Cash pooling is complex with a number of transfer pricing challenges, say KPMG practitioners.

Cash pooling arrangements are more intricate than simply setting arm’s length interest rates and book-keeping of deposits and loans. Cash pooling is not observed between unrelated parties, making it challenging to have an optimum yet robust transfer pricing policy. This article explores some common pitfalls faced by multinationals in structuring their cash pooling arrangements.

Global trade in goods and services reached about USD 33 trillion in 2024, or about 45x that recorded in the early years after the 1947 General Agreement on Tariffs and Trade (GATT). UN Trade and Development (UNCTAD) (Mar. 14, 2025); World Trade Organization, Evolution of trade under the WTO: handy statistics. Much of this growth has been driven by multinationals increasingly expanding and operating across borders. It is estimated that currently about 60% to 80% of global trade comes from intercompany transactions driven by the globalization of customer markets and extended supply chains.

As companies globalize, their Treasury operations become more complex. They have to consider how to efficiently finance short-term and long-term cash needs of geographically dispersed subsidiaries, and how to address liquidity needs across multiple currencies, in the face of varying political, legal, and tax landscapes across the jurisdictions in which they operate.

Cash pooling arrangements are a core Treasury function relied on by multinationals to optimize group-wide liquidity management and meet short-term funding requirements. Cash pooling can be an effective means to fund operations in one jurisdiction with excess cash available in other jurisdictions, thereby potentially minimizing the cost of external financing. While intercompany term loans or credit facilities could also serve this function, using them can quickly lead to an unmanageable number of intercompany transactions as the number of entities involved grows, rendering the process inefficient.

Cash pooling arrangements in contrast are potentially a lower cost and more efficient approach, which also allows for better management of risks. In a cash pooling arrangement, cash is managed centrally providing a unified comprehensive view of the participants’ cash positions and liquidity needs. It also allows the group to potentially centralize, naturally off set and hedge residual foreign exchange risks.

While there is significant benefit from cash pooling, they are complex arrangements that require careful consideration in structuring, implementing, and monitoring. There is more to cash pooling than simply accounting for cash in-flows and out-flows, and setting arm’s length interest rates. In this article we discuss common pitfalls seen in transfer pricing of cash pooling arrangements. To set the stage, we first discuss the two main types of cash pools that are commonly implemented.

I. Types of Cash Pooling Arrangements

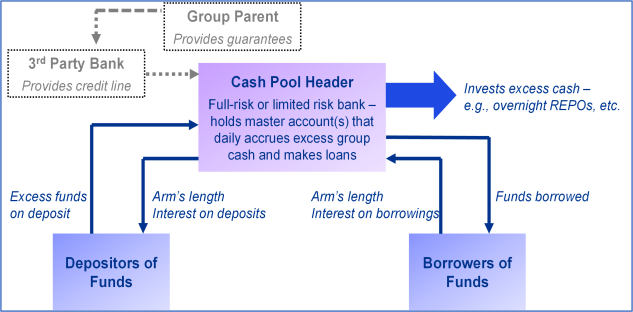

Cash pooling arrangements can broadly be categorized into either physical cash pooling or notional cash pooling. In a physical cash pool, the group entity that is the cash pool header (Header) generally functions as a full-risk or limited risk “bank”. Cash balances of each cash pool participant are physically transferred daily into a master account (or currency specific master accounts) held by the Header with a third-party bank. The pool header may often have access to a line of credit with the bank allowing it to cover any shortfalls when cash pool deposits are not enough to cover cash pool loans. In situations when deposits exceed borrowings, the Header will typically invest the excess cash in liquid assets such as US Treasuries, overnight REPOs or even in a bank account.

Sometimes the Header in a physical pool may also undertake other Treasury functions such as contracting with third parties for interest rate and/or foreign exchange hedges or other financial services for the cash pool participants, or performing asset-liability management for the group. How these additional activities get compensated (separately or as part of the Header’s role in managing and administrating the cash pool), depends on the facts and circumstances.

