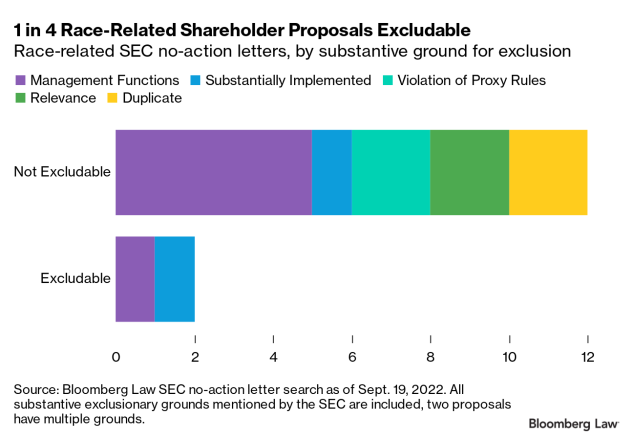

Companies are challenging race-related shareholder proposals for the very first time—likely a result of the steady influx of race-related shareholder proposals in H1 2022.

On at least nine occasions, companies have claimed a legal basis exists for excluding these proposals from their proxy statements, and they’ve sought non-binding “no-action letters” from the SEC’s Division of Corporation Finance.

Of the five substantive grounds covered by the no-action requests, the SEC’s responses provide three key takeaways.

1. Race-related public disclosures help excludability.

Companies anticipating race-related shareholder proposals should consider including relevant DEI reports and policies in their public disclosures.

In January, the ...

Learn more about Bloomberg Law or Log In to keep reading:

See Breaking News in Context

Bloomberg Law provides trusted coverage of current events enhanced with legal analysis.

Already a subscriber?

Log in to keep reading or access research tools and resources.