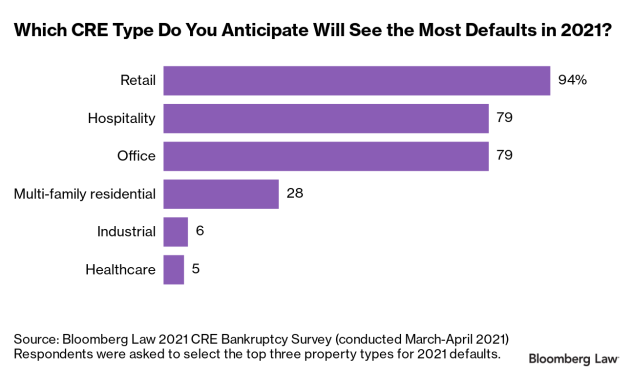

In Bloomberg Law’s 2021 Commercial Real Estate Bankruptcy Survey, we asked attorneys which commercial real estate (CRE) property types would see the most defaults in 2021. So far this year, data on delinquent CRE loans show some similarities—and one key difference—when compared with the attorneys’ predictions.

Respondents most often selected retail, hospitality, and office among their top three choices for 2021 defaults. The first two are not surprising, as pandemic-related distress in retail and hospitality has been high-profile in the last several months. Interestingly, an equal percentage of respondents selected office as selected hospitality for one of the top three ...

Learn more about Bloomberg Law or Log In to keep reading:

See Breaking News in Context

Bloomberg Law provides trusted coverage of current events enhanced with legal analysis.

Already a subscriber?

Log in to keep reading or access research tools and resources.