During the past five years, pension plan sponsors in the United States have dealt with another perfect storm of pension financial volatility, with large swings in asset returns and high-quality corporate bond rates trending to historic lows. These factors have contributed to erratic profit and loss (P&L), balance sheet volatility, and material increases in cash costs. In the mergers and acquisitions (M&A) world, putting the right value on a company’s defined benefit plans can be the difference between a successful transaction and one that fails to meet objectives.

Valuation Methods in M&A—

Deal Pricing Purposes

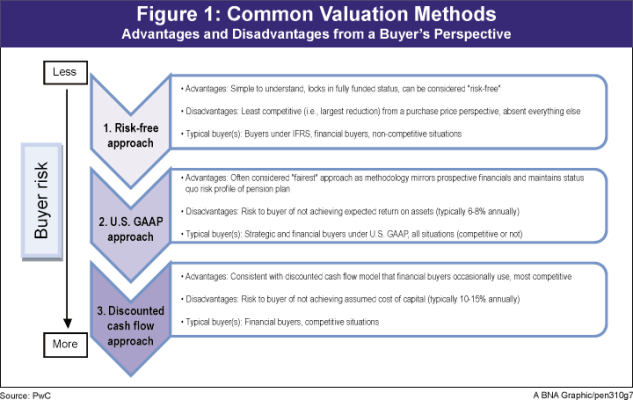

There are generally three commonly utilized approaches for valuing pension plans in M&A: (1) the risk-free approach, (2) the U.S. generally accepted accounting principles (GAAP) approach, and (3) the discounted cash- flow approach. Figure 1 summarizes the advantages and disadvantages of each from a buyer’s perspective.

There is no bright-line test on which method is appropriate, as it depends on various items, including a prospective buyer’s profile (i.e., financial versus strategic). For example, financial buyers, such as private equity firms, are primarily concerned with achieving an internal rate of return on their investment over a limited time horizon (i.e. 5 to 10 years). On the other hand, strategic buyers, such as public and private companies, are primarily seeking to buy a company for anticipated cost synergies and theoretically have indefinite time horizons. Typically, most U.S. buyers’ initial starting point is the U.S. GAAP method as this mirrors prospective financials and does not change the overall risk profile of the plan. From there, buyers can adjust methods to reflect their current situations.

The fundamental difference in valuation methods for deal-pricing purposes generally relates to the treatment of the unfunded liability; practice varies between ignoring the unfunded liability completely and receiving a dollar-for-dollar adjustment. Strategic buyers with existing plans will often take a view of the deficit that depends on whether they expect to achieve any benefit plan integration and synergies in combining plans (if they have one or more existing plans), whereas financial buyers are generally more wary of deficits: They often use the unfunded liability on a corporate bond basis as a starting point as they typically have a shorter expected holding period.

Under all three approaches, results from the most recent audited financials are adjusted and presented on a pro forma basis to reflect the current capital market interest rate environment and estimated asset performance since the last measurement date (i.e., if the transaction were to close today). Taking this approach, the pro formas reflect normalized earnings—which account for market cycles and represent what buyers should have in their model for the plan’s ongoing costs—and current estimated funding levels. The pro formas also capture estimated prospective cash requirements.

1. Risk-Free Approach

The first approach—the risk-free approach—can be considered the least price competitive, as the overall purchase price reduction is generally the largest of the three approaches. However, this method does provide the buyer with the least amount of prospective financial risk.

The main outcome of this method is that the pro forma underfunding is classified as a debt-like item and a corresponding quality of earnings adjustment to pro forma service cost is reflected.

To explain, the financial impact is broken into two components: (1) the historical liability based on past service of participants and (2) the prospective service of plan participants.

- Historical liability based on past service of participants: Since any plan underfunding will be inherited by the buyer, it will ultimately be the buyer’s responsibility to close the funding gap based on benefits incurred prior to acquisition. To account for the historical liability under this approach, the pro forma underfunding is appropriate to classify as debt-like, with a corresponding dollar-for-dollar reduction to the purchase price.

Under this approach, the buyer’s model would assume that it receives a purchase price reduction for the unfunded liability and then would hypothetically “fund up” the pension plan at the acquisition date, so assets equal liabilities at acquisition. Taking it one step further, a buyer would subsequently “immunize” the plan assets to 100 percent duration-matched bonds so that the assets would mirror the liability in every respect (i.e., duration, cash-flow timing, etc.). Doing so effectively de-risks the plan, as both assets and liabilities would move in tandem, thereby maintaining the 100 percent funding level prospectively. As you can imagine, this approach is the least risky to the buyer, as this method removes the material financial risks of the plan (i.e., equities) that are currently being managed by the company.

- Prospective service of plan participants: A prospective buyer would need to account for the future costs of retirement benefits earned by employees in each future year in their valuation models. To capture this, the service cost is most commonly used. This is true for both open and closed plans (i.e., where participants are still accruing benefits but the plan is closed to new entrants)

1 For recently frozen plans in which there are no longer pension accruals and prospective benefits are instead provided under a replacement defined contribution arrangement (e.g., tax code Section 401(k) plan), a reasonable approximation of those costs would be the service cost.

- Prospective P&L under this approach would include only the service-cost component, as the other components—such as interest cost and expected return on assets—would equally offset each other and historical gains/losses would be wiped out under purchase accounting. In an effort to normalize earnings for valuation purposes, a quality of earnings adjustment to reflect pro forma service cost only is appropriate.

