- Law firms are investing in Singapore as Asia deals hub

- Downturn in transactions, billing rate pressures hit profits

Singapore has emerged as a destination for Big Law firms seeking to access work across Asia, but high costs and a sharp decline in deals make it harder to generate profits.

Market pressure and falling deals activity limit what firms can charge clients in the region.

“Asian clients are just not accustomed to paying New York private equity rates,” said Giji John, a partner at Orrick, which has six lawyers in the country. “You have to meet those clients where they are and build a team that can create that profitability level.”

Leading US law firms are increasingly shifting to Singapore as they roll back their operations in China and Hong Kong. Many are keeping their offices small and asking lawyers to be nimble, targeting work across the Asia Pacific region.

Lower billing rates mean firms generally won’t pay lawyers at levels common in the US and UK, even as the local cost of living exceeds that of New York and London. Most have also abandoned seniority-based lockstep pay systems in favor of an “eat what you kill” model.

“If you had to pay in some kind of standard lockstep, the office might not make sense,” Richard Rosenbaum, executive chairman for global law firm Greenberg Traurig, said in an interview. “We pay based upon what people are contributing to the firm, including the profitability of their work.”

The firm, which launched an office in Singapore in 2023, now has 10 lawyers based in the country. Other US-based firms opening in the country in the last five years include Orrick, Cooley LLP, Baker Botts, McDermott Will & Emery, and Goodwin Procter. Each of those firms has fewer than 20 lawyers in the country.

Only two of the 30 largest US-headquartered firms—Baker McKenzie and Norton Rose Fulbright—have more than 50 Singapore-based lawyers. Both operate under Swiss verien structures, using a loose network of affiliated branches to gain scale.

Deals Dip

Orrick said earlier this year that it would close its Shanghai office and consolidate its China presence in Beijing. Deteriorating relations with the US, tighter security regulations in the country, and an economic downturn, have promoted similar moves by other firms.

Singapore is an attractive alternative, serving as a hub to reach regional Asian markets including India, Indonesia, Thailand, South Korea, Vietnam and China.

Lawyers in Singapore outposts have been using the country as a perch for regional deals for several years.

Jake Robson, Greenberg Traurig’s co-managing shareholder for its Singapore office and head of M&A for South and Southeast Asia, joined the firm in March from Asian law firm King & Wood. His work there included guiding REA Group on a deal to increase its ownership interest in Elara Technologies, an Indian real estate business, and on the divestment of its Malaysia and Thai businesses to Property Guru. Robson also advised Softbank Vision Fund on several rounds of investment into Grab, including businesses across Asia worth more than a total of $2 billion.

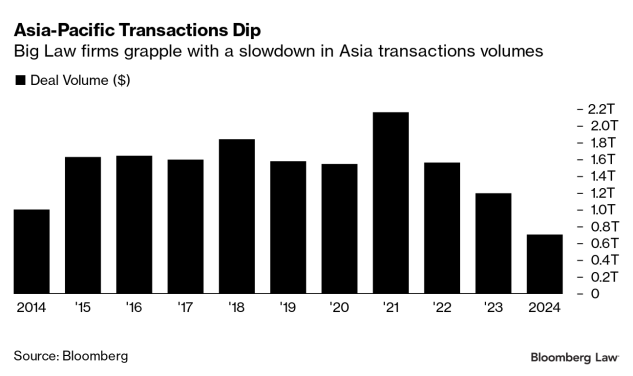

Big Law’s near-term ambitions in the region have been slowed by a downturn in the deals market.

M&A deal volume dropped last year to the lowest mark since 2014. The decline is driven in part by a drop in Hong Kong, where a population exodus has seen the economy contract.

Singapore benefits from a boost in investment inflow and relocation of Chinese businesses. The country attracted S$62 billion ($46.9 billion) in foreign direct investment from China in 2022—nearly 10% of its GDP—according to the Singapore Department of Statistics.

Still, Big Law attorneys based in the country are continuing to focus on work beyond its borders, said Rishab Kumar, a partner at Cooley.

“They focus on large, cross-border transactional practices and cross border litigation—the development of resources in new regions depends on the volume of those transactions.”

To contact the reporter on this story:

To contact the editors responsible for this story: Chris Opfer at copfer@bloombergindustry.com; John Hughes at jhughes@bloombergindustry.com; Alessandra Rafferty at arafferty@bloombergindustry.com

Learn more about Bloomberg Law or Log In to keep reading:

See Breaking News in Context

Bloomberg Law provides trusted coverage of current events enhanced with legal analysis.

Already a subscriber?

Log in to keep reading or access research tools and resources.