- Latham & Watkins has seen unusual turnover in London

- Departures come amid frenzied market, pay changes

Latham & Watkins for years has been viewed as arguably the most successful US law firm operating in London. Now, it’s taking its licks.

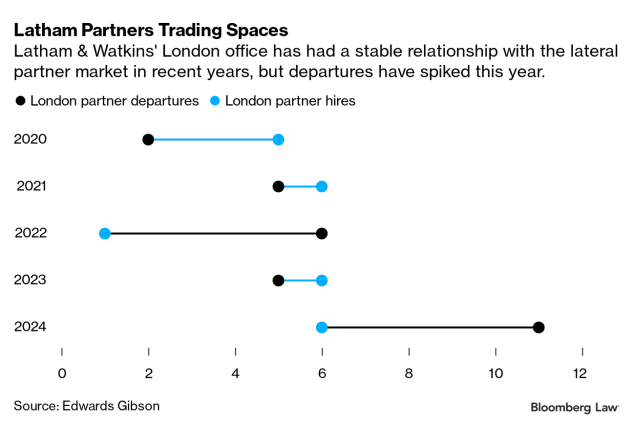

The firm has lost 11 UK partners to competitors this year, more than double the attrition it averaged the previous four years, according to data from legal recruiter Edwards Gibson. The defections include lawyers who formerly headed the London office and its intellectual property and litigation groups. They’ve come at the hands of other large, profitable US firms, including Sidley Austin, Skadden, Paul Hastings, and Milbank LLP.

“Latham made the right bets and it was very bold,” said Scott Gibson, a director at Edwards Gibson. “Until recently, I would say it almost had a cult-like feeling among people who were there. They loved it. And now, we’re seeing Latham losing partners.”

The exits coincide with two events: a historic surge in London partners switching law firms and a change in Latham’s compensation system.

Latham has the largest London office by headcount and revenue among US-founded firms, with more than 500 lawyers bringing in $758 million (£588 million) in the last fiscal year, according to Law.com data. It notched nearly $5.7 billion in global revenue last year, second most among all US-based firms, and its profits per equity partner were $5.5 million.

“Our success in London is the result of a deliberate, long-term strategy that is rooted in a deep commitment to our clients and our people,” Rich Trobman, the firm’s chair and managing partner, said in a statement. “Latham’s global platform and the quality of our team are unmatched, attracting the best talent in the market and offering outstanding career opportunities for young lawyers. We are extremely proud to be a market leader in the UK, Europe, and globally, and the destination of choice for our clients’ most complex matters. We remain committed to building on our momentum and success, and to achieving our ambitious goals.”

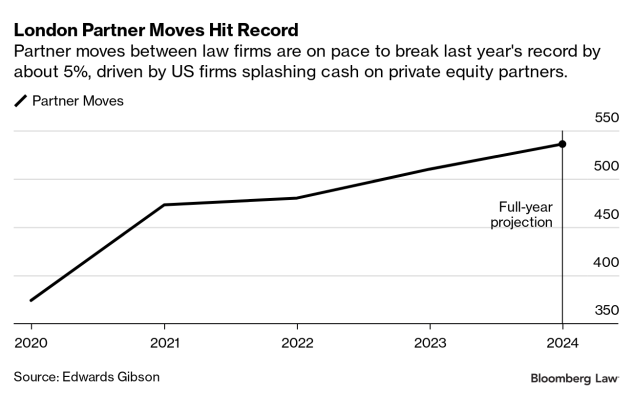

The shift in London isn’t confined to Latham. Through October, the city saw about 5% more lateral moves this year than it did during a record-setting 2023, according to Edwards Gibson, which has tracked partner hires in the city since 2007. If the pace holds up, there will be about 535 partner moves this year, compared to 510 last year.

Other top firms have seen departures. Kirkland & Ellis hired Paul Weiss’ London office leader Alvaro Membrillera in 2023. Star Kirkland partners Neel Sachdev and Roger Johnson left to join Paul Weiss last year. That move motivated more US firms to invest in London, recruiters said, and it’s led to a domino effect of moves across the city.

Latham’s size and success in London has made it a natural poaching target in the scramble for talent. Much of the movement gripping London firms is in practice groups where Latham has had enduring success: private equity and debt finance.

“Finance has been the majority of the moves in London, and that’s the growth of private credit, essentially,” said Adil Lalani, a London-based partner at recruiting firm Macrae. “So, the market’s there for this to happen. And it’s US firms recognizing that London is important. That shift has come more acutely in the last 12 to 18 months.”

Compensation Changes

Nine of the departures from Latham this year came after July, when the firm finalized changes to its compensation system. Following a broader market trend to better pay its highest performers, Latham allowed a small group of partners to earn significantly more “points” than previously permitted.

More points correlate to higher base pay. The firm also employs a bonus system to reward partners for performance. The move brought Latham’s highest compensation range closer to the top salaries—in the $20 million range—paid at the most profitable firms, according to multiple reports.

“Changes to the firm’s equity compensation structure were made following an in-depth review and extensive discussions and meetings in each office to ensure a transparent and thorough process consistent with our culture,” a firm spokesperson said in a statement.

The firm’s leadership had the opportunity to receive direct feedback from the partnership before moving forward, the spokesperson said, noting the changes allow the firm to reward more partners in its year-end bonus process.

The move was viewed by some industry sources as a break from Latham’s traditional culture, which has revolved less around stars than some of its closest competitors. It highlights challenges firms face as they respond to market pressures to meet top salary ranges.

“People think it’s suddenly normal to get paid $8-plus million a year when it’s really not,” said Christopher Clark, a director at Definitum Search. “The problem for any firm will be managing the internal reaction to key individuals being paid significantly more than other partners in the business, regardless of whether they fee earn or not.”

Latham has maintained its ability to attract lawyers from other firms, hiring six partners in London this year, consistent with levels in recent years. It also hired partner Pedro Rufino Carvalho, who joined from asset manager Patria Investments, where he was managing director and global general counsel.

Enter Sidley

Seven of Latham’s departing partners this year have jumped to Sidley, which has embarked on a broad effort to build its London practice.

Those exits began with a five-partner finance team led by Jayanthi Sadanandan and Sam Hamilton, who are now global co-heads of Sidley’s leveraged finance practice. Sadanandan had led Latham’s London office from 2015 to 2020.

Two more partners—Scott Colwell and Patrick Kwak—followed that group to Sidley. They told Bloomberg Law that firms were motivated to hire partners in response to private equity clients that demand full-service offerings.

Tom Thesing, Sidley’s London managing partner, said the firm would make additional hires there for its private equity business.

In another sign of how eager US firms have been to hire London’s finance partners, even Cravath, Swaine & Moore has been in on the trend. The firm, which historically relies very little on lateral partner hires, last month reportedly brought on two leveraged finance partners from UK-founded Linklaters.

To contact the reporter on this story:

To contact the editors responsible for this story:

Learn more about Bloomberg Law or Log In to keep reading:

See Breaking News in Context

Bloomberg Law provides trusted coverage of current events enhanced with legal analysis.

Already a subscriber?

Log in to keep reading or access research tools and resources.