCYTO®)

Continued

- • Defitelio® (Defibrotide). The maximum payment will remain at $75,900.

- • GORE® EXCLUDER® Iliac Branch Endoprosthesis (IBE). The maximum payment will remain at $5,250.

- • Praxbind® Idarucizumab. The maximum payment for a case involving Idarucizumab will remain at $1,750

- • Vistogard™ (Uridine Triacetate). The maximum payment for a case involving the Vistogard™ will remain at $37,500 for FY 2018.

CMS has approved the following new technologies for FY 2018:

- • Bezlotoxumab (ZINPLAVA™)—Cases involving ZINPLAVA™ that are eligible for new technology add-on payments will be identified by ICD–10–PCS procedure codes XW033A3 and XW043A3. The maximum new technology add-on payment amount for a case involving the use of ZINPLAVA™ is $1,900. Expected to increase overall FY 2018 payments by $2,857,600 (maximum add-on payment of $1,900 * 1,504 patients).

- • EDWARDS INTUITY Elite™ Valve System (INTUITY) and LivaNova Perceval Valve (Perceval) Ustekinumab (Stelara®)—The maximum new technology add-on payment amount for a case involving the INTUITY or Perceval valves is $6,110.23 for FY 2018. Expected to increase overall FY 2018 payments by $14,841,749 (maximum add-on payment of $6,110.23 * 2,429 patients).

- • Ustekinumab (Stelara®)—Cases involving Stelara® that are eligible for new technology add-on payments will be identified by ICD–10–PCS procedure code XW033F3 (Introduction of other New Technology therapeutic substance into peripheral vein, percutaneous approach, New Technology Group 3 ). The maximum new technology add-on payment amount for a case involving the use of STELARA™ is $2,400. Expected to increase overall FY 2018 payments by $400,800 (maximum add-on payment of $2,400 * 167 patients).

Comment

In the past, we have observed the length and discussion of new technologies. This year’s material is more than 100 pages. It would help if the discussion on these items were placed in a separate appendix. One must assume that most readers are only interested in actions being taken by the agency and not all the ongoing discussions and rational positions between CMS and the manufacturers.

V. OTHER DECISIONS AND CHANGES TO THE IPPS FOR OPERATING SYSTEM (page 714)

Changes to MS-DRGs Subject to the Postacute Care Transfer and MS-DRGs Special Payment Policies (§ 412.4)

To account for MS-DRGs subject to the postacute care policy that exhibit exceptionally higher shares of costs very early in the hospital stay, § 412.4(f) also includes a special payment methodology. For these MS-DRGs, hospitals receive 50 percent of the full MS-DRG payment, plus the single per diem payment, for the first day of the stay, as well as a per diem payment for subsequent days (up to the full MS-DRG payment (§ 412.4(f)(6)).

CMS has identified three MS-DRGs that it proposed to be included on the list of MS-DRGs subject to the special payment transfer policy. This change is occurring because CMS will delete MS-DRGs 984, 985, and 986 (Prostatic O.R. Procedure Unrelated to Principal Diagnosis with MCC, with CC and without CC/MCC, respectively) and reassign the procedure codes currently assigned to these three MS-DRGs to MS-DRGs 987, 988, and 989 (Non-Extensive O.R. Procedure Unrelated to Principal Diagnosis with MCC, with CC and without CC/MCC, respectively).

CMS is finalizing its proposed changes to the special payment policy status of MS-DRGs 987, 988, and 989.

Change to Volume Decrease Adjustment for Sole Community Hospitals (SCHs) and Medicare-Dependent, Small Rural Hospitals (MDHs) (§ 412.92) (page 729)

The MDH program is not authorized by statute beyond September 30, 2017. Therefore, beginning October 1, 2017, all hospitals that previously qualified for MDH status under section 1886(d)(5)(G) of the Act will no longer have MDH status and will be paid based on the IPPS Federal rate.

To qualify for a volume decrease adjustment, the SCH must: (a) submit documentation demonstrating the size of the decrease in discharges and the resulting effect on per discharge costs; and (b) show that the decrease is due to circumstances beyond the hospital’s control. If an SCH demonstrates to the MAC’s satisfaction that it has suffered a qualifying decrease in total inpatient discharges, the MAC determines the appropriate amount, if any, due to the SCH as an adjustment.

