In an unanticipated development, the Treasury Department and the Internal Revenue Service recently issued final and proposed regulations (New Guidance) that significantly modify the taxation of U.S. persons indirectly owning stock of a “controlled foreign corporation” (CFC) through a domestic partnership.

The New Guidance provides that, to determine the amount of a U.S. partner’s GILTI or Subpart F income inclusion, a domestic partnership will be treated as an “aggregate” of its partners (in the same manner as a foreign partnership), rather than as an “entity” owning stock of a foreign corporation. As a result, under the aggregate approach:

- A U.S. partner of a domestic partnership that is a U.S. shareholder of a CFC will have a global intangible low-taxed income (GILTI) or Subpart F inclusion determined by reference to its proportionate ownership interest in the domestic partnership.

- A U.S. partner of a domestic partnership that is not a U.S. shareholder (minority U.S. partner) will not have a GILTI or Subpart F inclusion.

The New Guidance retains the current tax code rules for classification and certain other purposes. A domestic partnership will continue to be treated as a domestic entity to determine whether a U.S. person is a U.S. shareholder and a foreign corporation is a CFC. In addition, the current tax code rules will continue to apply for other purposes relevant to ownership of foreign subsidiaries by domestic partnerships, such as Section 1248, and for international information return reporting.

The New Guidance is a favorable change and reverses the U.S. tax consequences to minority U.S. partners under prior law. Nonetheless, as a result of this change, minority U.S. partners now need to be more sensitive to potential U.S. tax exposure arising under the passive foreign investment company (PFIC) provisions, particularly in view of the potential inapplicability of the CFC/PFIC overlap provision of Section 1297(d). The New Guidance will impact planning and 2018 compliance decisions for domestic partnerships with minority U.S. partners.

The GILTI-related portion of the New Guidance (final regulations) applies to GILTI inclusions for tax years of a foreign corporation beginning after Dec. 31, 2017, and to tax years of U.S. shareholders and minority U.S. partners in which or with which the foreign corporation’s tax year ends. The Subpart F-related portion of the New Guidance (proposed regulations) is proposed to apply to tax years of a foreign corporation beginning on or after the date of publication of final regulations, and to tax years of U.S. shareholders and minority U.S. partners in which or with which the foreign corporation’s tax year ends. However, the proposed regulations include a provision for early adoption, subject to certain restrictions as to consistent application.

BACKGROUND

The Tax Cuts and Jobs Act (TCJA) significantly revised the U.S. international tax system and, as relevant to this article, introduced the GILTI provisions, which now result in most of the active income that otherwise is not Subpart F income of a CFC to be currently taxable to its U.S. shareholders.

Under prior law, the U.S. income tax consequences to a minority U.S. partner in a partnership that owned stock of a foreign corporation primarily depended on whether the partnership was formed under domestic or foreign law.

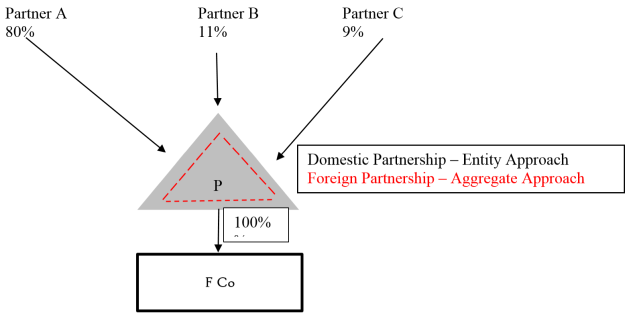

The simplified example, below, illustrates the U.S. income tax consequences under Subpart F and GILTI, before and after the New Guidance.

EXAMPLE: Partnership (P) owns 100% of the stock of F Co, a foreign corporation; F Co is a CFC; F Co derives Subpart F income and GILTI includible in the income of U.S. shareholders. P has three unrelated U.S. partners: A owns an 80% partnership interest in P; B owns an 11% interest in P; and C owns a 9% interest in P.

Subpart F Consequences Prior to New Guidance

If P were a domestic partnership:

- P would be treated as an entity.

- P would be the U.S. shareholder of F Co.

- F Co would be a CFC.

- P, as the U.S. shareholder, would include F Co’s Subpart F income in its income, notwithstanding it status as a pass-through entity.

- Partners A, B, and C would be required to include their respective distributive shares of P’s Subpart F income in their income.

If P were a foreign partnership:

- P would be deemed an aggregate of its partners and would not be a U.S. shareholder of F Co.

- Partners A, B, and C would be deemed to own F Co stock by reference to their respective ownership interests in P.

- Partners A (80%) and B (11%) each would be a U.S. shareholder of F Co.

- F Co would be a CFC because of Partners A’s 80% indirect ownership interest in F Co and Partner B’s 11% indirect ownership interest in F Co.

- Partner A would include 80% of F Co’s Subpart F income in its income, and Partner B would include 11% of F Co’s Subpart F income in its income.