Figure 1: Illustrative Physical Cash Pooling Arrangement

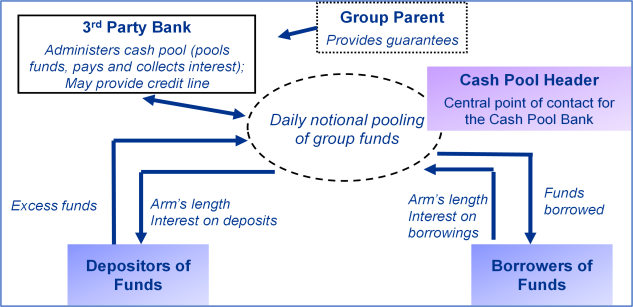

In a notional cash pool, the Header will not take an active role in managing the cash pool group’s cash and liquidity positions and will instead rely on the infrastructure provided by a third-party bank. The Header’s role is more administrative in nature acting as a central point of contact for the third-party bank. In this arrangement, there is typically no physical transfer of funds. The third-party bank notionally aggregates the balances in the accounts held by each of the cash pool participants with the bank, and it pays or charges each entity an interest rate depending on whether the entity’s balance is positive or negative. In some instances, prior to notional aggregation, the bank may sweep funds into currency specific accounts nominally held in the name of the Header. To limit its credit risks, the third-party bank will typically require a parental guarantee and / or cross guarantees from all cash pool participants.

Figure 2: Illustrative Notional Cash Pooling Arrangement

II. Common Transfer Pricing Pitfalls

The OECD Transfer Pricing Guidelines (2022) acknowledge that when unrelated entities do not or seldom undertake transactions entered into by related parties, it can be challenging to apply the arm’s length principle as there is “little or no direct evidence of what conditions would have been established by independent enterprises”. OECD Transfer Pricing Guidelines, ¶1.11 (2022).

This is especially true for cash pooling where one would struggle to point to a comparable transaction between truly unrelated parties. As such, there are particular challenges in transfer pricing of cash pooling. Apart from well-known issues such as setting arm’s length interest rates and adequate documentation, taxpayers can also be challenged in accurately delineating the cash pooling transaction or describing the functions of the cash pool header, and sharing synergies amongst the cash pool participants. The sections below address some of these key challenges and acknowledge that the perfect solution may not always be the most practical one and that taxpayers have to choose the optimal strategy based on their business needs and operational profile.

A. Characterization and Compensation of Cash Pool Header

In a notional cash pool, the third-party bank is the one that undertakes the primary functions of the cash pooling arrangement. The Header generally plays an administrative role and is typically compensated with a routine mark-up over its costs after paying the third-party bank fees. The third-party bank will typically propose the cash pool loan and deposit interest rates, with the loan rate higher than the deposit rate, with the resultant pool profits used to pay the third-party bank’s and Header’s fees.

In administering the notional cash pool, the third-party bank earns an administrative fee and does not control the level of deposit and loan balances, with the exception of ensuring that the loans do not exceed the sum of deposits and any credit line extended by the bank to the cash pool. This is different from its other business where the third-party bank actively manages balances and interest rates to maximize profit margins.

It is not unheard of for some multinationals to rely on the third-party bank to manage the cash pooling arrangement in autopilot mode. Doing so may not lead to an arm’s length result. For example, if deposit balances significantly exceed loan balances, the Header may end up in a loss position after the bank is paid its administrative fee, although the Header may be characterized as a routine service provider. Therefore, it is imperative to periodically review how the cash pool balances are moving over time. And to evaluate whether the third-party bank should adjust the interest rates.

The Header’s role in a physical cash pool is typically more involved and can range from anywhere between a full risk in-house bank to a limited risk service provider. While the arm’s length compensation for a limited risk service provider may be relatively straightforward to establish, everything in between requires careful deliberation.

One may be tempted to equate the physical cash pooling arrangement Header to a bank compensated by the interest spread it earns between deposits and loans. However, unlike a true banking enterprise, the Header in a physical cash pool is not targeting to maximize the interest spread income between deposits and loans. Instead, the Header’s primary role is to enable the cash pool participants to collectively enhance their cash management, obtain ready access to working capital, minimize reliance on external borrowing, and potentially efficiently invest the cash pool group’s excess cash balances in liquid assets.

For example, there may be a mismatch between cash pool deposits and loans, with the Header’s income from its financial market investments and interest income from cash pool loans being insufficient to cover the arm’s-length interest it must pay to cash pool depositors, after retaining a margin for its own activities. Or the Header is managing and assuming foreign exchange risks, and may have to absorb foreign exchange losses.

