- FTC encourages qualifying deals to request early termination

- Deals lawyers face tougher than expected deals market

M&A lawyers are cheering the Federal Trade Commission’s return to a tool to speed up the deals approval process, even as companies have been slow to embrace it.

The FTC is encouraging practitioners to request “early termination” of the agency’s review process, which the agency banned under the leadership of Lina Khan in the Biden administration. Early termination grants a swift end to reviews of transactions that don’t pose antitrust risk, shortening the process for companies fulfilling premerger filing requirements under the Hart-Scott-Rodino Act.

“It was abundantly clear that this was serving no useful purpose,” Bruce Hoffman, an antitrust partner at Cleary Gottlieb, said of the ban. “It was just acting as a drag on the economy and a cost increase, and it should have been rescinded relatively quickly, but was not.” Hoffman served as director of the FTC’s Bureau of Competition during President Donald Trump’s first administration.

Only a few months in, dealmakers are already seeing an improvement in how long it takes for transactions granted early termination to close.

“It’s true that the timeline is mostly back to what it used to be for deals that don’t really raise issues,” said Vadim Brusser, a partner at Sidley Austin. “The length of review for those deals is close to being back to what it was before the suspension.”

The FTC has granted early termination to 55 deals this year, including Merck’s $200 million licensing agreement with China-based Jiangsu Hengrui Pharmaceuticals. The deal for an oral heart medication could be worth up to $1.77 billion, dependent on passing certain milestones, according to Merck.

Early terminations haven’t “come back quite in full force,” FTC Commissioner Melissa Holyoak said in April at University of California Berkeley’s annual forum on M&A and the Boardroom. “I think some of it is we’re not getting the requests that we once did,” she said.

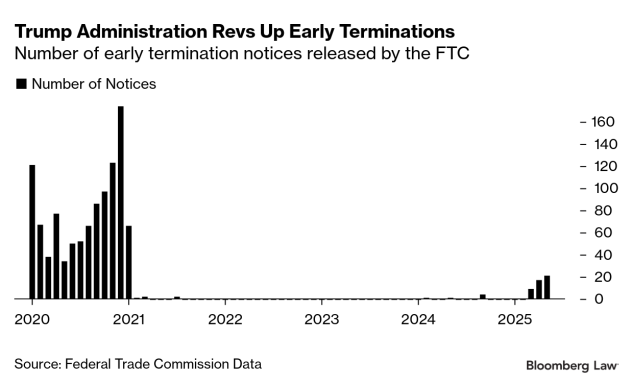

The FTC granted 17 early termination notices in April, about 78% fewer than in the same month in 2020, according to data from the commission. Early termination notices spiked to a total of 174 in December 2020, before the FTC abandoned the practice some two months later.

Bright Spot

Khan revived early terminations last year just before Trump was elected to usher in Republican control of the commission. The move was part of a broader overhaul of HSR filings, which took effect on Feb. 10.

Khan’s initial pause on early terminations was intended to be temporary to account for a large influx in deals. But she also warned that the speedy review of some deals could bring “significant harm,” citing a study of hospital mergers that showed prices increased at a higher average rate for mergers that received early terminations.

The return of early terminations is a small bright spot for dealmakers who have not seen the surge in activity they predicted when Trump was elected for a return to the White House.

Lawyers who previously were able to process HSR filings in about two weeks find it takes about twice as long with the new filing requirements, which require a deep-dive into private equity player owning multiple portfolio companies, or strategic buyers owning several business segments. The lengthened reviews increase costs for companies. A large bulk of transactions do not pose antitrust concerns but are still required to complete these complex HSR filings, which are triggered by deals based on the size of the parties and the transaction.

That means the new premerger filing requirements capture “stock options being exercised, inter- and intra-corporate rearrangements and other transactions where there’s no imaginable antitrust issue,” said Hoffman.

Trump’s tariff fights and geopolitical unrest have dampened transactions this year. Global deal volume nevertheless ticked up by 7% in the first quarter, compared to the same period last year, according to Bloomberg data. Kirkland & Ellis was once again Big Law’s top dealmaker over the quarter, advising on nearly $138 billion in transactions, followed by Davis Polk & Wardwell, Debevoise & Plimpton and Freshfields.

Keeping It Quiet

About 98% of the mergers filed with the FTC do not receive second requests for further antitrust scrutiny, said Holyoak, who joined the FTC last year after serving as Utah’s solicitor general. “I think that can be very beneficial to both the parties so that they can move forward with their transaction,” she said.

Early terminations can aid the FTC, which is tasked with reviewing much more detailed HSR filings, by reducing its slate of cases.

Some parties may choose to wait out the full period, even if they don’t have competitive issues to keep the deal confidential. The FTC publishes a notice, naming the parties involved, each time early termination is granted. That could be a deterrent for companies hoping to keep a deal private in the filing stages.

“HSR is confidential, but a grant of early termination is public,” said Hoffmann. “If you don’t want it to be public yet, you might not request early termination.”

To contact the reporter on this story:

To contact the editors responsible for this story:

Learn more about Bloomberg Law or Log In to keep reading:

See Breaking News in Context

Bloomberg Law provides trusted coverage of current events enhanced with legal analysis.

Already a subscriber?

Log in to keep reading or access research tools and resources.