The Big Four firm, also known as PricewaterhouseCoopers, said that revenue reached $56.9 billion in the fiscal year that closed in June. Declines in the firm’s Australia and China businesses capped growth at 3.7% the prior year, when its global fees reached $55.4 billion.

PwC’s growth trails that of peers Deloitte and Ernst & Young, which reported increases of 4.8% and 4% respectively for the latest fiscal year. KPMG, the smallest of the four firms, typically reports its results in December.

“This has been a year of extraordinary complexity—but also of progress,” said Mohamed Kande, global chair of PwC, in a statement. “Our network delivered growth while making bold investments.”

The results, the first under Kande’s leadership, reflect in part adjustments the firm has made to its book of clients, including in China, and its exit from several countries and business lines. That global reassessment of its business also contributed to a smaller global workforce, which slid 1.6% to 364,000 people.

The firm has invested heavily, putting $3.1 billion back into its business, including 12 acquisitions or other strategic investments in areas such as AI, business strategy, and tax. That includes a $1.5 billion investment to build out its artificial intelligence capabilities, the firm said.

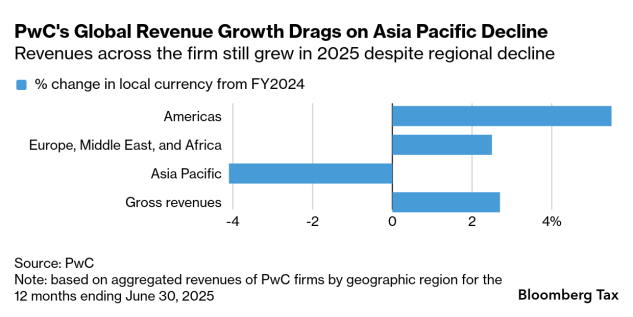

Revenue continued to contract in the PwC’s embattled Asia Pacific region, which includes Australia and China, with regional revenue dropping 4.1%—a smaller decrease than the 5.6% decline the previous year.

PwC faces ongoing investigations over a scandal involving leaks of confidential government tax plans in Australia to its private sector clients. Australian lawmakers are looking to make it easier to permanently bar contractors over future ethics violations.

The firm’s China and Hong Kong affiliates have seen an exodus of partners in the fallout of a six-month suspension and a $62 million penalty over audits for collapsed property developer Evergrande.

PwC’s business in Australia is growing and revenue in the broader Asian region should rebound this fiscal year backed by strong growth in Japan and India, the firm said.

Elsewhere, fees grew 5.5% in the firm’s Americas regions and 2.5% in its Europe, Middle East, and Africa region.

Partnerships with third-party vendors like

PwC’s global assurance practice, including its audit business, saw revenue increase 1.7% in local currency. Its tax practice nudged up 1% with clients seeking support for international tax rules and shifting tariff policies.

To contact the reporter on this story:

To contact the editor responsible for this story:

Learn more about Bloomberg Tax or Log In to keep reading:

See Breaking News in Context

From research to software to news, find what you need to stay ahead.

Already a subscriber?

Log in to keep reading or access research tools and resources.