2. U.S. GAAP Approach

The U.S. GAAP approach is likely the starting point for most U.S. buyers, as this method mirrors prospective financials and does not change the overall risk profile of the plan.

The main outcome of this method is that the pro forma underfunding is classified as a debt-like item and a corresponding quality of earnings adjustment to pro forma U.S. GAAP P&L is reflected.

To explain, the U.S. GAAP approach is similar to the risk-free approach above with the key difference being that pension fund assets would maintain their current investment allocation (i.e., typically 60 percent/40 percent equities and fixed income) and any corresponding debt-like adjustment for the unfunded amount would also be invested at the current investment allocation. To avoid any confusion, there would not be a reallocation of pension assets (to a more conservatively invested portfolio) for either (1) assets currently in the trust or (2) assets hypothetically used to fund the current deficit.

- Historical liability based on past service of participants: Similar to the risk-free approach, and considering that any underfunding will be inherited by the buyer, the pro forma underfunding is appropriate to classify as debt-like, with a corresponding dollar-for-dollar reduction to the purchase price.

- Prospective service of plan participants: Similar to the risk-free approach, the buyer would again include the service cost to account for retirement benefits earned by employees in each future year.

- In addition to the service cost, however, prospective P&L under this approach would include two other components: interest cost and expected return on assets (with the sum of these two often called the net financing cost). Under the risk-free approach, these two additional components would equally offset each other, whereas under the U.S. GAAP approach they would not. Instead, given the equity/fixed income investment mix, the expected annual long term return on the asset portfolio (as permitted under U.S. GAAP) is assumed to be 6 to 8 percent, which is higher than the annual interest cost on the liability. In an effort to normalize earnings for valuation purposes, a quality of earnings adjustment to reflect pro forma service cost and net financing costs is appropriate.

Note the net financing cost is an income item, which can be used to offset a portion of the service cost.

3. Discounted Cash Flow Approach

The third approach can be considered the most risky to a buyer. In addition to assuming that assets will return 6 percent to 8 percent annually (same as under the U.S. GAAP method), this approach also assumes that future cash requirements are discounted using the buyer’s cost of capital (typically 10 percent to 15 percent), which compounds the risk inherent in method 2 (U.S. GAAP). As transactions are becoming more competitive, buyers—particularly private equity buyers in competitive situations—are slowly gravitating to the discounted cash flow approach to remain a leading candidate in the deal process. However, the majority of U.S. buyers still incorporate either the risk-free or U.S. GAAP approach.

- Historical liability based on past service of participants: This method does not have an explicit upfront debt-like purchase price adjustment as other methods recommend. In reality, the deficit does not need to be funded at the acquisition date (in practice, the plan sponsor actually has several years to fund it); rather, the present value of the deficit funding requirement is taken over the buyer’s expected holding period. Deficit funding requirements are the cash requirements in excess of the cost of current accruals (i.e., the service cost).

Under this approach, the buyer’s assumed cost of capital is most often applied to the deficit funding requirements, as this is consistent with the required return for capital budgeting purposes. As cost of capital returns are primarily assumed to be 10 percent to 15 percent and the expected return on assets for a pension fund is 6 percent to 8 percent, there is an additional risk of not achieving a return in excess of 6 percent to 8 percent when applying the higher rates. Additionally, to the extent that the expected deficit funding requirements are not enough to fund the deficit during the holding period, the terminal value of the underfunding is also present valued at the cost of capital. This is because a future buyer would most likely wish to receive consideration for this underfunding upon future exit or sale.

The sum of the two present values—deficit funding and terminal value—is the implicit purchase price adjustment to capture the current deficit based on past service of participants.

- Prospective service of plan participants: Now that the buyer has recognized the historical liability based on past service, a quality of earnings adjustment similar to the risk-free approach is necessary to normalize earnings to the run-rate service cost (i.e., cost of future accruals).

Wrapping It All Up

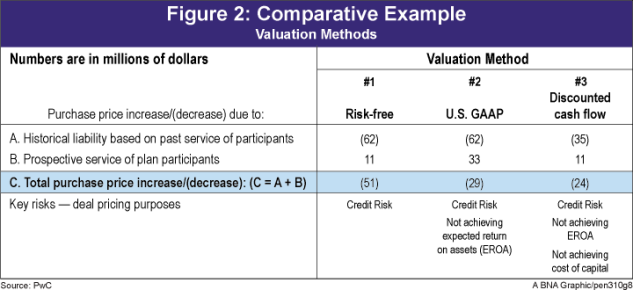

Valuing pensions in M&A encompasses reviewing the company financials and unraveling the accounting aspects that mask the true costs of providing pensions. Failure to properly account for pensions during the due diligence phase can make the difference between achieving the internal rates of return required and coming up short. In Figure 2, the results for a hypothetical pension plan that is approximately $62 million underfunded on a pro forma basis are presented. The three methods show the variability on the overall purchase price of the transaction through three different lenses, with the main difference being the level of risk a buyer is willing to assume. The good news is that all three methods generally lead to an overall purchase price impact that is lower than the absolute GAAP deficit, as earnings before interest, taxes, depreciation, and amortization are often positively effected.

Learn more about Bloomberg Law or Log In to keep reading:

See Breaking News in Context

Bloomberg Law provides trusted coverage of current events enhanced with legal analysis.

Already a subscriber?

Log in to keep reading or access research tools and resources.