- Rule change allows law firms to operate independently in Saudi Arabia

- Freshfields was top M&A adviser in Middle East for first quarter

Big Law firms rushing to expand their reach in Saudi Arabia are seeing more competition, even as slumping oil prices float a gloomy cloud over deals work across the Middle East.

Nearly four dozen multinational law firms launched or expanded practices in Saudi Arabia in the past two years, following a rule change allowing them to operate independently. The firms were lured by the prospect of steering diverse projects backed by the kingdom’s $700 billion Public Investment Fund, but an oil-price dip has widened the government’s deficit and threatens to slow business opportunities across the region.

“Even as we’ve seen diversification and new sectors growing, particularly in the Saudi sector, government decisionmaking and government dealmaking drives economic activity,” said Karen E. Young, a senior research scholar at Columbia University’s Center on Global Energy Policy. “We expect that to slow down.”

The flood of global law firms into the country reached a high mark in 2023, when deals behemoth Kirkland & Ellis and global law firm Gibson Dunn & Crutcher launched Riyadh offices. Latham & Watkins and White & Case are among prominent law firms that previously operated in the county through associations with local lawyers, but have launched regional offices in Saudi Arabia as required to compete for government business.

The bulk of global firms’ work in the country is tied to oil behemoth Aramco, the PIF, and government entities such as the Ministry of Finance.

The kingdom’s budget deficit could hit

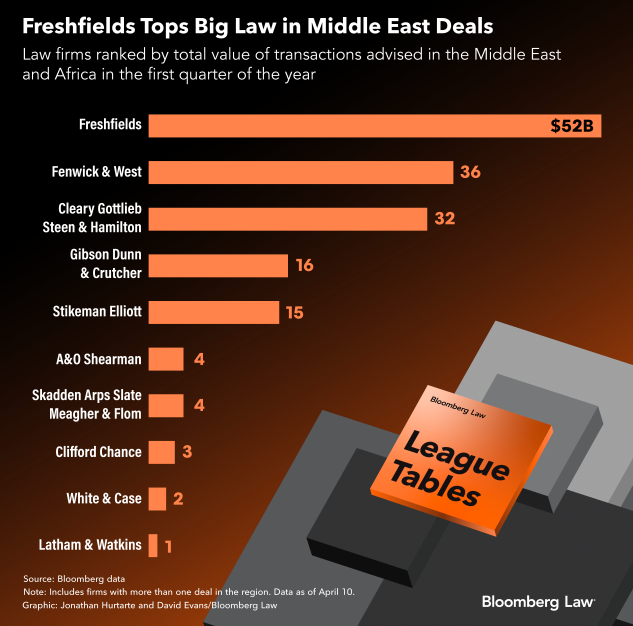

Freshfields Tops M&A

M&A deal volume across the Middle East hit $69.5 billion in the first quarter, according to Bloomberg data, the highest quarterly level since 2021. But falling oil prices and a global trade war will likely also weigh down activity across the Gulf Cooperation Council—the intergovernmental body that includes Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates—Young said.

“Usually, it takes about a couple of quarters for things to hit the GCC,” she said. “When we had the global financial crisis, it didn’t hit Dubai until 2009.”

Freshfields was the region’s top legal adviser for deals in the first quarter, guiding $52 billion worth of transactions. The UK-founded firm, which has been operating in Saudi Arabia for 15 years and has offices in Bahrain, UAE, and Israel, is bullish on the region.

“There’s a very robust deal flow pipeline,” said Pervez Akhtar, a Dubai-based M&A lawyer. “It’s a place where there’s a mode of momentum.”

Freshfields secured the top spot on the regional league tables by guiding Alphabet Inc.'s $32 billion cash purchase of Israeli cybersecurity company Wiz Inc. Google owner Alphabet is a key Freshfields client, whose deals often are led by US M&A partner Ethan Klingsberg. Freshfields was also among several firms that worked on Abu Dhabi National Oil Co. and Austrian OMV AG’s $13.4 billion purchase of Nova Chemicals from Abu Dhabi sovereign fund Mubadala Investment Co.

Large transactions similarly boosted Silicon Valley firm Fenwick & West, whose lawyers advised repeat client Wiz on the Alphabet deal and guided Niantic Inc.'s $3.5 billion sale to Scopely, a subsidiary of Saudi Arabia’s PIF.

A slower local market within Saudi Arabia is unlikely to dampen Big Law’s Middle East ambitions. King & Spalding, BCLP, and Pillsbury Winthrop Shaw Pittman since December have announced plans to launch offices in Saudi Arabia or expand their footprints in the country.

Dubai continues to be the top spot in the region for deals work, with the UAE often acting as a hub for local work from different regions, said Akhtar. Firms have recently continued expanding into the UAE, including Paul Hastings, which in April opened an Abu Dhabi outpost.

Local work on M&A, capital markets, fund formations, and other corporate projects may slow, but lawyers are also working on inbound investments , such as from private equity firms in Europe and the US, and Middle Eastern outbound investments.

Capital markets work may also be a bright spot. Flynas, an airline backed by billionaire Saudi Prince Alwaleed bin Talal, and Ejada Systems, a fintech company owned by one of the country’s biggest banks, are

Middle East governments are encouraging local initial public offerings, said Akhtar. “They don’t want people to keep going to London, the NASDAQ, Hong Kong or somewhere else—they want a local, active market,” he said.

Settling in Saudi

Several of the multinational firms opening up independent shops in Saudi Arabia have operated in the country since the early 2000s through affiliations with local partner firms. Running an independent office in Saudi comes with conditions: A majority of a firm’s lawyers are required to be locals, which has encouraged those offices to absorb or hire local affiliates for talent.

“It’s a heavy lift exercise, in terms of the establishment of our license and structure, getting operations up and running, recruiting lawyers and integrating them into the team, and then handling client work that starts to come in,” said Kamran Bajwa, a Middle East deals partner at Kirkland.

King & Spalding in January merged with Saudi Arabian firm Abdulaziz H. Al Fahad & Partners Lawyers (Al Fahad & Partners) to create a combined firm with a majority of Saudi Arabian fee-earners. The firm was among the first to be granted a license to operate independently by Saudi’s Ministry of Justice in 2023, before which it practiced through an affiliation with the Law Offices of Mohammed AlAmmar, which was created in 2007.

To contact the reporter on this story:

To contact the editors responsible for this story:

Learn more about Bloomberg Law or Log In to keep reading:

See Breaking News in Context

Bloomberg Law provides trusted coverage of current events enhanced with legal analysis.

Already a subscriber?

Log in to keep reading or access research tools and resources.