CMS is proposing to prospectively change how the MACs calculate the volume decrease adjustments and require that the MACs compare estimated Medicare revenue for fixed costs to the hospital’s fixed costs to remove any conceivable possibility that a hospital that qualifies for the volume decrease adjustment could ever be less than fully compensated for fixed costs as a result of the application of the adjustment.

CMS says it assumes 20 hospitals will qualify for the adjustment in FY 2018 and that the additional amount of the volume decrease adjustment payment based on our methodology will be $750,000 per hospital.

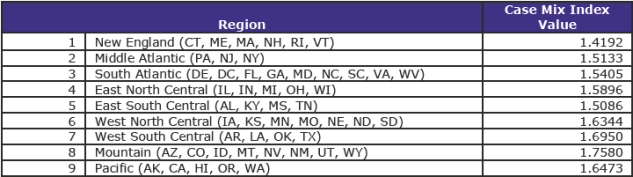

Rural Referral Centers (RRCs) Annual Updates to Case-Mix Index and Discharge Criteria (§ 412.96) (page 745)

A rural hospital with less than 275 beds may be classified as an RRC if—

- • The hospital’s case-mix index (CMI) is at least equal to the lower of the median CMI for urban hospitals in its census region, excluding hospitals with approved teaching programs, or the median CMI for all urban hospitals nationally; and

- • The hospital’s number of discharges is at least 5,000 per year, or, if fewer, the median number of discharges for urban hospitals in the census region in which the hospital is located. (The number of discharges criterion for an osteopathic hospital is at least 3,000 discharges.)

In addition to meeting other criteria, if rural hospitals with fewer than 275 beds are to qualify for initial RRC status for cost reporting periods beginning on or after October 1, 2017, they must have a CMI value for FY 2016 that is at least—

- • 1.6638; or

- • The median CMI value (not transfer-adjusted) for urban hospitals (excluding hospitals with approved teaching programs as identified in § 413.75) calculated by CMS for the census region in which the hospital is located.

The CMI values by region are set forth in the following table:

A hospital, if it is to qualify for initial RRC status for cost reporting periods beginning on or after October 1, 2017, must also have the number of discharges for its cost reporting period that began during FY 2017 a figure that is at least—

- • 5,000 (3,000 for an osteopathic hospital); or

- • The median number of discharges for urban hospitals in the census region in which the al is located.

All census regional discharge numbers are greater than 5,000.

Comment

CMS says that there are 243 RRCs, 317 SCHs, and 129 hospitals that are both SCHs and RRCs.

CMS identifies 96 MDHs that will no longer receive the blended payment and will be paid only under the Federal rate in FY 2018, it is estimated that those hospitals would experience an overall decrease in payments of approximately $119 million.

Payment Adjustment for Low-Volume Hospitals (§ 412.101) (page 751)

Under section 1886(d)(12) of the Act, as amended, most recently by section 204 of MACRA, the temporary changes in the low-volume hospital payment policy originally provided by the ACA and extended through subsequent legislation are effective through FY 2017. Beginning with FY 2018, the preexisting low-volume hospital payment adjustment and qualifying criteria, as implemented in FY 2005 will resume.

Section 1886(d)(12)(C)(i) of the Act defines a low-volume hospital, for fiscal years other than FYs 2011 through 2017, as a subsection (d) hospital (as defined in paragraph (1)(B)) that the Secretary determines is located more than 25 road miles from another subsection (d) hospital and that has less than 200 discharges during the fiscal year. Section 1886(d)(12)(C)(ii) of the Act further stipulates that the term “discharge” means an inpatient acute care discharge of an individual, regardless of whether the individual is entitled to benefits under Medicare Part A.

For FY 2018, a hospital must make a written request for low-volume hospital status that is received by its MAC no later than September 1, 2017, in order for the 25-percent, low-volume, add-on payment adjustment to be applied to payments for its discharges beginning on or after October 1, 2017 (through September 30, 2018).