In characterizing the physical pool Header and setting the transfer pricing policies, one needs to carefully consider the facts, and functional profile of the cash pooling arrangement, both today and potentially in the future.

It may be that in the initial phase of setting up a cash pooling arrangement, when participants are mostly depositing funds and not having significant borrowings, the Header’s primary role will be investing the cash pool group’s excess cash in liquid assets or holding them in a bank account. In such a situation, the Header may be more appropriately characterized as an agent or coordinator between the cash pool depositors and financial markets. However, as the cash pooling arrangement matures and participants are routinely both depositing into and borrowing from the cash pool, the role of the Header may be far more involved—handling cash requirements of the participants, managing foreign exchange exposure, and sourcing excess funds if and as needed. Alternatively, even as the cash pooling arrangement matures, demand for loans may not pick up, with the result that the Header is still primarily functioning as an agent between the cash pool depositors and financial markets.

Taxpayers may consider setting the transfer pricing policy to account for the functional profile of the Header evolving over time or in different factual circumstances. Otherwise, it is even more critical to revisit the transfer pricing policy regularly to validate whether it is still appropriate or requires update, including consideration of whether the Header continues to employ appropriate treasury personnel responsible for decision-making commensurate with the Header’s characterization.

Since the finalization of Chapter X of the OECD Transfer Pricing Guidelines (2022), several tax authorities have been taking the default position that in a physical cash pooling arrangement, the Header is a limited risk service provider and therefore should not be retaining benefits from cash pool synergies. Therefore, in this environment it is critical to monitor and document the functions performed by the Header as well as its decision making and risk bearing ability in order to support the amount of income retained at the Header. Otherwise, as observed in several cases in Europe, there is the risk of tax authorities recharacterizing the transaction and adjusting remuneration for cash pool depositors to leave only a nominal return for the physical cash pooling arrangement Header.

B. Credit Ratings

Cash pool deposits and cash pool loans are both intercompany loans, with the cash pool deposits being effectively short-term loans from cash pool participants to the Header. In benchmarking a loan, critical factors to consider include maturity term, currency denomination, market conditions, and credit rating. In particular, credit ratings which are an assessment of a borrower’s ability to service and repay the borrowed funds, are the foundation on which interest rates are determined in the market. While the multinational group or parent may have a credit rating published by one or more credit rating agencies, the individual cash pool participants will typically not.

In setting the cash pool deposit rates, there is often the tendency to compare the Header to a bank and set the cash pool deposit rate based on currency specific overnight bank deposit rates. However, banks in contrast to the Header are generally better capitalized, and are also regulated entities subject to liquidity restrictions and restrictions on their investing and lending activities. Furthermore, in both nominal and physical cash pools, the cash pool depositors are subject to the credit risk of the cash pool borrowers who may default on their obligations to pay interest or principal. Therefore, in setting the cash pool deposit rate, it may not be prudent to consider the Header as having the same creditworthiness as that of a regulated bank and to instead align the cash pool deposit rate to that of the cash pool group’s credit rating.

In deciding what credit ratings to use for loans from the cash pool, the simplest approach could be to apply the group or parent’s credit rating. The risk with this assumption increases to the extent that there is significant variability in credit worthiness among the cash pool participants and there is no explicit guarantee from the group parent, leading to potentially non-arm’s length results.

At the other end of the spectrum, one could individually estimate the credit rating of the cash pool participants and have customized cash pool loan interest rates based on each rating. But this can be a complex and resource-intensive exercise when there are a large number of cash pool participants, and prone to errors when up-to-date financial data is not readily available for each participant.

A middle ground taken by many is to categorize the cash pool participants into like risk tier sub-groups based on select financial ratios such as leverage, and to estimate credit ratings by sub-group. This can help avoid the pitfalls of simply using the parent / group rating and avoid the cumbersome, and possible erroneous, process of individual credit ratings.

Regardless of the approach taken, taxpayers should provide adequate support for the credit rating assumptions and positions taken as credit rating is a fundamental determinant of the cash pool deposit and loan interest rates.

C. Deposit and Loan Interest Rates

In a notional cash pool, the third-party bank will typically set forth a schedule of deposit and loan rates by currency. It may be tempting to simply base the transfer pricing policy on these interest rates set forth by the bank. But doing so may not be arm’s length. While most of the audits to-date have been focused on physical cash pooling arrangements, notional cash pooling arrangements are not exempt can be expected to come under more frequent examination in light of growing scrutiny of intercompany financial transactions by tax authorities.