- Partner C would not be a U.S. shareholder of F Co because its ownership interest in F Co is 9% and thus Partner C would not have a Subpart F inclusion.

Subpart F and GILTI Consequences under New Guidance

The New Guidance provides new rules for inclusion purposes but retains the pre-existing rules for U.S. shareholder, CFC, and other classification purposes, as well as certain other purposes. Pursuant to the New Guidance, under the facts of the above example, if P were a domestic partnership:

- For classification purposes:

- P is a U.S. shareholder of F Co.

- F Co is a CFC.

- Partners A and B are U.S. shareholders.

- Partner C is not a U.S. shareholder.

- For inclusion purposes: P is treated as an aggregate of its partners, with the consequence that:

- Partners A and B, each a U.S. shareholder of F Co., own 80% and 11%, respectively, of F Co stock.

- Partner A would have an inclusion of 80% of Subpart F income and/or GILTI.

- Partner B would have an inclusion of 11% of Subpart F income and/or GILTI.

- Partner C would not be a U.S. shareholder of F Co and thus would not have an inclusion under GILTI or Subpart F.

POLICY RATIONALE FOR NEW GUIDANCE

The impetus underlying the New Guidance (as opposed to a pure “entity” approach, which applied under prior law), was the aggregate treatment of multiple CFCs owned by a single U.S. shareholder under the GILTI regime. Under the GILTI provisions, a U.S. shareholder’s inclusion is determined by reference to the net sum of the pro rata shares of tested income and losses of all of the CFCs owned by the U.S. shareholder. The IRS and Treasury were of the view that failure to take into account the aggregation rules for CFCs owned indirectly through partnerships would frustrate the statutory purpose of the GILTI provisions. The preamble to the New Guidance also notes that treating a domestic partnership as an entity could have provided opportunities for abuse. That is, partnerships could then have been used to separate high-taxed income, proposed to be excluded from GILTI taxation in the proposed regulations included in the New Guidance, and tested interest expense, which indirectly would increase GILTI inclusions, from low-taxed income, tangible investments that reduce GILTI and losses. Another concern was whether a corporate owner might not be eligible for deemed paid foreign tax credits or the Section 250 deduction if the corporation were not treated as the direct holder of the foreign corporation stock. For these reasons the Treasury and IRS rejected a pure entity approach.

The Treasury and IRS issued proposed regulations in the New Guidance to extend the same principles to Subpart F inclusions because: (1) the GILTI and Subpart F income regimes are intended to work in tandem, (2) complexity and uncertainty would result if the two regimes were not coordinated, and (3) differing treatments would make it more difficult for taxpayers to comply with the applicable rules and for the IRS to audit compliance.