If a hospital’s request for low-volume hospital status for FY 2018 is received after September 1, 2017, and if the MAC determines the hospital meets the criteria to qualify as a low-volume hospital, the MAC will apply the 25-percent low-volume hospital payment adjustment to determine the payment for the hospital’s FY 2018 discharges, effective prospectively within 30 days of the date of the MAC’s low-volume hospital status determination.

CMS estimates the expiration of the current changes to the low-volume hospital payment and the change to the low volume payment adjustments will decrease aggregate low-volume payment adjustments from $316 million in FY 2017 to $4 million in FY 2018.

IME Adjustment Factor for FY 2018 (page 771)

For discharges occurring during FY 2018, the formula multiplier is 1.35.

Payment Adjustment for Medicare Disproportionate Share Hospitals (DSHs) for FY 2018 (§ 412.106) (page 771)

Beginning with discharges in FY 2014, hospitals that qualify for Medicare DSH payments under section 1886(d)(5)(F) of the Act receive 25 percent of the amount they previously would have received under the statutory formula for Medicare DSH payments.

The remaining amount, equal to an estimate of 75 percent of what otherwise would have been paid as Medicare DSH payments, is reduced to reflect changes in the percentage of individuals who are uninsured, is available to make additional payments to each hospital that qualifies for Medicare DSH payments and that has uncompensated care.

For FY 2014 and each subsequent fiscal year, a subsection (d) hospital (a PPS hospital) that would otherwise receive DSH payments made under section 1886(d)(5)(F) of the Act receives two separately calculated payments.

There are 3 factors in determining the amount of such payments.

Calculation of Factor 1 for FY 2018 (page 796)

Factor 1 is the difference between CMS’s estimates of: (1) the amount that would have been paid for Medicare DSH payments for the fiscal year, and (2) the amount of empirically justified Medicare DSH payments that are made for the fiscal year, which takes into account the requirement to pay 25 percent of what would have otherwise been paid under section 1886(d)(5)(F) of the Act. In other words, this factor represents CMS’s estimate of 75 percent (100 percent minus 25 percent) of its estimate of Medicare DSH payments that would otherwise be made, in the absence of section 1886(r) of the Act, for the fiscal year.

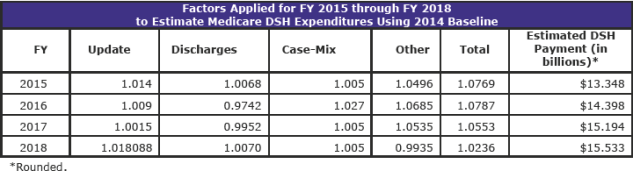

The FY 2018 proposed rule used the January 2017 Office of the Actuary estimate for Medicare DSH payments for FY 2018, without regard to the application of section 1886(r)(1) of the Act. That amount was approximately $16.003 billion. This estimate excludes Maryland hospitals participating in the Maryland All-Payer Model and SCHs paid under their hospital-specific payment rate. Therefore, based on the January 2017 estimate, the estimate for empirically justified Medicare DSH payments for FY 2018, with the application of section 1886(r)(1) of the Act, is approximately $4.001 billion (or 25 percent of the total amount of estimated Medicare DSH payments for FY 2018). Therefore, CMS proposed that Factor 1 for FY 2018 is $12,001,915,095.04, which is equal to 75 percent of the total amount of estimated Medicare DSH payments for FY 2018 ($16,002,553,460.05 minus $4,000,638,365.01).

For this final rule, CMS used June 2017 Office of the Actuary estimates for Medicare DSH payments for FY 2018, without regard to the application of section 1886(r)(1) of the Act. This amount was approximately $15.533 billion. This estimate excluded Maryland hospitals participating in the Maryland All-Payer Model and SCHs paid under their hospital-specific payment rate.

Therefore, based on the June 2017 estimate, the estimate for empirically justified Medicare DSH payments for FY 2018, with the application of section 1886(r)(1) of the Act, is approximately $3.888 billion (or 25 percent of the total amount of estimated Medicare DSH payments for FY 2018).

Factor 1 is the difference between these two estimates of the Office of the Actuary. Therefore, in this final rule, Factor 1 for FY 2018 is $11,664,704,643.27, which is equal to 75 percent of the total amount of estimated Medicare DSH payments for FY 2018 ($15,552,939,524.36 minus $3,888,234,881.09).