As discussed earlier, in both nominal and physicals cash pooling arrangements, it may not be appropriate to compare the Header to a bank and simply set the cash pool deposit rate based on overnight bank deposit rates. Some taxpayers add a minimal spread on top of overnight bank rates to account for the cash pool depositors bearing additional risks in comparison to depositing their funds with a bank. While this addresses the argument of options realistically available, the additional spread may not adequately account for differences in comparability between deposits with the cash pool versus a bank.

As best practice, some companies set the remuneration for the cash pool depositors using a two-step approach. The cash pool deposit rate is initially set by reference to overnight bank deposit rates. Subsequently, the interest income for the depositors is adjusted by allocating a portion of the profits at the Header to the cash pool depositors in acknowledgement that excess funds from the depositors are the key to driving the cash pool and generating group synergy benefits.

In setting cash pool loan rates, most taxpayers tend to consider some measure of creditworthiness of the cash pool participants—which may be the group credit rating, individual rating, or rating of like risk sub-groups. But pitfalls and risks may still arise. Such as, if the cash pool loan rate is set based on the group credit rating and there is significant deviation in credit worthiness of the cash pool borrowers from that of the group, the cash pool depositors and/or Header may not be adequately compensated for the credit risks they are exposed to absent an explicit parent guarantee.

Another potential pitfall is when taxpayers for practical purposes choose to set the cash pool loan rate using a common spread across all currencies. Even if the base rate to which the spread is added is currency-specific, e.g., SOFR for USD loans or SONIA for GBP loans, the market spread for loans with similar credit risk may differ by currency. While the credit spreads for major currencies like USD, EUR or GBP align somewhat closely, the same spread may not be supportable for all other currencies. In particular, for less liquid currencies, it is advisable to ensure a proper assessment of the credit spreads for that currency.

In summary, the transfer pricing policy for loans to a cash pool participant should be set using benchmarked arm’s length interest rates based on the credit risk of the participant. Additionally, no single leg of the cash pooling arrangement transaction—i.e., deposit “leg” and loan “leg"—should be considered in isolation. It is important to consider the overall arm’s length nature of the cash pooling transactions taking into account the interest income earned by cash pool depositors, the interest rate paid by the cash pool borrowers, and the compensation earned by the Header.

D. Credit Limits

It is not uncommon to see contractual agreements governing cash pooling arrangements be silent on borrowing limits. If further, there are no controls on how much can be borrowed by individual cash pool participants, one could potentially have situations where a cash pool borrower is leveraged outside market norms. This potentially runs the risk of its cash pool loans being viewed as equity and not debt, and resultant negative tax consequences such as denial of interest deductions or repayment of principal being characterized as dividends.

Similar to lending arrangements between unrelated parties, the cash pooling arrangement should ideally set borrowing limits. These can be documented within the body of the contractual agreement or as part of the cash pool controls and processes. This would avoid situations such as lending more than can be reasonably repaid, or lending additional funds to an overleveraged cash pool participant.

One option used by some taxpayers is to set the borrowing limit for each cash pool participant by reference to select financial ratios such as debt to EBITDA, similar to how many uncontrolled credit lines are structured. In this approach, the cash pool participant is able to borrow from the cash pool up to the point the financial ratio(s) are reached, after which depending on the facts it may not be allowed to borrow.

E. Transfer Pricing Policy Updates

Like all intercompany transactions, cash pooling arrangements should be reviewed and updated periodically to reflect changes in facts and circumstances, and market movements. Below we discuss some especially relevant areas for updates.

Most cash pools set loan interest rates based on a floating rate structure, that is as a spread plus a base market rate such as SOFR or 3-month Treasuries. This has the benefit of allowing the loan rate to fluctuate based on market interest rate movements. But it is a misconception to believe that the spreads can be set and left to run without being updated as the loan rate will still fluctuate with changes in the interest rate environment.

This is because spreads too are subject to change over time, and hence just relying on the floating rate nature of the interest rate will not fully capture changes in the interest rate environment. The following graph illustrates how credit spreads over the 3-month Treasury have fluctuated over the last two years.

