- Key conservative organizations gain steam in shareholder activism

- ESG groups garner single-digit support for resolutions

Conservative think tanks, bolstered by political success, are getting more active in shareholder campaigns as fewer social justice and environment proposals land in front of companies.

The Heritage Foundation, the influential policy organization behind conservatives’ Project 2025 roadmap, made a first-time foray into shareholder proposals this past season in opposition to some environmental, social, and governance corporate policies. It piggybacked on the success of activists like Robby Starbuck, who has lobbied to nix diversity, equity and inclusion programs.

The shareholder proposal process is a potent and growing vehicle for right-leaning groups looking to highlight their issues in the media and in board rooms. Their emergence as a player in the corporate annual meeting space is borne out by some recent numbers, which show anti-ESG groups gaining on the progressive organizations that have long dominated the space.

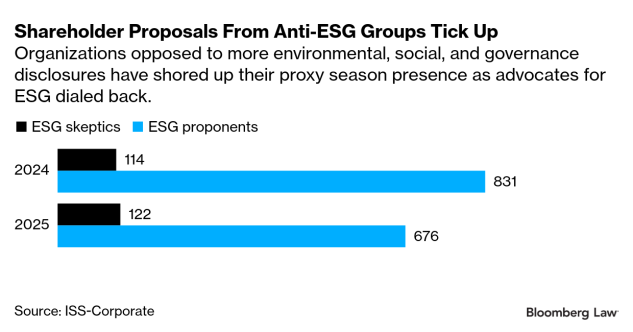

Groups that tend to be skeptical of ESG measures composed about 15.3% of all shareholder proposals from January through June, according to data from ISS-Corporate, a data and analytics provider for corporations. That’s up from 12% of all proposals the year before.

Meanwhile, pro-ESG groups still accounted for the vast majority of proposals, about 85%, but their overall number of proposals declined by 19% year-over-year. The median level of support for those resolutions also dropped a few points this year.

Another gauge of the shift: nearly half of the diversity, equity and inclusion proposals filed for annual meetings this past year were anti-DEI, according to The Conference Board’s Governance & Sustainability Center.

Corporations like Target shed their diversity initiatives following President Donald Trump’s January directive to investigate “illegal discrimination” in publicly traded companies. But the larger corporate world still has a long way to go—on DEI but also other ESG tenets—before it reaches center after years of leftward influence, conservative groups say.

“For years really, most shareholder proposals were brought by left-wing proponents, which means corporate America more broadly was really only hearing one side of these issues,” said Luke Perlot, associate director of the National Legal and Policy Center’s Corporate Integrity Project. “By providing the other side of the issue, we also give companies an off-ramp.”

Timothy Smith, senior policy adviser at the Interfaith Center on Corporate Responsibility, a pro-ESG shareholder group, acknowledged resolutions from conservative groups noticeably ticked up this year, attributing it to a politically-coordinated fight.

“Clearly there’s some money behind this,” he said.

Joining Ranks

The Heritage Foundation offered shareholder proposals scrutinizing DEI practices, abortion drug dispensing, alleged financial surveillance, and calls for divestment from Israel at large-cap companies such as

Conservatives’ larger presence during proxy season didn’t stop with private organizations. The state of Oklahoma earlier this year became the first red state to submit shareholder proposals, according to Bloomberg News reporting. The state targeted

Support for ESG resolutions isn’t usually high to begin with. But median support for anti-ESG groups’ proposals was distinctly low this year, at 1.3%. Pro-ESG groups, by contrast, garnered 16.8% median support.

Shareholder resolutions are meant to gauge investors’ interest on issues relevant to companies’ health, said Danielle Fugere, president and chief counsel at As You Sow, a progressive shareholder advocacy organization. Conservatives’ insistence on sticking with unpopular bids shows they’re “politicizing the shareholder arena” instead of meaningfully engaging with the process, she said.

It’s safe to say Heritage’s number of proposals will “materially increase” in coming years, said John Backiel, a visiting fellow for the foundation’s capital markets initiative.

When Backiel and his colleague, Andrew Olivastro, started out in 2022, almost every shareholder proposal came from a left-leaning group, said Olivastro, the foundation’s chief advancement officer.

Conservative groups have since scrambled to bulk up their corporate activism—a space they’ve come to view as a key battleground in the fight to win mainstream ideological credit and combat what they see as the corporate world’s move to the left.

“The post-George Floyd racial reckoning really brought these radical left-wing policies into the mainstream,” Perlot said.

A few big wins for progressive corporate activism also rattled conservatives—particularly investor Engine No. 1’s successful campaign to elect new renewable energy-friendly board members to

Shareholder proposals don’t need to pass—headlines alone can dial up public pressure on companies, said Ariane Marchis-Mouren, senior corporate governance researcher at The Conference Board. Companies sometimes even negotiate with groups to keep proposals off ballots, Perlot said.

Rethinking DEI

Anti-DEI proposals composed about 40% of DEI proposals this year as conservative groups turned toward the shareholder process to advance culture war narratives, said Andrew Jones, principal researcher at The Conference Board’s Governance & Sustainability Center.

But conservative shareholders may focus less on DEI moving forward as the Trump administration emboldens companies to shed programs, Perlot said.

Some of the country’s largest companies—including

“Most of the companies that we’re shareholders in have significantly walked back their DEI programs,” and lingerers will struggle to justify keeping initiatives, Perlot said.

But companies “talking out of both sides of their mouth” on DEI are going to see increased pressure, said Stefan Padfield, executive director of the National Center for Public Policy Research’s Free Enterprise Project.

Some corporations are scrapping symbols of DEI in marketing materials and disclosures—replacing words like “diversity” with less politically charged terms like “belonging,” for instance—but are quietly continuing programs, Padfield said.

“What you’re seeing is both sides not happy,” he said. “The right’s not happy because when you change from ‘equity’ to ‘belonging’ you’re still discriminating. The left’s not happy because when you change from ‘equity’ to ‘belonging,’ you’re backtracking.”

To contact the reporter on this story:

To contact the editors responsible for this story:

Learn more about Bloomberg Law or Log In to keep reading:

See Breaking News in Context

Bloomberg Law provides trusted coverage of current events enhanced with legal analysis.

Already a subscriber?

Log in to keep reading or access research tools and resources.