[Factor 1 for FY 2017 was $10,797,476,782.62, which was equal to 75 percent of the total amount of estimated Medicare DSH payments for FY 2017 ($14,396,635,710.16 minus $3,599,158,927.54).]

The Office of the Actuary’s final estimates for FY 2018 began with a baseline of $12.395 billion in Medicare DSH expenditures for FY 2014. The following table shows the factors applied to update this baseline through the current estimate for FY 2018:

Methodology for Calculation of Factor 2 for FY 2018 (page 815)

The statute states that, for FY 2018 and subsequent fiscal years, the second factor is 1 minus the percent change in the percent of individuals who are uninsured, as determined by comparing the percent of individuals who were uninsured in 2013 (as estimated by the Secretary, based on data from the Census Bureau or other sources the Secretary determines appropriate, and certified by the Chief Actuary of CMS) and the percent of individuals who were uninsured in the most recent period for which data are available (as so estimated and certified), minus 0.2 percentage point for FYs 2018 and 2019. [The current FY 2017 formula is minus 0.1 percent.]

The calculation of Factor 2 for FY 2018 using a weighted average of OACT’s projections for CY 2017 and CY 2018 is as follows:

- • Percent of individuals without insurance for CY 2013: 14 percent.

- • Percent of individuals without insurance for CY 2017: 8.3 percent.

- • Percent of individuals without insurance for CY 2018: 8.1 percent.

- • Percent of individuals without insurance for FY 2018 (0.25 times 0.083) + (0.75 times 0.081): 8.15 percent

Factor 2 = 0.5801 [The 2017 factor 2 was 0.5536]

1-|((0.0815-0.14)/0.14)| = 1- 0.4179 = 0.5821 (58.21 percent)

0.5821 (58.21 percent) - .002 (0.2 percentage points for FY 2018 under section 1886(r)(2)(B)(ii) of the Act) = 0.5801 or 58.01 percent

The FY 2018 final uncompensated care amount is: $11,664,704,643.27 x 0.5801= $6,766,695,163.56.

[The proposed FY 2018 uncompensated care amount was: $12,001,915,095.04 x 0.5801 = $6,962,310,946.63.]

[The FY 2017 Final Uncompensated Care Amount is: $10,797,476,782.62 x 0.5536 = $5,977,483,146.86.]

[Note: The difference between the amounts in FY 2017 and FY 2018 is the approximately $800 million CMS says will increase overall PPS payments]

Calculation of Factor 3 for FY 2018 (page 815)

Factor 3 is equal to the percent, for each subsection (d) hospital, that represents the quotient of (1) the amount of uncompensated care for such hospital; and (2) the aggregate amount of uncompensated care for all subsection (d) hospitals that receive a payment under section 1886(r) of the Act for such period (as so estimated, based on such data).

Factor 3 is applied to the product of Factor 1 and Factor 2 to determine the amount of the uncompensated care payment that each eligible hospital will receive for FY 2018 and subsequent fiscal years; i.e., the pool amount of $6,767 billion.

Time Period for Calculating Factor 3 for FY 2018, Including Methodology for Incorporating Worksheet S–10 Data (page 815)

In the FY 2017 IPPS/LTCH PPS final rule, in order to mitigate undue fluctuations in the amount of uncompensated care payments to hospitals from year to year and smooth over anomalies between cost reporting periods, CMS finalized a policy of calculating a hospital’s share of uncompensated care based on an average of data derived from three cost reporting periods instead of one cost reporting period.

For FY 2018, CMS will continue to use the methodology finalized in FY 2017 and to compute Factor 3 using an average of data from three cost reporting periods instead of one cost reporting period.

For FY 2018, CMS will compute Factor 3 for each hospital by—

- • Step 1: Calculating Factor 3 using the low-income insured days proxy based on FY 2012 cost report data and the FY 2014 SSI ratio;

- • Step 2: Calculating Factor 3 using the insured low-income days proxy based on FY 2013 cost report data and the FY 2015 SSI ratio;

- • Step 3: Calculating Factor 3 based on the FY 2014 Worksheet S–10 data, and

- • Step 4: Averaging the Factor 3 values from Steps 1, 2, and 3; that is, adding the Factor 3 values from FY 2012, FY 2013, and FY 2014 for each hospital, and dividing that amount by the number of cost reporting periods with data to compute an average Factor 3.