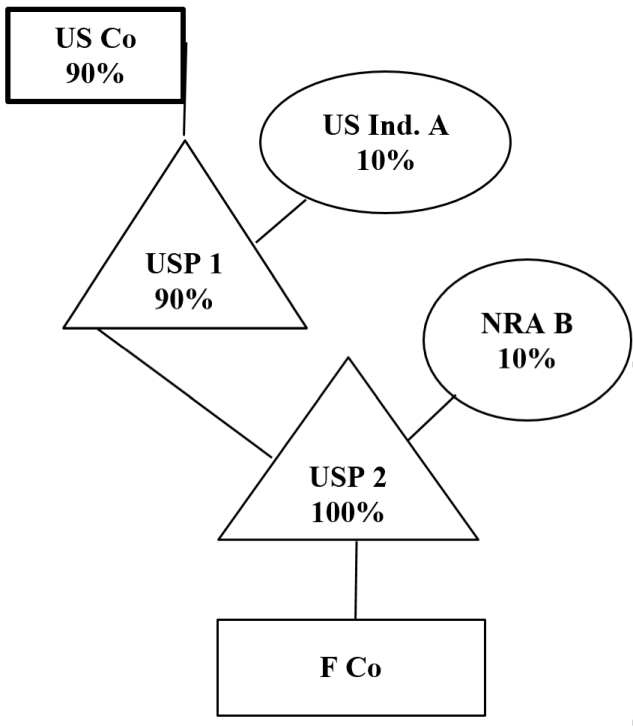

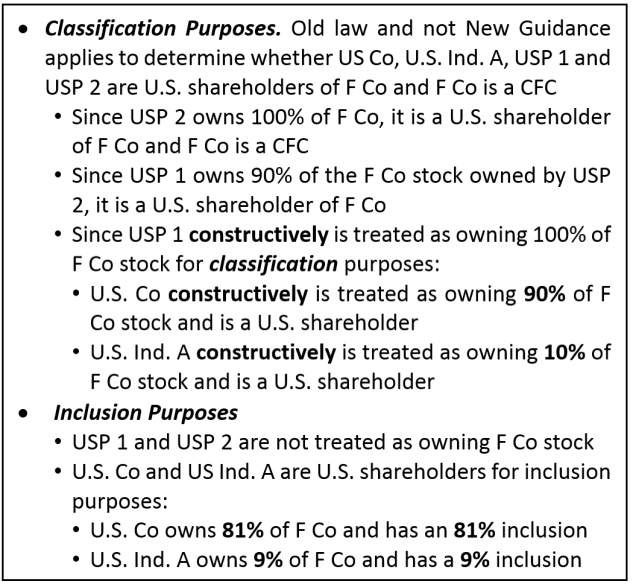

WHAT THE NEW GUIDANCE DOES NOT CHANGE

The New Guidance explicitly does not modify certain classification determinations, including as to whether (1) a U.S. person is a U.S. shareholder, or (2) a foreign corporation is a CFC. The New Guidance continues to treat partnerships as entities for these purposes, and, as relevant in this context, the application of certain constructive ownership rules. In an example highlighted in the New Guidance, depicted below, the application of the indirect and constructive ownership rules can cause a U.S. partner to be treated as a U.S. shareholder where that would not be the case under a pure aggregate approach. Thus, advisors need to continue to be alert to the application of the current law constructive ownership classification rules, which were broadened under the TCJA with the repeal of the limitations on downward attribution under former Section 958(b)(4).

Example

INCREASED RELEVANCE OF PFIC RULES

The New Guidance eliminates GILTI and Subpart F income inclusion exposures for minority U.S. partners. However, relief from one tax regime may result in exposure to another tax regime. Minority U.S. partners should direct increased attention to exposure under the PFIC provisions. In the absence of an inclusion under Subpart F, the CFC/PFIC overlap rule may no longer except minority U.S. partners from the PFIC regime.

Relevant to minority U.S. partners, on July 10, 2019, the IRS issued proposed regulations under the PFIC provisions clarifying (1) the PFIC indirect ownership provisions, (2) the application of the income and asset tests that determine PFIC classification, and (3) the insurance exception.

REMAINING QUESTIONS

The New Guidance does not address certain areas, and taxpayers will need to look to further Treasury and IRS guidance to fill in the gaps. One area that remains unclear is the effect of the New Guidance on the maintenance of partners’ capital accounts in a partnership under Section 704. In addition, the New Guidance notes that under prior law PTEP accounts were maintained and basis adjustments were made at the partnership level, and not at the level of the partners. The Treasury and IRS have requested comments on appropriate transition rules from prior law to the New Guidance.

COMPLIANCE CONSIDERATIONS

Although adopted in 2019, the New Guidance eliminates GILTI exposure for minority U.S. partners retroactively to 2018. The application to 2018 raises numerous U.S. tax reporting issues for domestic partnerships, including LLCs, private equity funds, alternative investment vehicles, and minority U.S. partners.

A domestic partnership is required to file Form 1065 (U.S. Return of Partnership Income) and issue Schedule K-1 (Partner’s Share of Income, Deductions, Credits, etc.) to each partner no later than the 15th day of the third month following the tax year end of the partnership. Accordingly, a calendar-year partnership is required to file its return by March 15. A partnership may file Form 7004 to request an automatic six-month extension of time to file its return, Schedule K (Summary Schedule), and Schedule K-1. A calendar-year partnership with an extension has until September 15 to file. Even if a partnership with an extension has already timely filed a tax return, any such partnership may still file a “superseding return,” or a return filed subsequent to the originally-filed return but within the filing period, including extensions. A timely filed superseding Form 1065 is considered the original return of the partnership.

For partnerships that have not filed an automatic extension and that have not elected out of the Bipartisan Budget Act of 2015 (BBA) centralized partnership audit procedures, relief may be available under Revenue Procedure 2019-32 to be treated as having filed an automatic extension.

The BBA centralized partnership audit procedures apply to tax years of all partnerships beginning in 2018, unless any such partnership is eligible for, and make, an election to not have these procedures apply. A partner in a BBA partnership, in general, is required to treat partnership-related items on its return in the same manner as they are treated on the partnership’s return. A BBA partnership is also prohibited from amending the information required to be furnished to its partners after the due date of the return; however, it is possible for an authorized representative of the partnership to file an administrative adjustment request (AAR) to correct a previously filed partnership return. The adjustment to the partnership-related items reflected in an AAR is taken into account by the partnership and, as applicable, the partners, in the year the AAR is filed and not the year to which the adjustment relates.

CONCLUSION

The modification made by the Treasury and IRS not to tax minority U.S. partners under GILTI and Subpart F is a welcome change but is not without technical complexity. Stakeholders that have helpful suggestions should provide their comments to the government.

This column does not necessarily reflect the opinion of The Bureau of National Affairs, Inc. or its owners.

Alan Winston Granwell is of counsel in the Washington office; Robert G. Lorndale is a partner in the Washington office; Christopher F. Marotta is an associate in the Miami office; William M. Sharp, Sr. is a partner in the Atlanta, San Francisco, and Tampa offices.

Learn more about Bloomberg Tax or Log In to keep reading:

See Breaking News in Context

From research to software to news, find what you need to stay ahead.

Already a subscriber?

Log in to keep reading or access research tools and resources.