“Tax warfare” may cause unforeseen consequences such as double taxation, says a Grant Thornton practitioner.

Recent global tax changes show us heading down a path towards “tax warfare”. For the past decade, the Inclusive Framework at the Organization for Economic Cooperation and Development (“OECD”) has been attempting to extend the taxing jurisdiction of “market countries” over large multinational companies (“MNCs”) that are able to access consumers in those market countries without triggering taxing jurisdiction under traditional international tax rules (“Modified Taxing Jurisdiction”). Some market countries have grown impatient and have unilaterally adopted digital services taxes (“DSTs”), specialized excise taxes focused on digital services revenue. Recently, the Trump administration has threatened, imposed, deferred and re-imposed the highest tariffs in a hundred years on goods imported into the US, sometimes justifying these heightened tariffs as “reciprocal” tariffs to fix trade imbalances. In response, other countries are establishing or considering retaliatory tariffs and considering additional DSTs.

Each of these approaches allows the market country to extract tax revenue from MNCs that transact business with consumers in that market country. Each of these approaches is also seen by some as “weaponizing” the tax and tariff systems for a purpose not supported by traditional international tax policies. In this global tax environment, high-minded tax policies are losing ground to self-interested taxing goals in a manner that threatens global commerce.

International Tax Policies

Following World War I, the newly-created League of Nations commissioned a group of prominent economists to meet in Geneva, Switzerland to develop an efficient, effective and equitable policy framework for international taxation. The project focused on the threat of double taxation and how to create a new international tax framework that would support the growth of global commerce. The policies developed by the League of Nations were fundamental to creating standards for international taxation. In 1928, the League of Nations issued draft model income tax treaties for the reciprocal relief of double taxation of international income; a hundred years later, these models still form the basis for most existing tax treaties.

Current Trends

Modern business practices, particularly internet-based business models, have strained the application of traditional international tax policies, particularly those establishing taxing jurisdiction based on the location of assets and personnel. Even after establishing the jurisdiction to tax, the appropriate allocation of the profits between related enterprises (read “transfer pricing”) has proven difficult.

Three tax/tariff approaches have developed over the last decade to allow market countries to impose tax/tariffs on MNCs doing business with consumers in those market countries. The first, Modified Taxing Jurisdiction, grew out of an OECD policy-based interest in “expanding the taxing rights of market jurisdictions where there is an active and sustained participation of a business in the economy of that jurisdiction”. The second, DSTs, have been advanced by market countries impatient for the OECD efforts to protect the rights of market countries. The third approach, substantial new tariffs, does not appear to be based on conventional tax policies; instead, the tariffs appear to be retaliation by the US for perceived tax and non-tax transgressions by other countries. Other countries have begun to impose retaliatory tariffs of their own.

Consequences—Double Taxation

The Modified Taxing Jurisdiction, DSTs and tariffs are potent weapons in a global tax conflict. Each approach produces significant tax revenues for the market country, even without traditional taxing jurisdiction over the parties to the transaction, but the impact of the three taxing approaches on MNCs is quite different.

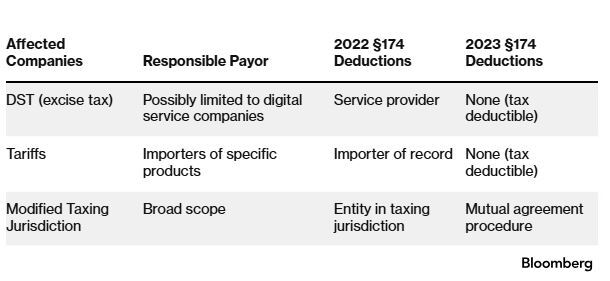

The impact of the DSTs may be limited to a small group of companies with large amounts of digital advertising and data-driven revenue, and tariffs may be limited to particular tangible goods from particular countries, but the impact of Modified Taxing Jurisdiction is not likely to be narrowly defined. The payor of a DST would be the manufacturer or service provider, for tariffs it would be the importer of record, and for Modified Taxing Jurisdiction it would be the entity resident in the taxing jurisdiction. Finally, only Modified Taxing Jurisdiction would be seen to create “double tax”, so only the Modified Taxing Jurisdiction would create access to the mutual agreement procedure to pursue relief from double tax.

Takeaways

The aggressive pursuit of tax advantage, particularly DSTs and tariffs is disproportionately borne by particular industries. Further, despite the deductibility of these DSTs and tariffs, they still impose an additional tax burden on the affected taxpayers. In retrospect, the direction of the League of Nations to avoid double tax and remove obstacles to global commerce does not look at all old-fashioned.

This article does not necessarily reflect the opinion of Bloomberg Industry Group, Inc., the publisher of Bloomberg Law, Bloomberg Tax, and Bloomberg Government, or its owners.

Author Information

Steven C. Wrappe is the National Transfer Pricing Technical Leader at Grant Thornton LLP and an adjunct professor at New York University School of Law and University of California-Irvine School of Law.

The views expressed herein are those of the author and do not necessarily reflect the views of GT Advisors.

Grant Thornton LLP and GT Advisors (and their respective subsidiary entities) practice as an alternative practice structure in accordance with the American Institute of Certified Public Accountants Code of Professional Conduct and applicable law, regulations, and professional standards. Grant Thornton LLP is a licensed independent CPA firm that provides attest services to its clients, and GT Advisors and its subsidiary entities provide tax and business consulting services to their clients. GT Advisors and its subsidiary entities are not licensed CPA firms.

Write for Us: Author Guidelines

To contact the editor responsible for this story: Soni Manickam at smanickam@bloombergindustry.com

Learn more about Bloomberg Tax or Log In to keep reading:

See Breaking News in Context

From research to software to news, find what you need to stay ahead.

Already a subscriber?

Log in to keep reading or access research tools and resources.