Comment

This is a complex and difficult section to decipher. CMS has not provided any clear decisions with regard to its final actions.

There is much discussion from commenters about the proprietary use of S-10 data. Yet, the material presented may only serve to confuse the issue further. Providers need to carefully understand this complex issue and most importantly verify their S-10 data.

Hospital Readmissions Reduction Program (page 907)

CMS proposed the following policy changes for the Hospital Readmissions Reduction Program: (1) the applicable time period for FY 2018; (2) the calculation of aggregate payments for excess readmissions for FY 2018; (3) changes to the payment adjustment factor in accordance with section 15002 of the Cures Act for FY 2019; and (4) updates to the Extraordinary Circumstance Exception policy beginning in FY 2018 as related to extraordinary circumstances that occur on or after October 1, 2017.

CMS is adopting its proposal that the “applicable period” for the Hospital Readmissions Reduction Program would be the 3-year period from July 1, 2013 through June 30, 2016.

The Cures Act added subparagraphs (D) and (E) to section 1886(q)(3) of the Act, which directs the Secretary to assign hospitals to peer groups, develop a methodology that allows for separate comparisons for hospitals within these groups, and allows for changes in the risk adjustment methodology.

For discharges occurring after FY 2018, the Secretary may consider the removal as a readmission of an admission that is classified within one or more of the following: transplants; end-stage renal disease; burns, trauma; psychosis; or substance abuse.

For FY 2018, a hospital subject to the Hospital Readmissions Reduction Program will have an adjustment factor that is between 1.0 (no reduction) and 0.9700 (greatest possible reduction).

The Hospital Readmissions Reduction Program currently includes the following six applicable conditions: acute myocardial infarction (AMI); heart failure (HF); pneumonia (PN); total hip arthroplasty/total knee arthroplasty (THA/TKA); chronic obstructive pulmonary disease (COPD); and Coronary Artery Bypass Graft (CABG) Surgery.

Comment

CMS estimates that 2,577 hospitals will have their base operating MS-DRG payments reduced. As a result, CMS estimates that the Hospital Readmissions Reduction Program will save approximately $556 million in FY 2018, an increase of $24 million over the estimated FY 2017 savings.

The HRRP material extends some 72 pages. This discussion has no final decision sections. It creates difficulty in following. Irrespective, CMS received numerous comments regarding the proposed subject matter and is responding, accordingly. No doubt interest is heavy because of the provisions financial impact.

Hospital Value-Based Purchasing (VBP) Program: Proposed Policy Changes (page 980)

Section 1886(o) of the Act, as added by ACA section 3001(a)(1), requires the Secretary to establish a hospital value-based purchasing program (the Hospital VBP Program) under which value-based incentive payments are made in a fiscal year to hospitals that meet or exceed performance standards established for a performance period for such fiscal year.

Section 1886(o)(7)(B) of the Act instructs the Secretary to reduce the base operating DRG payment amount for a hospital for each discharge in a fiscal year by an applicable percent. The FY 2018 program year is 2.00 percent.

CMS estimates that the total amount available for value-based incentive payments for FY 2018 will be approximately $1.9 billion. This is intended to be budget neutral.

CMS notes that non-teaching hospitals would have an average increase, and teaching hospitals would experience an average decrease in base operating DRG payment amounts.

CMS is finalizing its proposal to remove the current PSI 90 measure from the Hospital VBP Program beginning with the FY 2019 program year.

