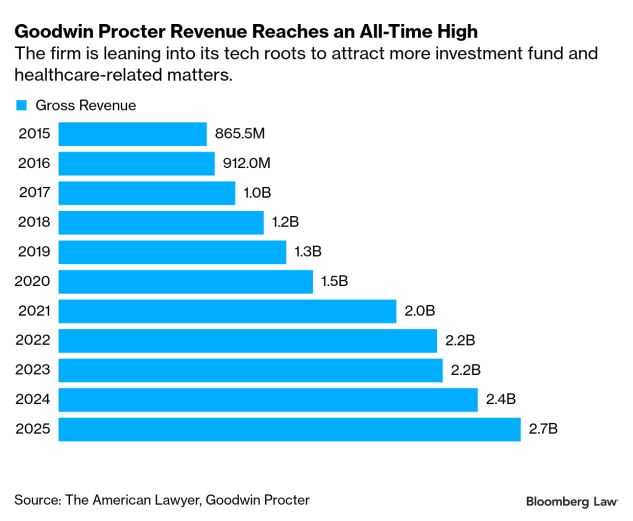

Goodwin Procter’s mergers and acquisitions and litigation work elevated its revenue to $2.7 billion in the year ending Sept. 30, according to the firm’s chairman.

“The numbers are an output of people doing really good work and a strategy being effective and working,” Anthony McCusker said in an interview. The revenue grew more than 12% and is the firm’s highest to date. Goodwin, ranked 18th in AmLaw’s 2024 list of firms by revenue, doled out more than $1.6 million in revenue per lawyer.

McCusker credits the growth to a strategic plan called Goodwin 2033, which calls for more internal collaborations between attorneys, from dealmakers to litigators.

“We think that making sure they’re interacting with each other and looking at a broad industry of funds as opposed to a narrow sector of say, real estate or private equity or venture, is going to lead to better results,” McCusker said.

“People have really embraced looking at, how do we become the firm that meets the aspirations we have for ourselves?” he said of the firm’s reaction to the strategic manifesto.

The firm is making a deeper play for investment fund and healthcare-related matters as it focuses on long-term growth, McCusker said. Goodwin’s litigation practice is largely powered by intellectual property matters from its tech and life science clients. It’s getting more work there, and more from general business litigation, including corporate disputes and class action securities work.

Goodwin is among the law firms seeking a stronger foothold in shareholder activism work that surged in the middle of this year, according to Bloomberg Law data.

Newly-elected managing partner Joshua Klatzkin will also help guide the firm’s strategy. The private equity lawyer is set to join leadership October 2026 and succeed the firm’s current managing partner Mark Bettencourt. Klatzkin has represented Goldman Sachs Asset Management in an investment, and he represented a Mexican investment fund in a sale to BlackRock.

The Boston-founded firm made strategic hires throughout the year, including the poaching of partner Leonard Wood from Sidley Austin to lead its shareholder activism and takeover defense practice group last month.

“It’s really important to have the discipline to know what it is we want and not get sucked into lower level or non priorities,” McCusker said.

Many firms in recent years have looked to mergers as a tool to scale up quickly, grow revenue and increase rates, but McCusker said the firm’s strategic vision does not include merger plans. He also said climbing the AmLaw 100 leaderboard is not a priority.

Instead of chasing behemoth status, the firm is making its billing structure more flexible to meet clients’ needs. McCusker said Goodwin offers contingency fee and fixed fee arrangements and is open to working with litigation funders.

Goodwin’s revenue growth is on par with the rest of its immediate competitors. Revenue at the country’s 100 largest law firms rose by 11.4% in the first quarter, outpacing growth from a year ago, according to a April 2025 report by Wells Fargo’s legal banking unit.

Goodwin’s profits skyrocketed during a boom in demand in 2021. The firm brought in roughly $2 billion in revenue and more than $3.6 million in profits per equity partner in 2021, according to The American Lawyer.

It then slogged through economic swamps in recent years. Goodwin was one of many tech-heavy firms that laid off attorneys, paralegals and professional staff amid a slowdown in corporate work beginning January 2023. A year later, the firm rolled out a client-immersion program that placed its most junior lawyers with clients’ in-house counsel—work typically reserved for more senior associates. Goodwin paid associates their full salaries during the rotations and made them eligible for bonuses.

McCusker became chair of the firm in 2023 after leading Goodwin’s Silicon Valley office. He joined the firm in 2010 from Gunderson Dettmer to launch the firm’s West Coast technology practice.

He has worked with emerging companies and venture capital firms in investment rounds and funding, including Sequoia Capital and Greylock Partners. He also advised The Washington Post Company on the sale of the newspaper and related publication assets to Amazon.com founder and CEO Jeff Bezos and his private investment firm, Nash Holdings.

To contact the reporter on this story:

To contact the editors responsible for this story:

Learn more about Bloomberg Law or Log In to keep reading:

See Breaking News in Context

Bloomberg Law provides trusted coverage of current events enhanced with legal analysis.

Already a subscriber?

Log in to keep reading or access research tools and resources.