With some 5,500 new investigative officers promised in the UK’s recent budgets and the June Spending Review, the general public expects His Majesty’s Revenue and Customs to “do more, with more.” However, it seems the chains have still not come off in the case of HMRC’s most aggressive civil tax investigations carried out by the Fraud Investigation Service, or FIS, where large amounts of tax are believed to be at risk and/or suspicions of tax fraud are alleged.

Despite an impressive responsibility, staff numbers have stayed stubbornly close to or below 5,000 across the country. Anecdotal evidence shows that the public is not afraid of FIS civil investigations and is seldom aware that a person has been subject to one—so the low number of investigations has a poor deterrence effect.

Over the 2024-2025 period, only 450 new such investigations were commenced (down from 480 in the 2023-2024 period), although FIS still managed to secure almost £190 million ($257 million) in revenue.

Why are these investigations “serious”? Because these civil investigations are a lot more time intensive and resource hungry, FIS investigators typically manage no more than 10 at any time. Other front-line HMRC officers (for example, in Wealthy and Mid-sized Business Compliance and Individuals and Small Business Compliance) have a much higher number of cases (30 to 40). So more time, attention, and experience is required by tax investigation specialists supporting their clients.

HMRC is seeking recovery of taxes, late payment interest, and typically large penalties, for failing to submit correct tax returns or failing to notify HMRC that taxes were payable. Allegations of having acted deliberately or dishonestly are typical, with HMRC seeking to publicly name and shame people too.

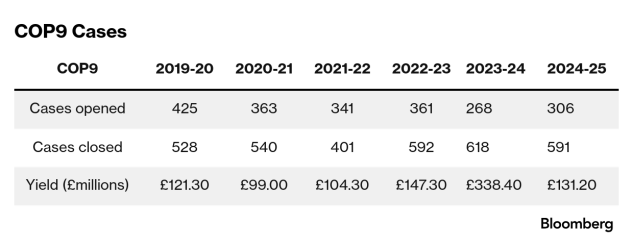

Code of Practice 9

A Code of Practice 9, or COP9, is a civil investigation of suspected tax fraud, where taxpayers are explicitly accused of having acted dishonestly/with fraudulent intent. Taxpayers are given an opportunity to admit (at a high-level) tax fraud within 60 daysin return for being able to make disclosures in much more detail later.

Taxpayers must disclose the background and reasons for their deliberate actions, compute the additional income, profits, gains, taxes, and late payment interest and penalties—all at their own cost. HMRC expects taxpayers to commission comprehensive disclosure reports—usually prepared by suitably experienced tax investigations specialists. In return, lengthy, in-depth, and intrusive investigations by HMRC are avoided, which can otherwise run on for many years.

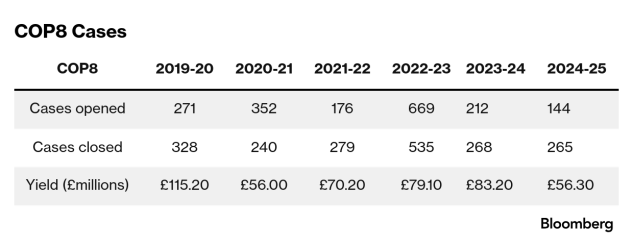

Code of Practice 8

A Code of Practice 8, COP8, is a civil investigation into large amounts of tax at risk, but not necessarily due to tax fraud—but it can include that. It’s not unusual for these to be used against marketed avoidance schemes or arrangements and bespoke tax planning, where HMRC is likely to have made a discovery about historic tax risks.

The investigators are well prepared to argue they have identified new information and culpability— also triggering penalties. There is little possibility of dissuading them in favour of a COP9-style disclosure report and also typically some span years due to their in-depth nature.

COP9 and COP8 similarities. COP9 and COP8 have the following in common:

They’re carried out by HMRC’s FIS. They’re not routine HMRC compliance checks which are in a single tax year or accounting period. FIS may approach third parties for information. Typically they consider and assess several prior years or periods, by claiming theyhave made “discoveries”. FIS investigators tend to identify and challenge “careless” and “deliberate” actions which support their reasons for looking at older periods, and so habitually go beyond the normal four years assessing-limit.

COP9 and COP8 differences. In practice, COP9 investigations alarm most clients—given the unambiguous allegations of suspected tax fraud. But it’s possible to secure immunity from a criminal tax investigation and potential prosecution by admitting tax fraud and accepting HMRC’s offer of commissioning a detailed disclosure report —a taxpayer may explain what happened, when, why, how, with whom, plus present evidence and comprehensive figures.

In practice, COP8 investigations are comparatively underrated because HMRC generally does not immediately allege tax fraud, and sometimes their inquiry is broad or vague. These investigations might appear similar to routine inquiries at first, but as the cases progress, clients often realize that the FIS investigators are looking at old transactions and are ready to use formal Information Notices to gather facts and evidence from them and third parties.

In a COP9 investigation, the client and their adviser should take control of the case by securing the disclosure process for tax frauds and other irregularities, agreeing to investigate all matters in detail themselves. This includes approaching third-parties for information and records, for example, suppliers, customers, banks. They should manage HMRC’s expectations by providing material progress updates as well as timeframes for disclosure report submissions,and making timely payments on account.

In a COP8, the client is the subject of an investigation, so HMRC is asking questions and verifying information to test and confirm their tax risks. A COP8 is comparatively more difficult to manage due to the uncertainties including HMRC’s willingness to approach third parties directly causing clients distress e.g., reputational damage.

COP9 and COP8 Statistics

- Overall in fiscal year 2024-2025, perhaps due to decreasing resources in FIS’ civil unit and/or newer ways of working with other HMRC teams, 30 fewer cases were closed.

- Much fewer COP8 cases were opened, in favor of more COP9 investigations opened.

- There was a continuing trend of fewer FIS civil investigations opened.

- HMRC’s focus appears to remain on concluding older COP9 cases as in recent years. They are regularly criticized for not settling inquiries and investigations sooner.

- Penalties charged in COP9 cases were almost double, averaging £25,719 per case, compared to £13,585 in COP8 cases. This is unsurprising, because COP9 cases are about tax fraud, whereas COP8 cases focus on tax planning where a client might not also be culpable.

- Total revenues secured in 2024-2025 more than halved to £187.5 million (856 settlements), from 2023-2024’s higher total of £421.60 million (886 settlements). However, 2023-2024 seems to be an anomaly year, suggesting more larger yielding cases were settled. Despite an almost identical number of conclusions, the yield in 2024-2025 was lower then 2022-2023.

Tax practitioners consider that there is a clear case for more such investigations, given the yields and deterrence effect that would secure, but HMRC seems to disagree.

This article does not necessarily reflect the opinion of Bloomberg Industry Group, Inc., the publisher of Bloomberg Law, Bloomberg Tax, and Bloomberg Government, or its owners.

Author Information

Amit Puri is the Managing Director at Pure Tax Investigations.

Write for us: Author Guidelines

To contact the editors responsible for this story: Soni Manickam at smanickam@bloombergindustry.com;

Learn more about Bloomberg Tax or Log In to keep reading:

See Breaking News in Context

From research to software to news, find what you need to stay ahead.

Already a subscriber?

Log in to keep reading or access research tools and resources.