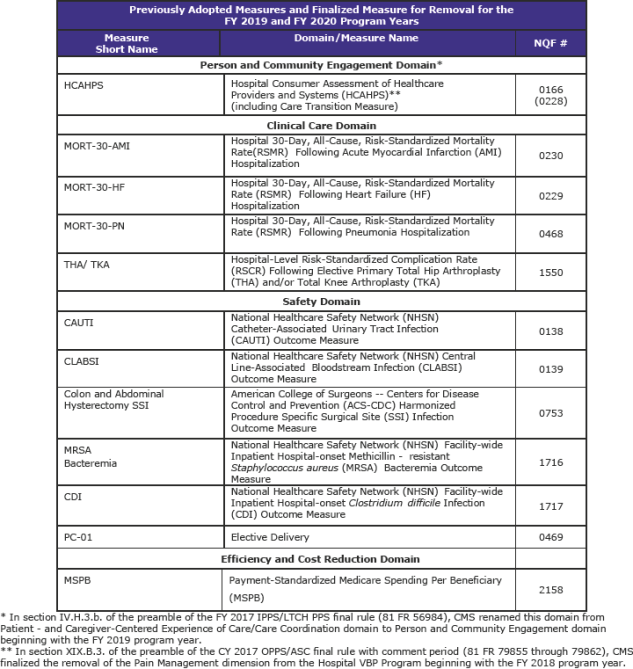

In summary, for the FY 2019 and FY 2020 program years, CMS has finalized the following measure set: (page 995)

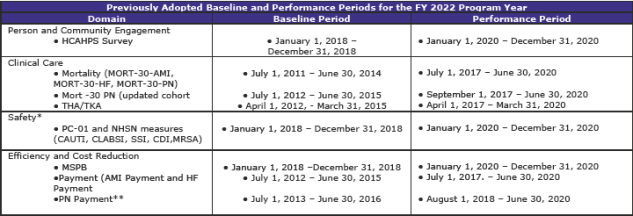

CMS is finalizing a New Measure for the FY 2022 Program Year and Subsequent Years: Hospital-Level, Risk-Standardized Payment Associated with a 30-Day Episode-of-Care for Pneumonia (PN Payment). The PN Payment measure is intended to be paired with the MORT-30-PN measure. The PN Payment measure will be added to the Efficiency and Cost Reduction domain. (page 997)

The Patient Safety and Adverse Events (Composite) measure is a weighted average of the reliability-adjusted, indirectly standardized, observed-to-expected ratios for the following 10 individual Patient Safety Indicators (PSI) component indicators:

- • PSI 03 Pressure Ulcer Rate;

- • PSI 06 Iatrogenic Pneumothorax Rate;

- • PSI 08 In-Hospital Fall with Hip Fracture Rate;

- • PSI 09 Perioperative Hemorrhage or Hematoma Rate;

- • PSI 10 Postoperative Acute Kidney Injury Requiring Dialysis Rate;

- • PSI 11 Postoperative Respiratory Failure Rate;

- • PSI 12 Perioperative Pulmonary Embolism (PE) or Deep Vein Thrombosis (DVT) Rate;

- • PSI 13 Postoperative Sepsis Rate;

- • PSI 14 Postoperative Wound Dehiscence Rate; and

- • PSI 15 Unrecognized Abdominopelvic Accidental Puncture/Laceration Rate.

CMS will adopt, as proposed, the Patient Safety and Adverse Events (Composite) measure for the Hospital VBP Program beginning with the FY 2023 program year. CMS says that the measure would be added to the Safety domain, like the previously adopted PSI 90 measure. (page 1,044)

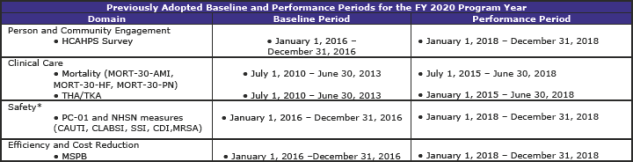

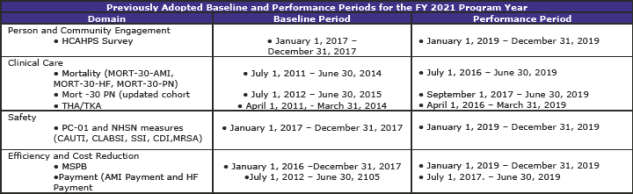

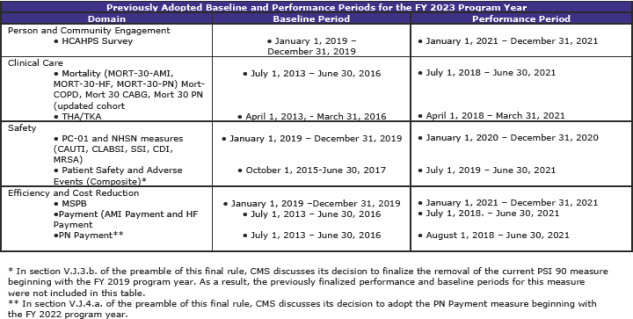

Summary of Previously Adopted and Baseline and Performance Periods for the FY 2019 through FY 2023 Program Years (page 1,059)

The tables below summarize the baseline and performance periods that CMS is proposing in this rule.

