- Investments in anti-ESG funds rose to $2.1 billion in 2023, report shows

- ESG funds led by firms like BlackRock and Vanguard still dominate

The decades-long trend of investing in funds tied to environmental, social and governance factors has a rising adversary: anti-ESG funds.

But those funds, while growing in popularity, still are far below in both inflow and overall size to vie with ESG funds run by established mega asset managers like BlackRock and Vanguard. And some analysts predict they’re unlikely to ever catch up.

“I wouldn’t dispute that the number has increased. I mean, there’s an anti-ESG backlash, there’s a movement, people are trading off of it, people are launching funds,” said Witold Henisz, faculty director of the ESG Initiative at the University of Pennsylvania. “There’s some funds moving in, but it’s pocket changecompared to ESG.”

Firms dedicated to counter the ESG-fund market have steadily begun to open their own funds, promising investors to return to a time when shareholder interest—and not “values”—were paramount. The number of funds and amount flowing into them is surging at a steady clip, according to a report by financial-analysis firm Morningstar.

The firm identified 27 funds it considers to have an anti-ESG agenda, largely defined from their marketing materials and prospectuses, said Morningstar Associate Director of Sustainability Research Alyssa Stankiewicz. The paper analyzed the funds’ performance, marketing and purpose and show the trend will stay niche, Stankiewicz said.

The funds generally invest in industries ESG funds purposefully exclude. The report shows a category of funds called “anti-ESG” invest nearly 25% of its portfolio in the “controversial weapons” industry. That’s different from conventional weapons, in that controversial weapons “have a disproportionate and indiscriminate impact on civilian populations.”

The combined size of the anti-ESG funds has risen to $2.1 billion, but that’s still a small fraction of the nearly $270 billion ESG-fund market, she said.

“There will always be people that just want to invest in the traditional energy sector,” Stankiewicz said. “But I don’t know that it’s always going to stay sort of this anti-ESG, anti-woke messaging—that’s really going to reach a fever pitch.”

Origins

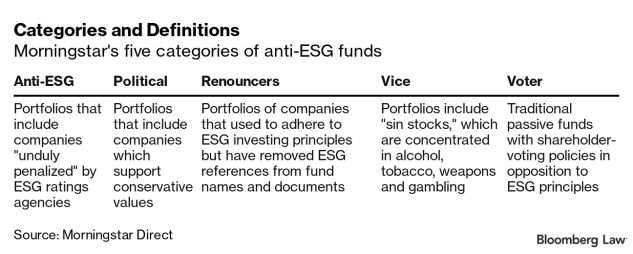

Morningstar’s white paper, issued Thursday, breaks down the definition of anti-ESG funds in five categories based on their marketing or investing habits.

The categories range from “Anti-ESG,” or portfolios built with companies penalized by ESG ratings agencies; to “Renouncer,” defined as funds previously claimed to adhere to ESG investing principles but that have scrubbed references to ESG “for fear of being associated with the ESG movement.”

Anti-ESG funds first appeared in the early 2000s, but only recently began growing substantially. In the early days, funds focused investments in “sin stocks” or companies with politically conservative values.

Last year, pressures on the energy industry because of Russia’s invasion of Ukraine also led some funds to focus on the energy sector, she said.

“The energy crisis last year was a big driver of support for the discourse around ESG and anti-ESG,” she said.

‘Shareholder Primacy’

Proponents of anti-ESG funds say there is no explicit “anti-ESG” effort on their part. Their funds—and business model—aim to return companies’ focus to pure capitalism: Whatever doesn’t increase companies’ value to shareholders should be pruned.

The concept is called “shareholder primacy,” rather than “stakeholder primacy,” that has come to drive companies’ ESG decisions, Strive Asset Management CEO Matt Cole said. The firm manages eight ETFs, seven of which made it into Morningstar’s report. The firm was founded in 2021 by Vivek Ramaswamy, who left to run for president earlier this year.

Stakeholder primacy, according to Cole, makes companies consider non-shareholder perspectives on how their businesses should be run. Those outside perspectives include employees and customers which can sway companies away from pure profitability.

Before Strive, Cole worked at the California Public Employees’ Retirement System, the largest public pension fund in the US. He left after 16 years, he said, because companies began speaking out on political issues that “have nothing to do with their core businesses.”

“This stakeholder capitalism movement in ESG is really drastically changing corporate America,” Cole said.

There’s some truth to that: every anti-ESG fund identified by Morningstar has gained traction with some investors, according to the report.

And some have performed well, like the most popular anti-ESG fund, the God Bless America ETF—ticker: YALL—has grown to $35 million and is outperforming the S&P 500 by 7%, Bloomberg Intelligence ETF Analyst Eric Balchunas said.

But the market isn’t fool-proof—demand for some funds has rapidly dwindled. Constrained Capital ESG Orphans ETF launched in May 2022 and picked up about $870,000 each quarter since. But the fund filed to liquidate earlier this month.

“These are never going to compete with BlackRock and Vanguard,” Balchunas said. “Their best hope is to carve out a little niche for themselves so they can, you know, have a life.”

To contact the reporters on this story:

To contact the editor responsible for this story:

Learn more about Bloomberg Law or Log In to keep reading:

See Breaking News in Context

Bloomberg Law provides trusted coverage of current events enhanced with legal analysis.

Already a subscriber?

Log in to keep reading or access research tools and resources.