Figure 3: Option Adjusted Spread (OAS) Over 3-Month Treasury for BBB-, BBB and BBB+ Rated Bonds (source: Bloomberg)

Additionally, even if the market spreads do not move or do so minimally, a change in the cash pooling arrangement interest rate spread may be warranted based on any changes in credit ratings.

One needs to periodically validate and, if needed, update the interest rate benchmarking to account for both changes in market spreads as well as the cash pool participants’ creditworthiness. The benchmarking should ideally be updated annually including support for income retained at the Header and how that aligns with its functional profile. Otherwise, the taxpayer runs the risk of their transfer pricing policy falling outside arm’s length ranges.

It is not uncommon for taxpayers to obtain a tax ruling in the jurisdiction of the cash pool header and to agree with the tax authority on a set margin for the header. European tax authorities are opening up to the idea of granting advanced pricing agreements (APAs) for cash pooling arrangements. Such rulings and APAs provide some relief to the companies from uncertainties of tax audits. However, companies cannot indefinitely continue to rely on those arrangements beyond the stipulated period without proper review and renewal as there may be material changes in market interest rates, or the credit ratings relied upon, or if the functional profile of the Header requires updating.

F. Habitual Borrowers / Lenders and Accurate Delineation

Cash pooling arrangements are short-term liquidity management tools. They enable cash pool participants to pool short-term funds, and to borrow for working capital or other short-term needs.

However, it is not uncommon for some cash pool participants to be continuously depositing into, or borrowing from, the cash pool and often carrying balances over multiple years. This creates the risk that tax authorities (with the benefit of hindsight) may recharacterize these cash pool deposit / loan balances as long-term transactions and assess higher interest rates. We have seen several tax authorities (including Switzerland) win this argument in court and successfully make transfer pricing adjustments using longer term rates.

It is therefore imperative for taxpayers to have a process to monitor cash pool balances on a regular basis, and documented policies in place as to when a cash pool deposit / loan should be converted into a longer maturity term credit facility or loan.

G. Transfer Pricing Documentation

It goes without saying that preparing contemporaneous documentation annually is a key tool for demonstrating compliance with transfer pricing rules. However, just as important is the content of the documentation. In particular, it is important for taxpayers to document with support that the transfer pricing policies, and specifically the loan and deposit rates implemented, do not leave some of the cash pool participants worse off than not participating in the cash pool. Taxpayers should also take care to update their interest rate benchmarking in line with market changes and to provide support for their selection of the credit ratings relied on in setting cash pooling arrangement interest rates.

III. Conclusion

Depending on the way the business is set up and the functional profile of the Header, there may be a technically “right” way to set up the transfer pricing arrangements around a cash pooling arrangement. However, given the lack of predictability of how deposit and loan balances will change over time, or foreign exchange will move against each other, or interest rate and credit ratings will behave over the years, it does not take much for any “right” transfer pricing policy for a cash pooling arrangement to end up having unreasonable / unwarranted impacts. In many situations having a top of the class treasury software can significantly reduce the effort required in setting up, monitoring, and updating the balances and transfer pricing policies for a cash pooling arrangement. Therefore, it is critical to stay vigilant, and to adapt to material changes in fact, and find the right balance between perfection and a practical solution depending on exposure to tax risk and appetite for risk tolerance.

This article does not necessarily reflect the opinion of Bloomberg Industry Group, Inc., the publisher of Bloomberg Law and Bloomberg Tax, or its owners.

Author Information

Vinay Kapoor is a transfer pricing principal in the Economic & Valuation Services practice in New York. Sayantani Ghose is a transfer pricing principal in the Washington National Tax office in Stamford, CT.

The information in this article is not intended to be “written advice concerning one or more Federal tax matters” subject to the requirements of section 10.37(a)(2) of Treasury Department Circular 230. The information contained herein is of a general nature and based on authorities that are subject to change. Applicability of the information to specific situations should be determined through consultation with your tax adviser. This article represents the views of the authors only, and does not necessarily represent the views or professional advice of KPMG LLP.

Write for Us: Author Guidelines

Learn more about Bloomberg Tax or Log In to keep reading:

See Breaking News in Context

From research to software to news, find what you need to stay ahead.

Already a subscriber?

Log in to keep reading or access research tools and resources.