Comment

This is another section with extensive and complex material. The material—some 112 pages—contains additional tables regarding standards beyond FY 2019 as well as much scoring information.

Changes to the Hospital-Acquired Condition (HAC) Reduction Program (page 1,092)

For the FY 2020 program, CMS is returning to a two-year time period for the calculation of HAC Reduction Program measure results.

CMS is modifying the Extraordinary Circumstances Exception (ECE) policy for the HAC Reduction Program by:

- (1) allowing the facility to submit a form signed by the facility’s CEO or designated personnel;

- (2) specifying that CMS will strive to provide a formal response notifying the facility of its decision within 90 days of receipt of the facility’s request; and

- (3) specifying that CMS may grant ECEs due to CMS data system issues which affect data submission.

V. CHANGES TO THE LONG-TERM CARE HOSPITAL PROSPECTIVE PAYMENT SYSTEM (LTCH PPS) FOR FY 2017 (page 1,212 & addendum pdf page 2,227)

Updates to the Payment Rates for the LTCH PPS for FY 2018 (page 1,610)

MACRA requires that the annual update for FY 2018, after applications of the reductions for the MFP (productivity) adjustment and the “other adjustment” (under section 1886(m)(3)(A)) is 1.0 percent.

For LTCHs that fail to submit required quality reporting data for FY 2018, the update is reduced further by 2.0 percentage points, or an (negative) update factor of -1.0 percent.

CMS is applying a factor of 1.01 to the FY 2017 LTCH PPS standard Federal payment rate to determine the FY 2018 LTCH PPS standard Federal payment rate. Further, CMS is applying an area wage level budget neutrality factor of 1.0006434. CMS also is applying a budget neutrality adjustment of 0.9651 for changes to the short stay outlier (SSO) payment methodology

Therefore, CMS is finalizing a LTCH PPS standard Federal payment rate of $41,430.56 calculated as $42,476.41 (the current FY 2017 rate) x 1.01 x 1.0006434 x 0.9651) for FY 2018.

The amount for those not providing quality is $40,610.16 (calculated as $42,476.41 (the current rate) x 0.99 x 1.0006434 x 0.9651).

The labor-related share under the LTCH PPS for FY 2018 is 66.2 percent.

The FY 2018 LTCH PPS standard Federal payment rate wage index values are presented in Table 12A (for urban areas) and Table 12B (for rural areas), available on the CMS Web site.

There is a COLA for Alaska and Hawaii. Those values are the same as for the IPPS (see above).

High-Cost Outlier (HCO) Cases

Section 1886(m)(7)(A) of the Act makes CMS’s existing regulatory budget neutrality requirement at § 412.523(d)(1) for the 8.0 percent HCO target for standard Federal payment rate cases a statutory requirement beginning in FY 2018.

In addition, section 1886(m)(7)(B) of the Act requires, beginning in FY 2018, that the fixed-loss amount for HCO payments be determined so that the estimated aggregate amount of HCO payments for such cases in a given year are equal to 99.6875 percent of the 8.0 percent estimated aggregate payments for standard Federal payment rate cases (that is, 7.975 percent). In other words, sections 1886(m)(7)(A) and (7)(B) requires that CMS adjust the standard Federal payment rate each year to ensure budget neutrality for HCO payments as if estimated aggregate HCO payments made for standard Federal payment rate discharges remain at 8.0 percent, while the fixed-loss amount for the HCO payments is set each year so that the estimated aggregate HCO payments for standard Federal payment rate cases are 7.975 percent of estimated aggregate payments for standard Federal payment rate cases.

CMS is establishing a fixed-loss amount of $27,382 for LTCH PPS standard Federal payment rate cases for FY 2018. The current threshold is $21,943.